Community banking

Community banking

-

Hometown, which agreed to buy Millbury Savings Bank, has already completed one acquisition this year and has another pending.

February 27 -

The Seattle company has a letter of intent to sell its home loan centers to Homebridge Financial Services.

February 27 -

Ronald Rubin, who was a CFPB enforcement attorney, will head an office overseeing nearly 200 state-chartered banks.

February 26 -

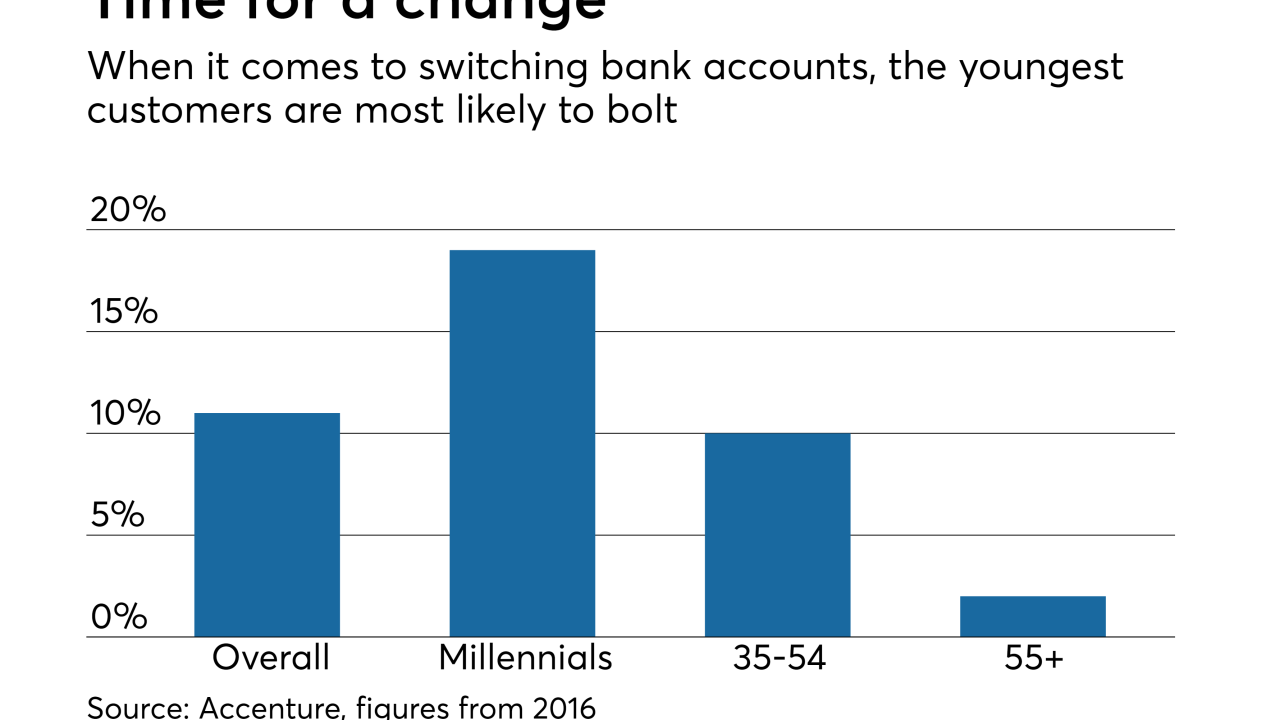

The drudgery of filling out forms and changing bills prevents many customers from swapping banks. One fintech has simplified that exchange, and banks are willing to pay it to deliver them new customers.

February 26 -

The agency wants to increase the maximum SBA Express loan to $1 million from $350,000 to pump up volume.

February 26 -

Alan White, who will step down in April, and Jeremy Ford have served as the company's co-CEOs since September 2016.

February 25 -

Tiny banks are recording healthy returns by carefully managing expenses and credit quality.

February 25 -

Midwest BankCentre in St. Louis, with the help of a stable of fintechs, started Rising Bank to keep up with big banks in the hunt for deposits and millennial customers.

February 25 -

Year to date through Sep. 30, 2018. Dollars in thousands.

February 25 -

Some companies on SourceMedia’s Best Fintechs to Work For list offer their employees extra time off to live boldly.

February 24 -

Richard Marotta, who became Berkshire Hills' CEO after his predecessor's abrupt resignation, says his top priorities are squeezing more profit from existing operations and improving corporate culture.

February 22 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

The Indiana company will pay $68 million for Citizens First.

February 22 -

The company will close a dozen branches, including eight in Colorado.

February 21 -

As large banks put stronger fraud monitoring and authentication technology in place, fraudsters have been turning to small banks, like Kennebunk Bank on the coast of Maine. Here's how it fought back.

February 21 -

Mel Watt calls FHFA watchdog “sexist,” after it concludes he’s guilty of sexual harassment. State Street sues the "Fearless Girl" sculptor. Banks big and small face mounting pressure on gender pay gap and board diversity. And another top 40 U.S. bank might get a female CEO.

February 21 -

Bankers are eager to expand there through M&A, de novos or other means, encouraged by strong employment and disruption created by recent consolidation.

February 21 -

Fairwinds Credit Union in Orlando is set to buy Friends Bank, the third time this year a Florida-based bank has agreed to sell to a credit union.

February 20 -

The Illinois company will pay $46 million for a bank that is a fraction of its size.

February 20 -

Fairwinds Credit Union's deal for Friends Bank marks the third time this year that a Florida bank has agreed to be sold to a credit union.

February 20