-

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15 -

The LendingClubs and SoFis of the world have a big head start, but HSBC's U.S. unit says its partnership with the fintech Avant will help it close the gap in online personal loans.

August 14 -

Black and Hispanic owners of one-person businesses are more likely to be discouraged from applying for financing, and they’re less likely to receive financing when they do apply for it, than their white counterparts, according to a new report from the New York Fed.

August 14 -

The Los Angeles company said it is also looking into internal controls tied to construction lending.

August 13 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

The Michigan company disclosed that an unnamed client made a large payment on a $6.5 million nonperforming loan.

August 9 -

Anticipating recession, banks start scrubbing loan books; how Trump's political appointees thwarted tougher settlements with two big banks; the Fed's plans on its real-time payment service; and more from this week's most-read stories.

August 9 -

The New Jersey company was reportedly shopping itself around last fall. Fresh off an agreement to buy Gold Coast Bancorp in New York, CEO Kevin Cummings says he is ready to explore other acquisitions.

August 9 -

There are opportunities to make loans for strip malls and regional distribution centers but executives need to put the right risk management in place.

August 9 -

Growers Edge is adapting retail financial technology to compete with traditional banks in ag lending and crop insurance.

August 8 -

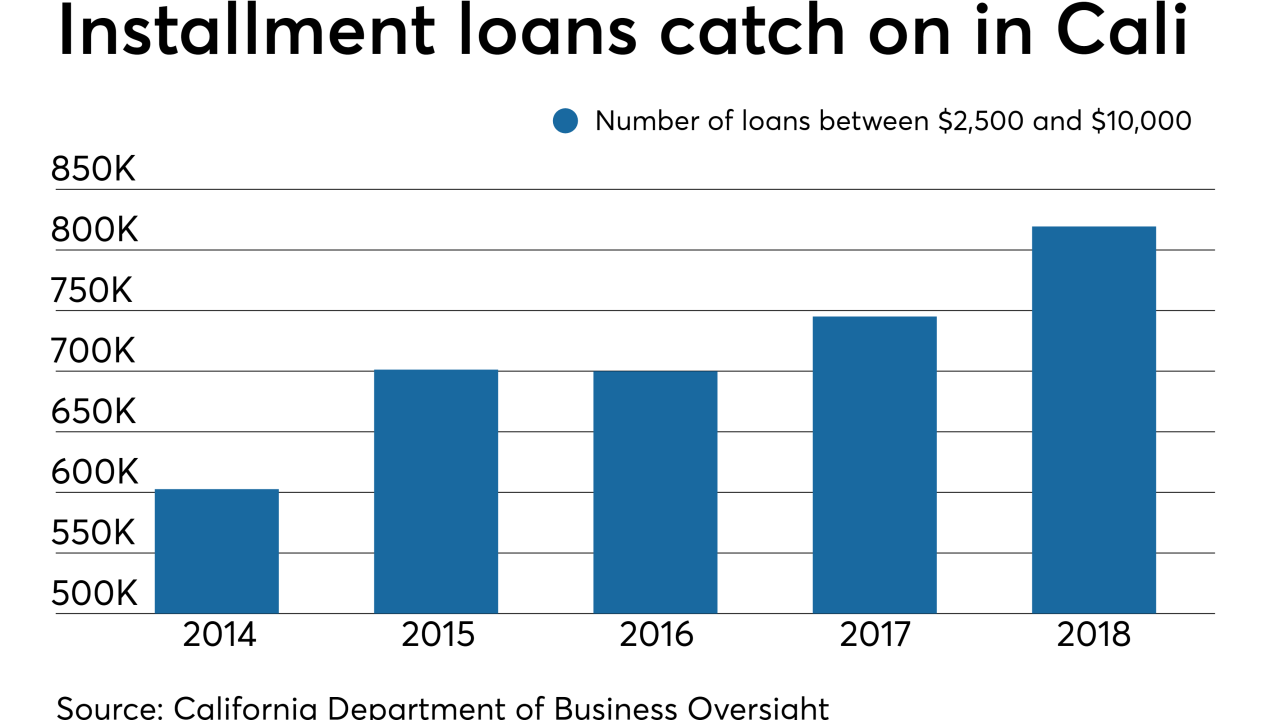

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

Fresh data from the Fed, FDIC and Bank of England shows that, directly or indirectly, banks are taking on more leveraged loans. But whether this puts their loan and securities portfolios at risk remains open for debate.

August 8 -

Mall landlords accustomed to offering rent reductions to ailing retailers are mulling a new strategy to forestall the industry's collapse: positioning themselves as lenders to tenants struggling to stay afloat.

August 7 -

The card company is buying the corporate-services businesses of Danish payments provider Nets A/S; the online lender’s stock plunged after it missed second quarter earnings expectations.

August 7 -

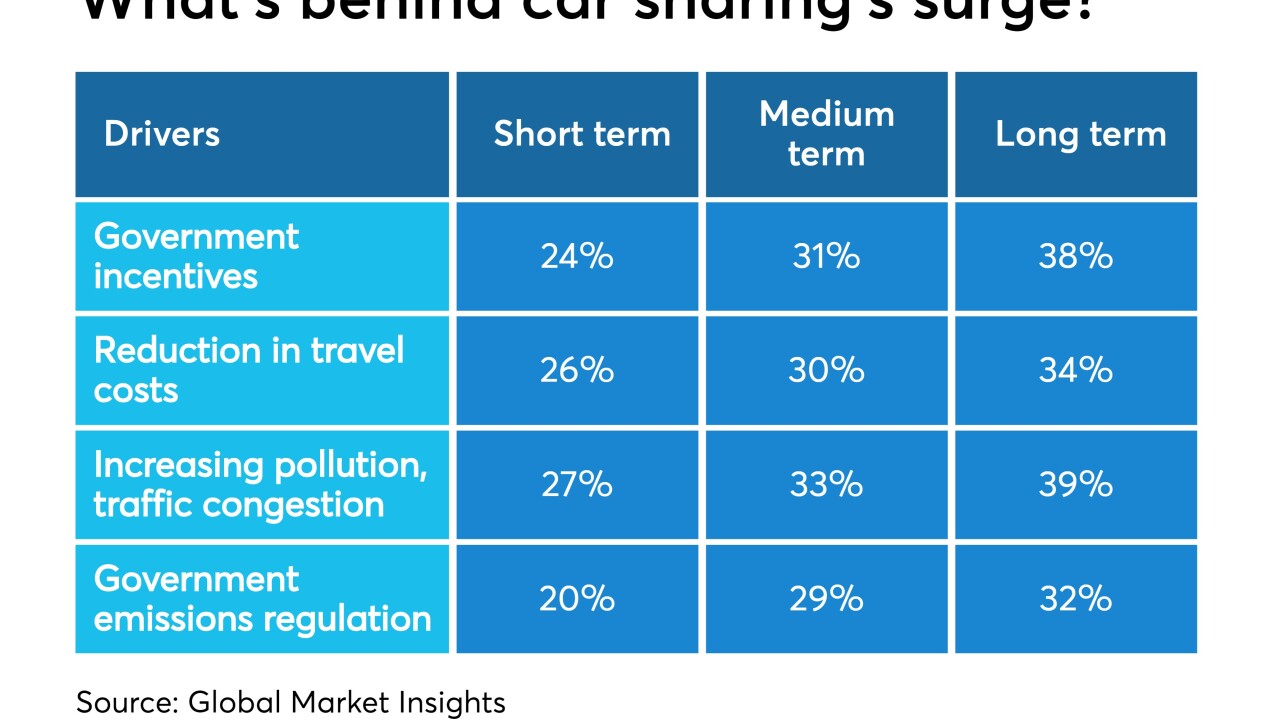

The industry faces additional risks when members take out auto loans and then list their new vehicles on apps for others to rent.

August 7 -

The San Francisco company forecast a modest profit in the third quarter because its cost-cutting plans are ahead of schedule. It's also starting a program to sell riskier loans to sophisticated investors.

August 6 -

The Upstart Network, the first and only startup to participate in the bureau’s program for promising digital platforms, claims that using nontraditional credit data items has helped loan volume and affordability.

August 6 -

The Atlanta fintech, whose shares have plummeted since it went public last year, also said it will stop providing financial guidance to its investors.

August 6 -

Krista Morgan, the founder and CEO of P2Binvestor, discusses her firm's bank deals and the tech driving its platform.

August 6