-

The largest U.S. bank's strong third quarter did not insulate its leaders from being pressed about the downside of pricey investments in technology, whether capital rules make commercial lending growth hard for big banks to achieve, and whether another economic downturn is edging closer.

October 12 -

Double-digit gains in interest and noninterest income more than offset higher deposit, compensation costs.

October 12 -

The third interest rate increase of the year could have a significant impact on banks' lending, deposit gathering and even M&A decisions. Here's what to expect.

October 10 -

Proposition 10 would give local jurisdictions a freer hand to restrict rents, but critics say that would lead to property devaluations. Some see an effect regardless of whether the measure passes.

October 10 -

It's difficult to predict exactly what might be the next threat to the financial system. Here's a roundup of some prime suspects.

October 9 -

Big banks are expected to report that commercial lending weakened in the third quarter thanks to tax cuts, nonbank competition and seasonal factors. It raises questions about whether the second-quarter rally was an anomaly and if an overall economic slowdown is edging closer.

October 9 -

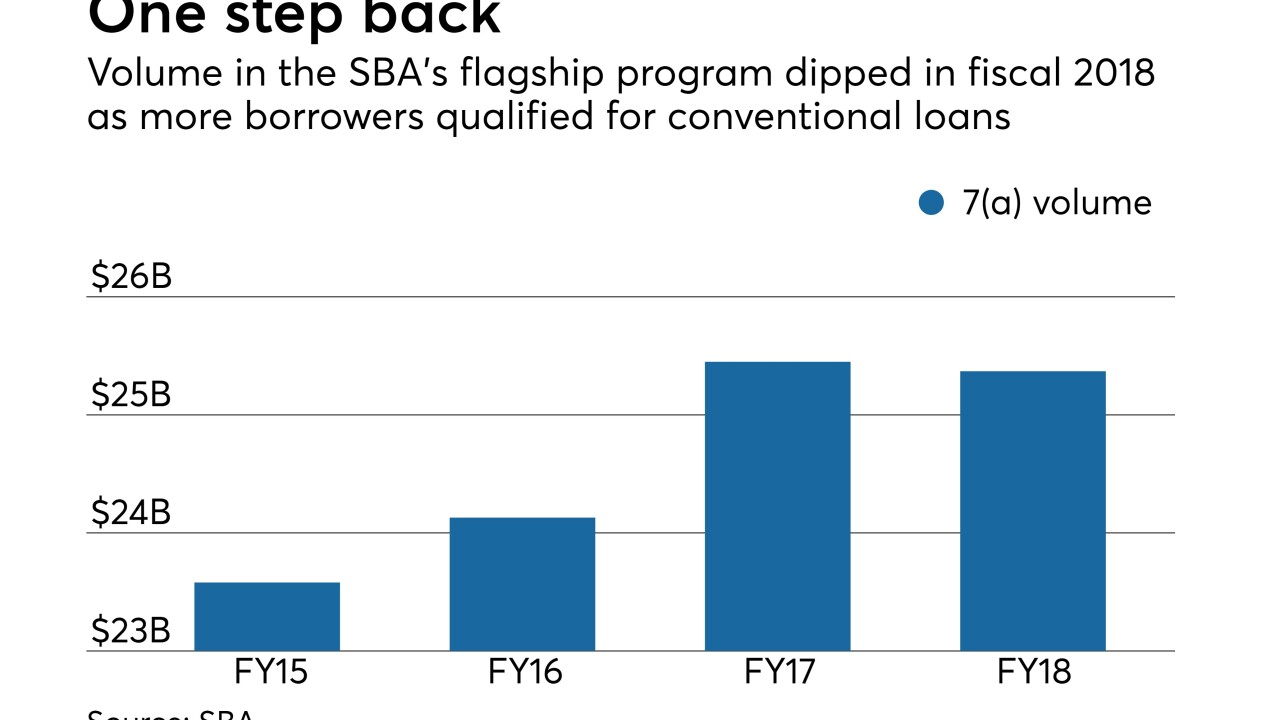

The agency's 7(a) program had a small year-over-year decline, with bankers pointing to lender discipline and more borrowers qualifying for conventional loans.

October 9 -

Credit unions in the Great Lakes State continued to add members in Q2 while a variety of loan types saw double-digit growth.

October 9 -

Wells Fargo is doubling down on the gun industry, undaunted by criticism of its deep ties to firearm companies and the National Rifle Association.

October 5 -

A paper released by the agency’s Center for Financial Research says aspects of someone’s digital footprint — including whether they use Apple or Android — help predict likelihood of default.

October 4 -

Banks are being encouraged to offer smaller loans as an alternative to payday products, but their high interest rates can still put consumers in debt.

October 3 Center for Responsible Lending

Center for Responsible Lending -

The economy could “positively slow down in mid-2019” and consumer debt levels are a huge concern, but technology and lessons learned from the crisis could still create opportunity for small banks, says Beneficial’s Gerry Cuddy ahead of a big speech on current conditions.

October 2 -

The agency found that banks with less than $10 billion in assets were more prone than larger lenders to go beyond using standard criteria in evaluating borrowers.

October 1 -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

The Department of Justice and the Securities and Exchange Commission announced settlements Friday related to alleged misconduct that occurred during Renaud Laplanche’s tenure atop the online lender.

September 28 -

Readers parse JPMorgan Chase CEO Jamie Dimon's latest public comments, debate a California small-business lending bill, weigh the impact of open banking and more.

September 27 -

Few small businesses in Puerto Rico applied for credit to finance recovery from hurricane damage. The reasons are instructive for financial institutions’ response to disaster recovery, the New York Fed says.

September 27 -

Gov. Jerry Brown’s administration sent letters Wednesday to 20 nonbank lenders that charge triple-digit annual percentage rates to try to determine if their use of online referrals is steering borrowers into larger loans than they want or need.

September 26 -

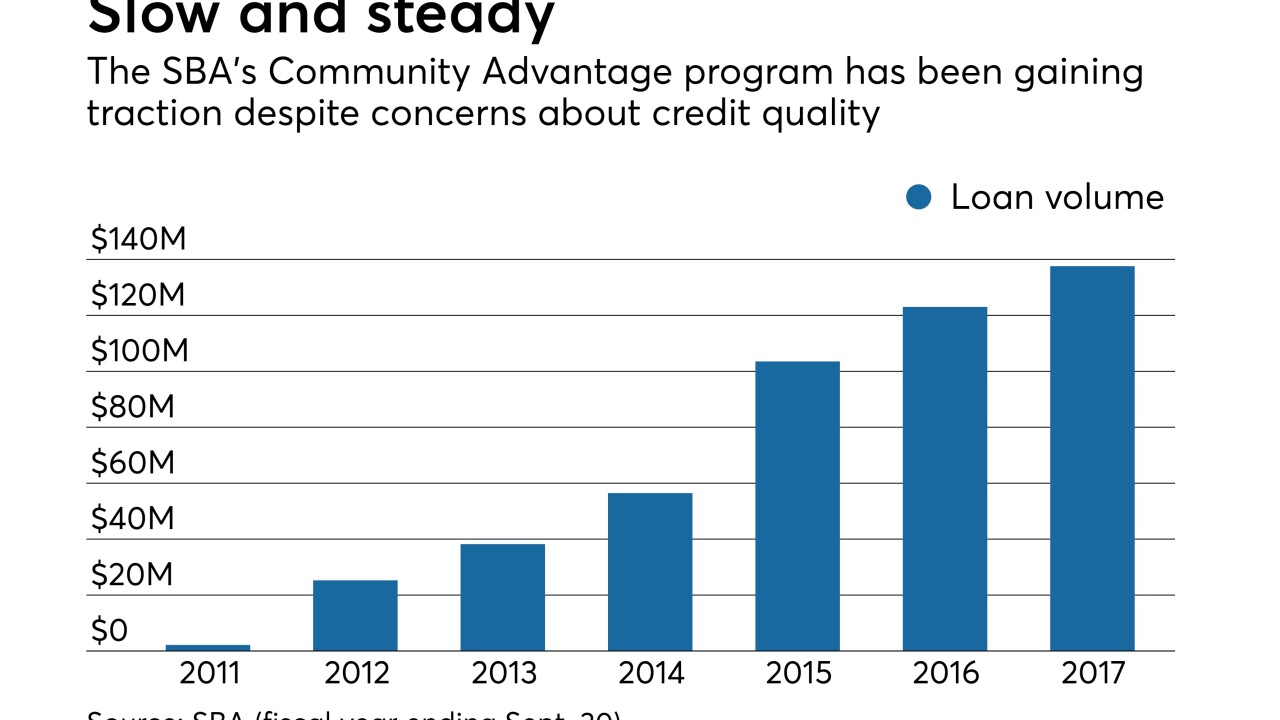

Some lenders fear a moratorium on new participants, and other restraints, could be the beginning of the end for the agency's Community Advantage program.

September 26 -

The House of Representatives passed two bills that would tie appraisal waivers for Small Business Administration loans to bank rules for commercial real estate loans, despite objections from the Appraisal Institute about its members being cut out of transactions.

September 26