-

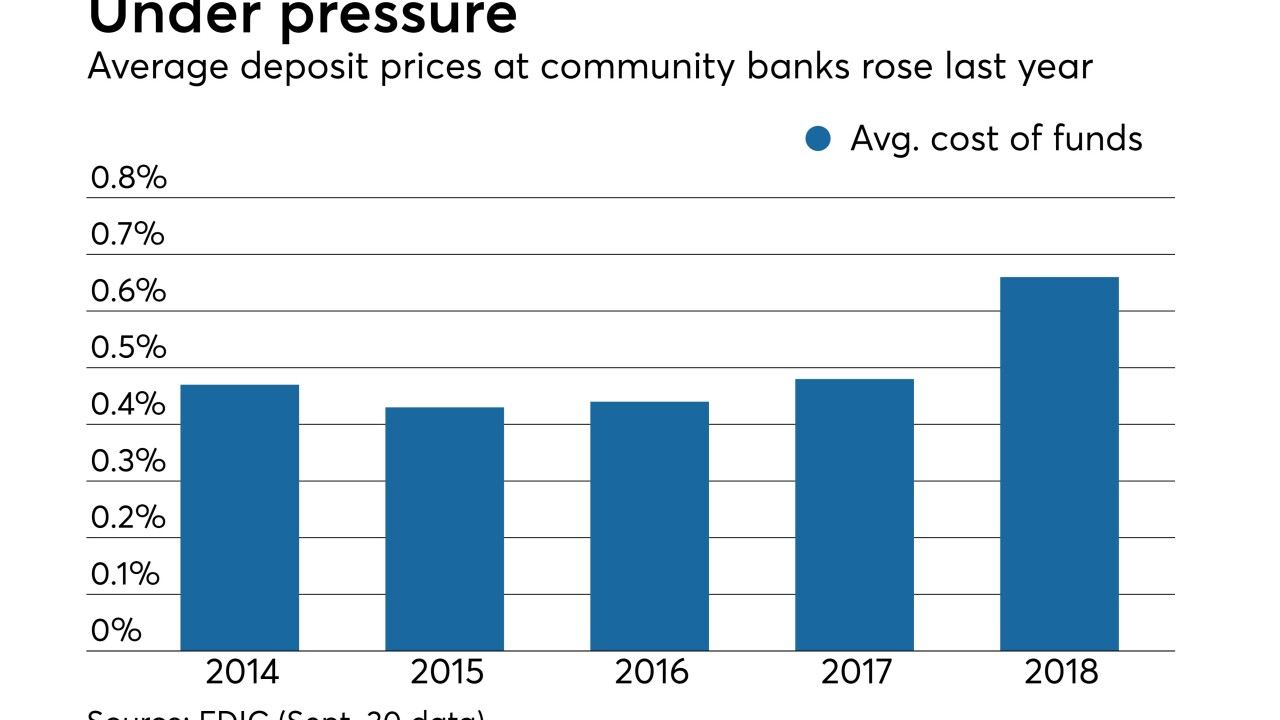

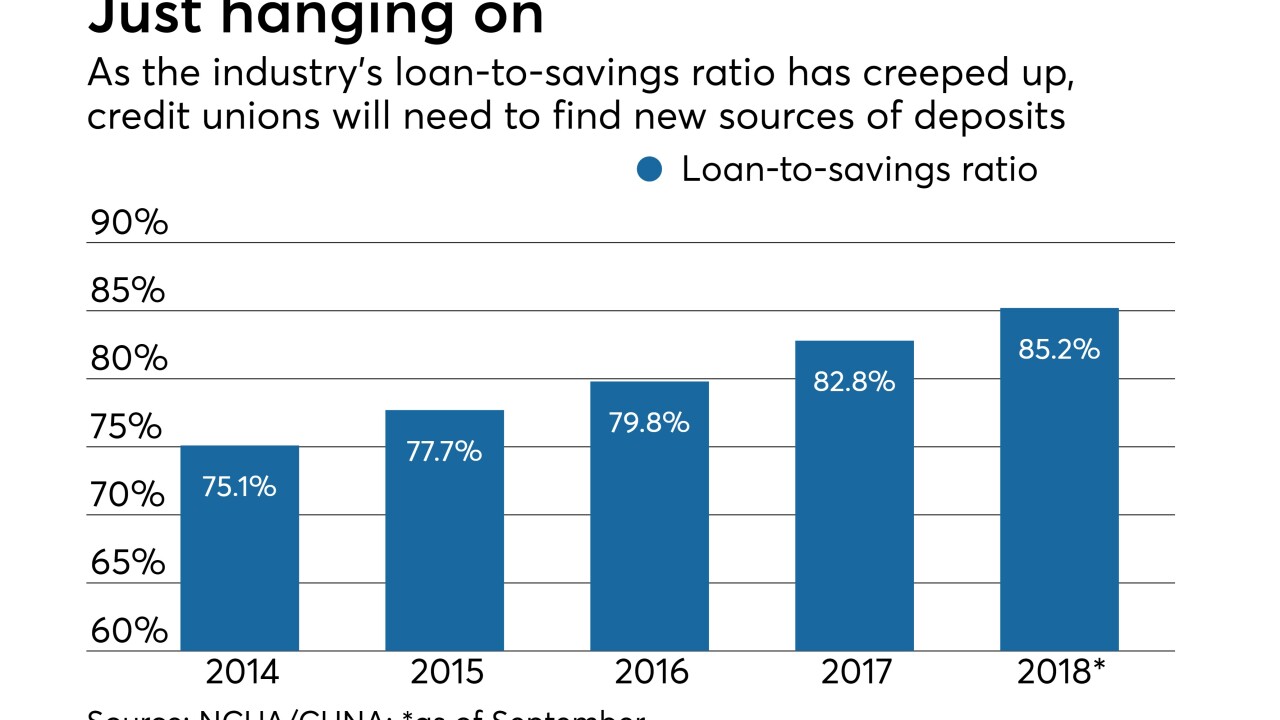

Banks and credit unions are experimenting with ways to maximize margins in an environment where the yield curve is flat, depositors want them to pay up and they fear the Fed could actually cut rates.

February 13 -

Wells says it's made progress but needs to do more to rebuild trust with customers and regulators; despite rate hikes by the Fed, big banks continue to effectively pay nothing in interest to savings customers.

January 31 -

A new report from Cornerstone Advisors finds credit union executives aren't all that bullish on the year ahead, while banker optimism is back on the rise.

January 28 -

The consent order against California Check Cashing Stores is part of a broader crackdown by the Department of Business Oversight on small-dollar lenders trying to skirt interest rate limits.

January 22 -

The central bank’s investments under its quantitative easing program have put its balance sheet in the red under mark-to-market accounting, another potential risk for an agency already under political fire.

January 10

-

The accounts — which eschew paper checks and overdraft protection — appeal beyond the low-income customers they were intended for; lenders are embracing artificial intelligence systems to analyze more data to determine creditworthiness.

January 4 -

An effort to increase awareness of the transition to a new benchmark rate, and nudge banks to start preparing, is expected to intensify in 2019.

December 30 -

The industry could see a boost in mortgage lending from regulatory changes, but other factors may slow growth.

December 26 -

Amid rising rates and a surge in lending, credit unions will need to find additional sources of deposits to fund growth.

December 21 -

The central bank may be looking at other benchmarks besides the fed funds rate to conduct monetary policy; dropping human appraisers from most home sales raises concerns.

November 30