Community banking

Community banking

-

Nonbank mortgage firms are seeking formal assurance from the Consumer Financial Protection Bureau that they will not become subject to surprise audits or enforcement without involvement of a state regulator.

February 14 -

Achieva Credit Union, which recently formed a business to advise other acquisition-minded credit unions, has agreed to buy Preferred Community Bank.

February 14 -

A strategic payments plan could shine a light on critical gaps in a community bank’s offerings; one frequently missed opportunity is credit cards, writes Deborah Matthews Phillips, managing director of payment strategy for Jack Henry & Associates.

February 14 -

The company agreed to buy Bank of River Oaks for $85 million in cash.

February 13 -

The Justice Department required the sales before signing off on MainSource's pending sale to First Financial in Cincinnati.

February 13 -

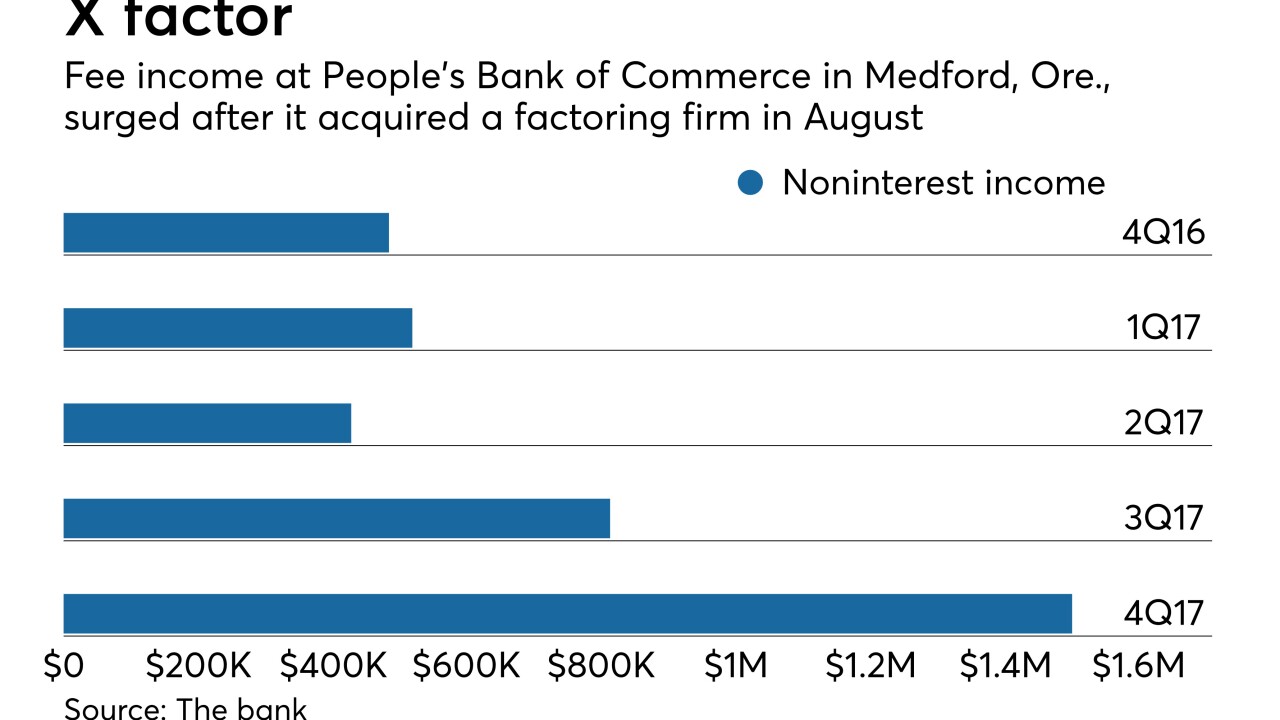

People's Bank of Commerce in southern Oregon decided it had to diversify to survive, so when a director heard a factoring firm he co-founded was up for sale, the bank seized the moment. Now it has other deals in mind.

February 13 -

HopFed was ordered to pay the legal fees for Stilwell Group, which sued the bank after its directors passed a bylaw intended to keep the investor off its board.

February 12 -

The company must develop and implement a system of internal controls to ensure full Bank Secrecy Act and anti-money-laundering compliance.

February 12 -

As the economy strengthens, more banks are facing pressure to pay up for the best lenders and tech specialists.

February 12 -

Wells Fargo’s troubles show that the bank needs to rebuild trust with consumers and the diverse neighborhoods where it operates in order to succeed.

February 12 -

The California company has agreed to buy Grandpoint Capital, a business bank in Los Angeles, for $641 million.

February 12 -

Cambridge Bancorp in Massachusetts is looking to prove to entrepreneurs that it is in the business for the long haul.

February 9 -

Codorus Valley Bancorp fired Dwight Utz, the head of its bank unit, "without cause" just a few weeks after reporting earnings of $12 million for 2017.

February 8 -

The Fed determined that Jacob Goldstein, who was also president of NBRS Financial Bank, improperly signed off on loans without telling the board that he would benefit from them. The bank failed in 2014.

February 8 -

Capital One has been rolling out coffee shops where it can offer banking services — but are not considered branches. The cafes have been especially effective at gathering deposits, putting more pressure on community banks that have already been losing deposits to their larger rivals.

February 8 -

A provision in the Senate’s two-year budget deal would cut the Federal Reserve's operating surplus by $2.5 billion, the second time in recent years that Congress has diverted Fed funds.

February 8 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

Additional consolidation would not strengthen the industry, but would instead leave consumers with less choice and reduced access to financial services.

February 8 -

The U.S. banking arm of the Dutch lender Rabobank has forfeited nearly $370 million for anti-money-laundering deficiencies that authorities say allowed untraceable money transfers on behalf of criminals.

February 7 -

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7