Digital banking

Digital banking

-

U.S. Bank and Regions revamped their apps with accessibility in mind; JPMorgan Chase built a branch for customers who are deaf. Such efforts can help banks appeal to more customers in existing markets.

September 11 -

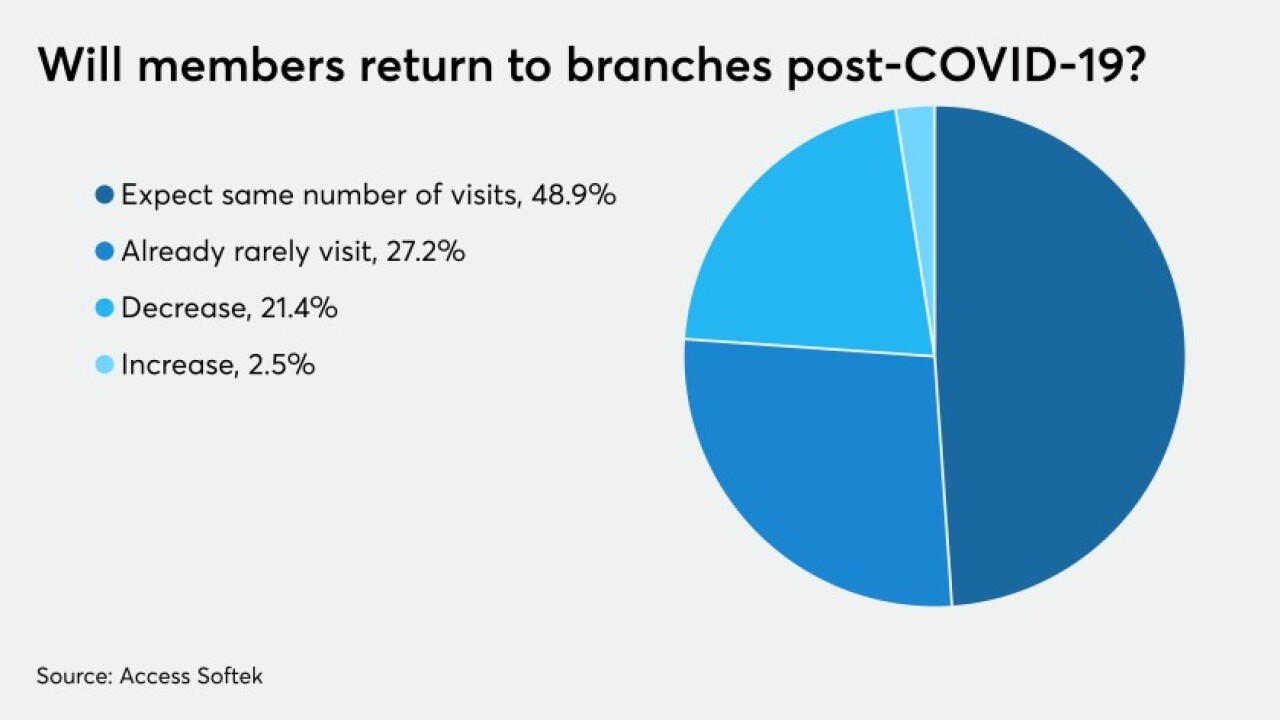

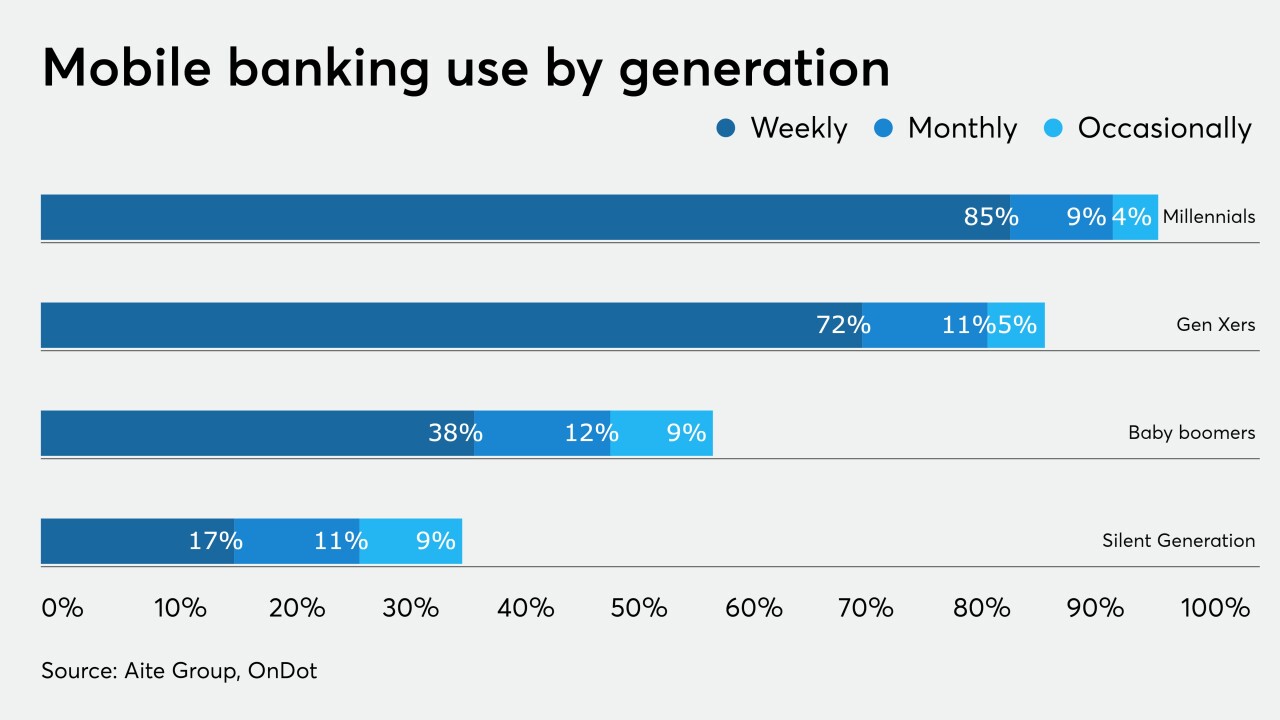

Members are completing more of their banking online than ever before, forcing many institutions to rethink their strategies for physical locations.

September 11 -

Citigroup named Hassan to the new role as part of a move to combine its marketing and branding divisions.

September 9 -

How Bank of America plans to stay ahead of the pack in digital banking; Wells Fargo gets top marks for COVID-19 safety; PPP lenders nearing $10B asset mark fear regulatory ordeal; and more from this week’s most-read stories.

September 4 -

Institutions considering new technologies must ask themselves what they're looking for not just from a product but from a partner.

September 4 -

Texas Trust Credit Union boosted loan volumes with a marketing tool inspired by “Game of Thrones,” but gamification strategies can be risky in light of data privacy concerns.

September 4 -

Many community banks, like Peoples Community in Wisconsin, say they proceeded despite the technological challenges presented by social distancing because the crisis has exposed the shortcomings of their digital systems.

September 3 -

The fintech Wealthfront's latest wrinkle gives clients a high level of control over their money, including the ability to set automatic transfers to savings accounts or exchange-traded funds.

September 2 -

BBVA and U.S. Bank are fine-tuning the search functions on their sites and apps to improve navigation, sales and customer retention.

September 1 -

Banks that work with the data aggregator will tell it when account updates are ready, so it can refresh fintech (or bank) apps immediately.

September 1