-

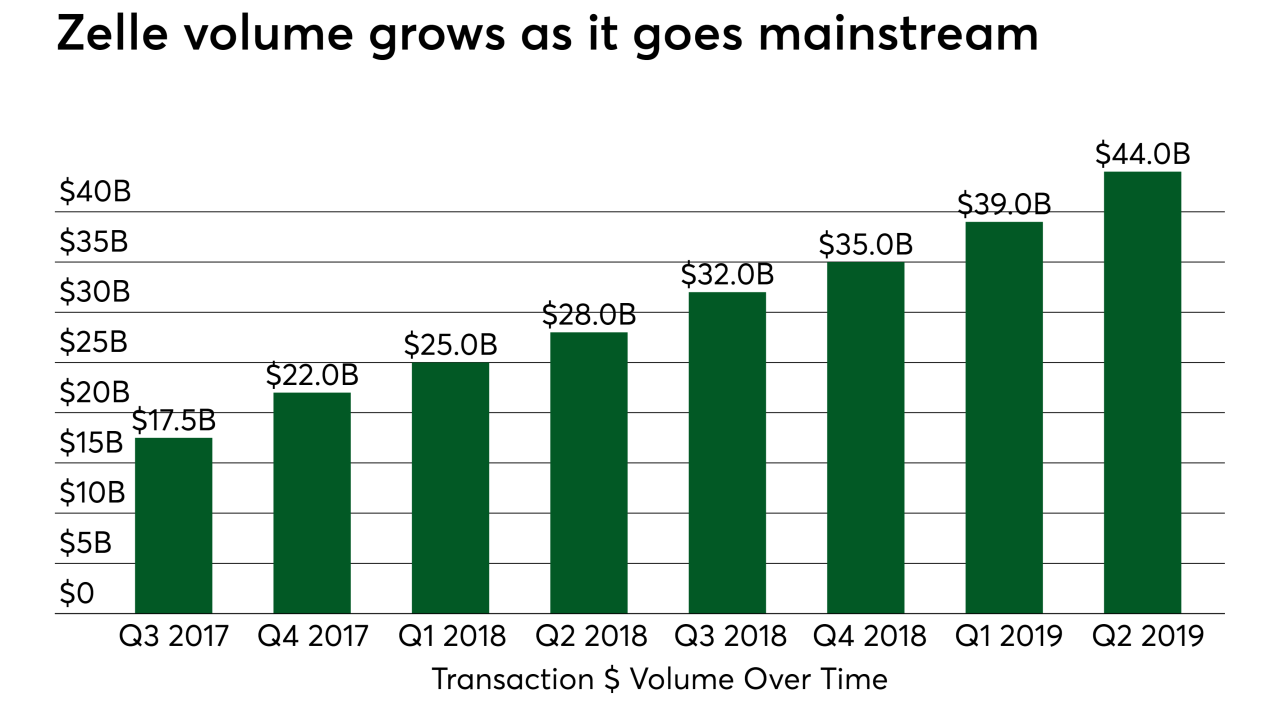

Early Warning's Zelle P2P network processed $44 billion in payment volume over 171 million transactions during the second quarter of 2019, a growth of 56% in volume and 71% in transactions year-over-year.

July 26 -

By offering Prime subscribers one-day shipping instead of the standard two, Amazon saw a dramatic change in shopping behavior — and a corresponding rise in costs.

July 26 -

Top technology innovations in digital banking you need to see

July 26 -

Rakuten joins a growing list of fintechs trying to enter the regulated banking sector. All have faced their share of obstacles.

July 26 -

The mobile point of sale market has grown far beyond its roots as an off-the-shelf dongle for smartphones. The category is now driving major acquisitions, collaborations and international deployments.

July 26 -

Readers react to BofA defending reverse mortgage borrowers, support the Federal Reserve creating a real-time payments system, advocate for consolidating federal bank agencies and more.

July 25 -

New data from PSCU shows a 46% increase in sales volumes for credit union members compared to last year.

July 25 -

Payconiq has built an omnichannel, multicountry payment platform that uses a mobile payment app to leverage existing bank infrastructure in order to make payments in-store and online payments as well as to send P2P payments.

July 25 -

Banks and third parties must work together to safeguard data being shared when a customer uses mobile apps.

July 25 The Clearing House

The Clearing House -

The number of transactions to send money across borders has risen for 36 consecutive months, but this could eventually slow.

July 25 -

Giant Eagle’s supermarkets go back a century, literally, making the Pittsburgh chain one of the best tests yet for how the supermarket experience can adapt to mobile technology and the de-emphasizing of traditional checkout.

July 25 -

The P2P service, based on the time its users spend with it, has the capability of luring users into other services attached to Venmo.

July 24 -

The brokerage expects customers will use conversational tech to check accounts and perform other financial transactions while stuck in traffic.

July 24 -

One year out from hosting the Summer Olympics, Japan’s merchant base has a low ratio of contactless acceptance compared with other major markets.

July 24 -

Increased connectivity and speed could mean shorter transaction times for consumers, quicker and more stable connectivity between merchants and acquirers and even an end to offline payments, writes James Daniels, vice president and head of Asia Pacific at FIME.

July 24 FIME

FIME -

If the Federal Reserve doesn't maintain an active role, Wall Street megabanks could take over the payments system.

July 24 Calvert Advisers LLC

Calvert Advisers LLC -

Accounts that offer high interest rates can bolster fee income and lower noninterest expenses, though credit unions have to carefully watch these products to ensure they actually make money.

July 24 -

While loan growth continues to outpace competitors, Discover says it has been tightening its standards, given the late stage of the credit cycle.

July 23 -

Calling it the largest B2B trading platform in the world, Alibaba Group has opened Alibaba.com to small and medium-size U.S. businesses to reach an addressable market of $23.9 trillion.

July 23 -

Starbucks is looking to reclaim its role as the global leader in streamlined, intuitive order-and-pay systems through machine learning technology it’s developing in-house and through a deal with restaurant-tech startup Brightloom, its new equity investment partner.

July 23