Community banking

Community banking

-

Organizers aiming to open a de novo just outside Charlotte say there's a need for a new community bank after several years of consolidation in the market.

February 22 -

Stilwell Group and Jeffrey Thorp will gain board seats in exchange for a vow to refrain from waging proxy battles against MB Bancorp.

February 22 -

The company will still use the building for its main office, but it will move its administrative staff to another building.

February 22 -

The Chicago bank is denying a report that its CEO, Steve Calk, made $16 million in mortgage loans to former Trump campaign chairman Paul Manafort in exchange for a job in the White House.

February 21 -

The Puerto Rico-based bank failed in 2015. The FDIC, its receiver, is seeking unspecified economic and punitive damages from 16 lenders, including Bank of America, Barclays and Credit Suisse.

February 21 -

Bank consolidation in the city has picked up in recent months despite erratic oil prices and flooding tied to Hurricane Harvey.

February 21 -

The internet giant, SunTrust, Ally and other backers have invested $16 million in a new funding round for Greenlight Financial Technology, further blurring the lines between banks and tech companies.

February 21 -

The Michigan company has been acquisitive lately, buying California branches and a wealth advisory firm.

February 21 -

First Citizens, which wants to buy KS Bancorp, has filed a lawsuit to challenge a so-called poison pill provision that the much smaller bank's board recently passed.

February 21 -

Choice, which has a history of acquisitions, is buying a financial institution that largely focuses on business banking.

February 20 -

Superior Choice Credit Union's deal for Dairyland State Bank in Wisconsin is the second such deal announced this year.

February 20 -

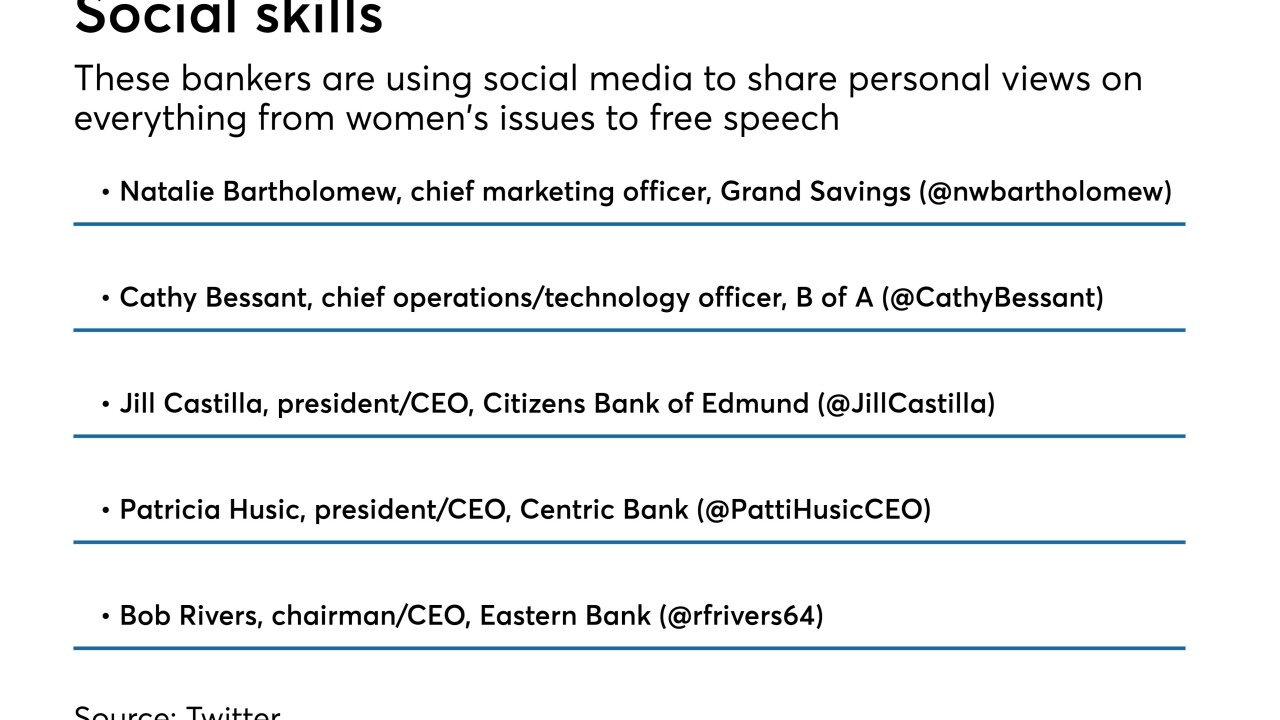

Bob Rivers, CEO of Eastern Bank, was praised and criticized after he called out a Boston sports radio station whose on-air personalities made insensitive remarks. The incident underscores why bankers must be mindful about the positions they take.

February 20 -

The company could use proceeds from the planned offering to add branches and make bigger loans.

February 20 -

Just two months after a capital infusion, First Capital Bancshares added banking veterans including John McCoy and Harvey Glick as directors in a board overhaul, changed CEOs, and decided to move its corporate headquarters to Charleston, S.C.

February 16 -

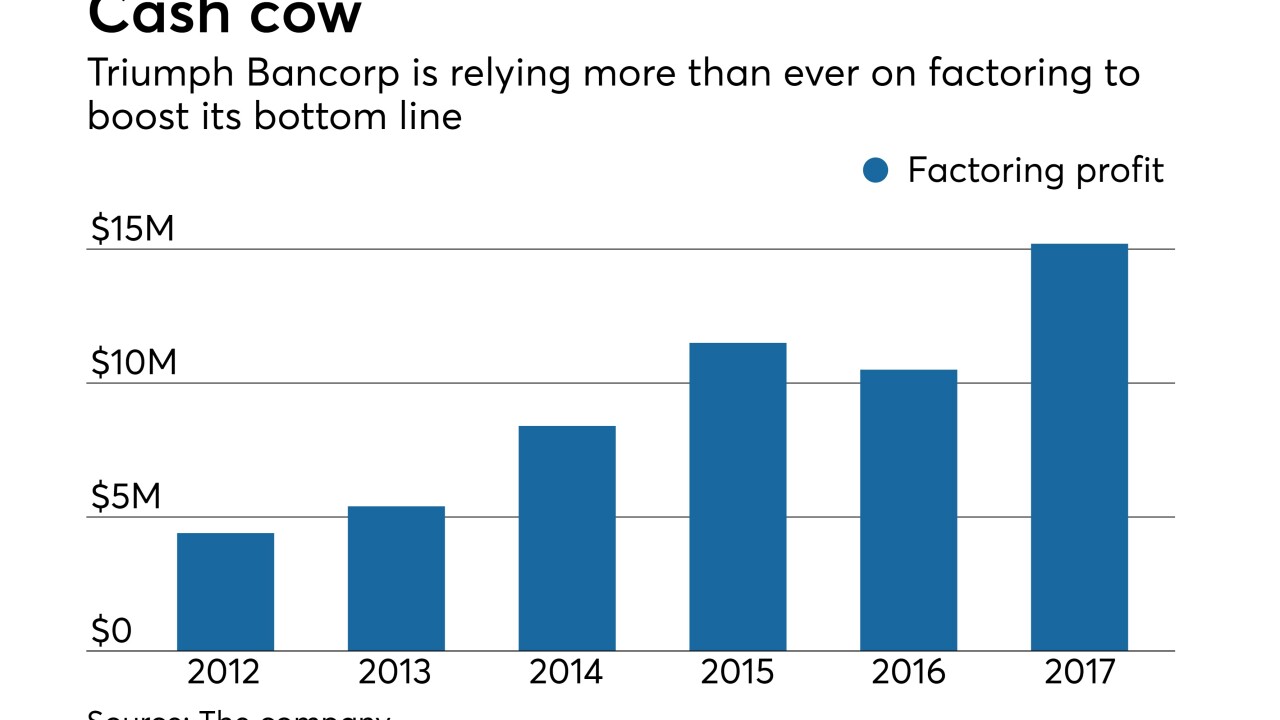

Triumph Bancorp has developed technology to help freight brokers make faster payments to truckers, charging a fee for the service.

February 16 -

Their partnership aims to make it easier for community banks and other institutional investors to vet loans that they could buy from online lenders.

February 16 -

The Chicago institution, formed in 2010 to buy the failed ShoreBank, has hired Sandler O'Neill to gauge interest from potential buyers, according to a published report.

February 15 -

Having solid relationships with those who cover the banking industry can lend credibility to management teams, especially when times are tough.

February 15 -

The as-yet-unnamed bank, which would be based near Charlotte, N.C., would be led by Randy Helton, a former CEO at American Community Bancshares.

February 14 -

The company, which recently shared a three-year plan to bring in more lower-cost deposits and commercial loans, seems ready to play offense a year after the ouster of its CEO.

February 14