M&A

M&A

-

The Georgia company agreed to pay $84 million for a bank with nine branches and $715 million of assets.

April 22 -

The deal would be Independent's sixth since 2015 and would continue a wave of consolidation among Boston-area banks.

April 22 -

On its path to diversify beyond check printing, Deluxe has agreed to purchase Texas-based merchant services firm First American Payment Systems for $960 million.

April 22 -

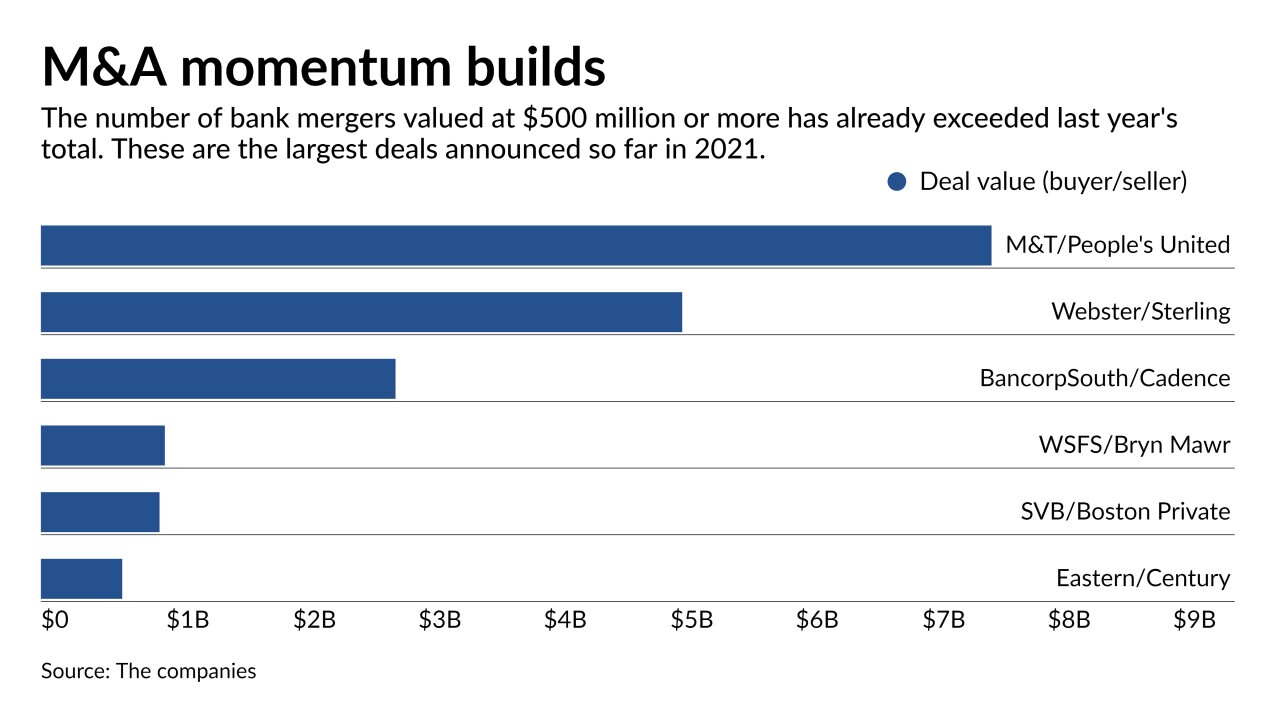

Clarity on credit quality has bankers ready to strike deals after a lengthy pause. A steady rise in stock prices has also given potential buyers the financial wherewithal to pursue acquisitions.

April 21 -

The Dallas company agreed to sell MSRs tied to $14 billion of mortgages to PHH Mortgage.

April 21 -

The Tennessee company says it has been pitching specialty finance products inherited from Iberiabank to its own clients.

April 21 -

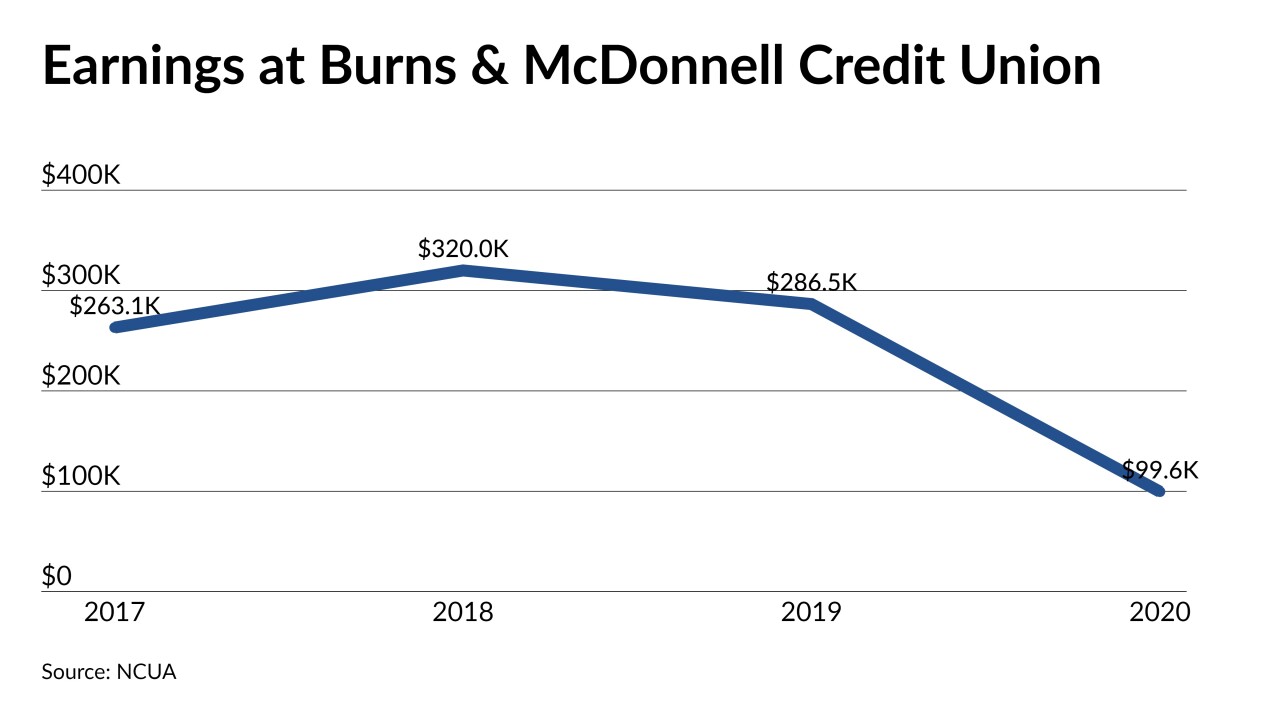

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

Rhodium BA Holdings said it has proposed paying a higher price to disrupt the banking company's proposed sale to DLP Real Estate Capital.

April 20 -

The San Diego company will pay $55 million to Morgan Stanley for a business that has 200 custody relationships, $23 billion of custodial assets and $1.2 billion of deposits.

April 20 -

The Connecticut company has struggled to put deposits from its health savings account business to work across the Northeast. Buying Sterling Bancorp for $5 billion will provide Webster with new opportunities in a number of business lines, including asset-based lending and equipment finance.

April 19