The Unsinkable

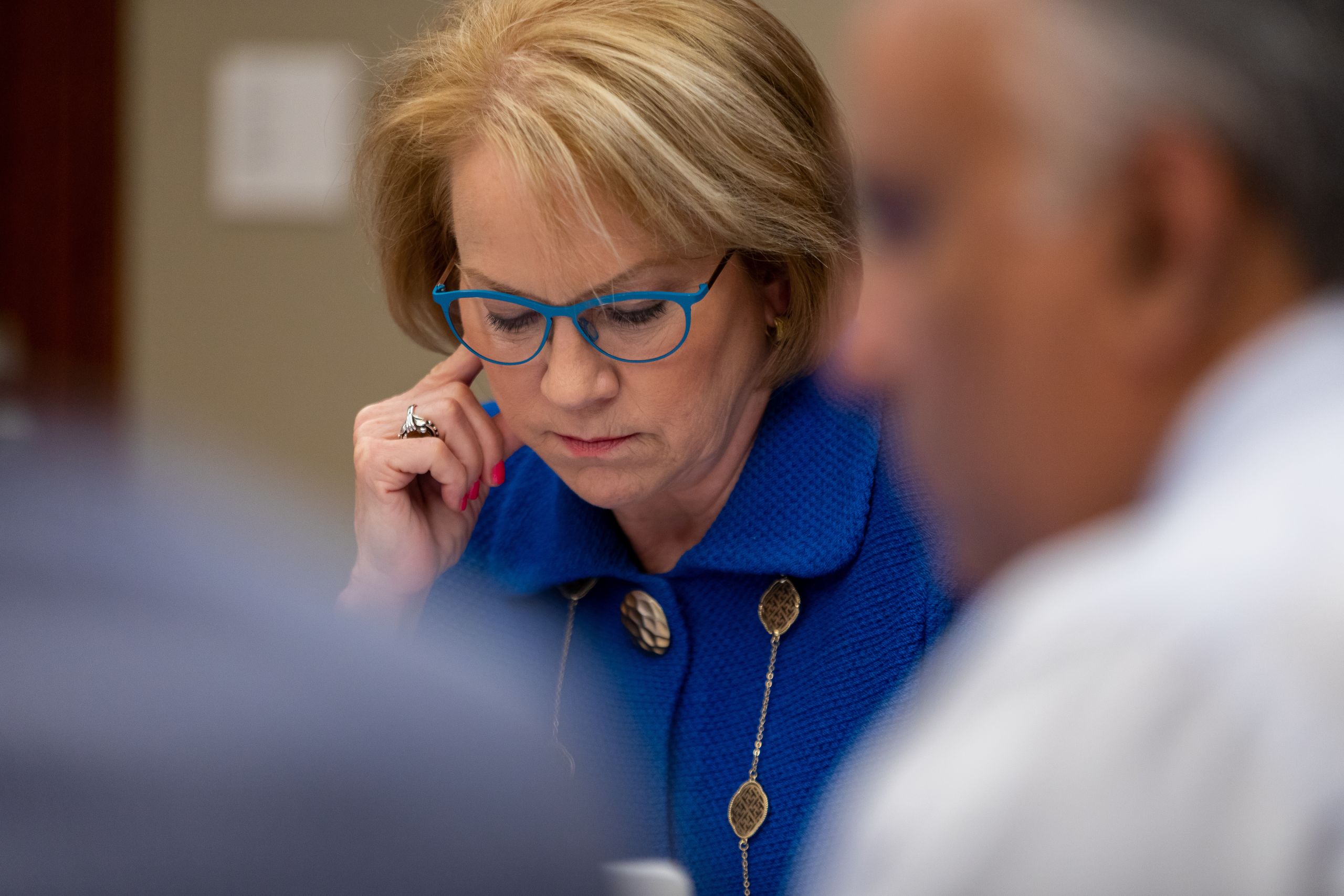

Cathy Bessant

She turned around troubled business units, rebounded after a demotion and beat cancer. Now Bank of America’s chief operations and technology officer is taking on her biggest challenge yet: ensuring AI is used responsibly.

A few hours into a busy morning, Cathy Bessant is on her way to a fireside chat with several hundred interns at Bank of America’s Charlotte, N.C., headquarters. As she walks through the lobby, she points to a spot that used to be a gym and is now a restaurant.

“I’m still in mourning, even 10 years later,” she says. “I liked the competitive spirit at the gym; it made me do more.”

Competitiveness is a key theme of Bessant’s 37 years in the banking industry, all but two of which were spent at BofA, where she is now chief operations and technology officer. Another is the need for a challenge.

When she was in ninth grade, the Title IX civil rights law was passed that prohibited any educational program or activity receiving federal funds from discriminating against women. “Suddenly my high school had a girls’ swim team,” Bessant says.

She joined because she was a good swimmer who wanted to get faster. It didn’t go well at first. “I’ve had the agony more than once of getting polite applause and realizing it’s because I was last,” she admits. “It was humiliating. So I like the challenge of figuring out how to have impact even if I wasn’t going to be the fastest.”

By senior year, she was captain of the team. “Not because I was the fastest person and not because I set out for the glory of it,” she says. “I set out for the challenge of it.”

This same mindset has guided her throughout her career. When she first joined BofA, she jumped at an opportunity that others didn’t appreciate. It was a territory in the Rust Belt that included Detroit during an auto industry slump.

“I liked that that was the territory nobody wanted,” she says.

She did well enough that she was later sent to run the Florida region when it was losing market share. “It was, ‘Send Cathy,’ ” says Bessant, who ranks as the No. 1 Most Powerful Women in Banking for 2019, her third year in a row atop the list. “I like being known for fixing things.”

Responsible AI and the future of work

Not everything she sets out to fix is broken. Her decision to tackle the issues facing society around artificial intelligence is more of a preventive measure.

A few years ago, Bessant, who oversees a $14 billion annual budget, was thinking about artificial intelligence software and the fact that it’s designed by humans who build their own biases into it. She considered the role that her company and others should play in making sure AI is used for good and doesn’t have unintended negative consequences.

She wanted to go beyond BofA in studying the issue, as it not only affects the industry broadly, but has implications for many others sectors, from government to higher education.

So in April 2018, she worked with Harvard University to create a Council on the Responsible Use of Artificial Intelligence, to bring together people from academia and the corporate world to work on ethical questions around AI.

“The council is focused on societal infrastructure and on bringing to light and having candid discussions about when it doesn’t go well,” she says.

“I've never seen a situation I didn't want to take on. I'm persistent and even when I've had failures, I get up and do it again. I respect that attribute in people who will take whatever you throw at them and figure out a way."

The group recently saw a demonstration of bias in facial recognition.

“When I change my glasses, facial recognition doesn’t recognize me,” Bessant says. “The darker your skin is, the less likely the software is to recognize your face.”

Lately, Bessant and the council have been focused on the impact of emerging technology like AI and robotic process automation on the workforce of the future.

“Workforce transformation is serious and hard and important,” Bessant says. “Our people are very worried and, to me, that means very distracted by it. No company can afford to be idle about that distraction.”

While some fear that computers might one day largely replace people in many jobs, Bessant doesn’t see it that way. BofA, for example, still needs skilled operations staff, she says.

“How motivated our workers are, how confident they are, is 100% correlated to what service they give,” she says. “And more and more, the cost of poor service is huge. There’s complete zero tolerance for it. And when you do make a mistake, it’s all over social media. Confident, competent people are the only thing that can deliver flawless execution.”

But that doesn’t mean nothing is going to change. While employees continue to do their daily work, Bessant wants them to be “reskilling” for jobs of the future. She started an internal “university,” where the 95,000 people in her group can take online courses and learn how to code, how to design bots, and other skills.

She also intends to double the percentage of open positions in her group filled by internal hires — from 38% to 76%.

Asked if she believes there is merit in bringing in new people with fresh perspectives, who have honed their skills at tech companies like Amazon and Google, Bessant acknowledges there is. That’s why her goal is not 100%.

She says the percentage may change over time.

“But I want managers to feel pressure to pull for the kind of educational models, certification models, internal development and training people need,” she says.

AI could be used to help with this, she notes. It could help chart the jobs and education people have as they move from one place to another, to learn, for instance, if people in finance turn out to be great coders, and to see what that career path looks like.

“We don't need to battle anybody for talent. We have the talent pool."

All of this could help with the tech talent shortage and reduce the cost of churn, which she calls a “useless expense.” “We don’t need to battle anybody for talent,” Bessant says.

“We have the talent pool,” as long as the company invests in helping employees develop new skills and employees take advantage of the opportunity.

BofA’s best-known use of AI is probably Erica, the cognitive voice and chat-driven virtual assistant it launched in June 2018.

More than 7.6 million users have completed 55 million requests through the chatbot. The most popular interactions are transaction searches across accounts, views of proactive insights, bill payments, funds transfers and requests for routing numbers and FICO scores. The virtual assistant also provides a weekly snapshot of month-to-date spending, tracks month-to-month changes to FICO scores, flags upcoming recurring charges, and sends alerts for upcoming payments due on BofA credit cards.

Beyond the AI work of her company and the Council for the Responsible Use of AI, Bessant spoke about responsible AI in seven different talks at the Davos conference this year. She also hosted a private BofA dinner, along with Dean Athanasia, the company’s president of consumer and small business, on the topic of responsible AI with 20 guests from academia, government, chief executives and chief information officers.

Building empathy

Though she’s clearly a driven, ambitious Type A — she has climbed the corporate ladder, summited Mount Kilimanjaro and survived breast cancer — Bessant often acts like a Type B: friendly, soft-spoken, patient, empathetic.

Part of this is likely the Southern manners common in Charlotte, where, in a three-block walk through the downtown, multiple strangers smile and say hello. One, a man shouting “Jesus saves” on a corner, pauses to tell a passerby to have a wonderful day. None of them ask for money.

Bessant, who grew up in Michigan and moved around the country for various roles at BofA, has been in Charlotte for the past two decades.

But her warm disposition also could be the result of a lesson she learned years ago, when she was demoted for a year.

Her boss at the time told her: “I see you in community meetings and people love you, and you are not loved in here. You need to go figure out what the difference is.”

Bessant realized that when she was out in the community, she was a good listener. She also was more relaxed.

“I had to make changes in my style and embrace being natural and authentic,” she says.

Bessant speaks at American Banker’s Most Powerful Women awards gala last fall.

Bessant speaks at American Banker’s Most Powerful Women awards gala last fall.

Bessant’s life has also given her opportunities to acquire an unusual level of empathy.

She grew up poor, in a 900-square-foot house with six people, one bathroom and no shower.

Her brother was in a car accident in 2013 in which he broke his pelvis in nine places, tore his aorta and both lungs, and ended up in a coma for more than 20 days. He was convicted of DUI manslaughter because the passenger in his car, his girlfriend, died. He also spent time in prison. He will never drive again and may never work again, though he does do volunteer work.

“Most people look at someone like me and would think I didn’t know what a probation officer was,” Bessant says.

Such experiences have helped shape Bessant, forging a unique blend of strength and sensitivity.

It is something others notice about her.

Henry Cisneros, a former secretary of housing and urban development, once introduced Bessant to an audience as “the unsinkable Molly Brown,” a reference to the socialite who survived the wreck of the Titanic and urged the crew to take the lifeboat back for more passengers

Andrea Smith, the chief administrative officer at Bank of America, has a similar take on Bessant. “She would describe her career not as one that went always up, but one that went sideways and down,” says Smith, whose office is next door to Bessant’s. “But she was determined to learn from each setback and was always very resilient.”

Bessant describes herself as "bulldogged."

“I’ve never seen a situation I didn’t want to take on,” she says. “I’m persistent and even when I’ve had failures, I get up and do it again. I respect that attribute in people who will take whatever you throw at them and figure out a way.”

When Bessant was diagnosed with breast cancer in 2010, her boss, BofA Chairman and Chief Executive Brian Moynihan, encouraged her to take time off during her treatment.

“I said, ‘Are you trying to make me crazy?’ ” Bessant recalls. “If I’m not occupied I will dwell in a bad place. So then I doubled down and said I’m not going to miss a day of work. I missed a few, but that was the goal I set for myself.”

When she interviews job candidates, Bessant asks them to tell her about a setback they’ve had. Often they don’t want to admit they’ve had one.

“You can tell the fake ones; they make up adversity,” she says. “But if a person tells a poor story or says they can’t recall that they’ve had one, that they’ve been on a straight trajectory, I may finish the interview, but my ears shut down.”

5G, cloud, inclusion

By virtue of her position, Bessant is keenly aware of emerging technology and the potential impact it will have as it goes mainstream.

One issue already on Bessant’s radar in a big way is 5G, the faster communication network technology being rolled out by Verizon and

AT&T.

“We have to have it,” she says. “The ways we intend to use technology in society demand it.” For instance, driverless cars require huge amounts of bandwidth. Wi-Fi networks are easily strained. BofA has two 5G pilots underway now. Bessant is also working to make Charlotte one of the first cities to be 5G enabled.

“It’s a dream right now,” she says. “We don’t have the infrastructure for it to be a reality.”

She also wants to make sure all communities have 5G, perhaps with the government’s help, so disadvantaged areas don’t get left out.

Cloud computing is another priority.

Bessant says the hacking of a cloud provider in July validated BofA’s current hybrid cloud strategy, in which 80% of workloads run on an internal cloud.

One of the benefits of using a hybrid cloud is that BofA embeds its own security and safety controls.

“The reason we are cautious is that with many cloud providers we still have to maintain our cocoon of controls,” Bessant says. “So not only do we pay a third-party expense, but we retain a lot of our internal expense.”

BofA will switch to an external cloud only when Bessant is confident that the economics and safety make sense.

Family matters

It’s the end of the day, and Bessant says she is taking her brother to a minor league baseball game that night. They go often.

“I have season tickets,” she says. “I grew up in a baseball family.”

The night before, Bessant, her husband and her brother went out to dinner and, back at her brother’s house later, helped him take out the garbage. It had been raining and there was a big divot on the top of trash can. She ended up getting soaked.

Their closeness is something she appreciates. “I have a best friend to watch baseball with, so we both benefit from that relationship,” she says.

The final question she gets — what is next for her — is the hardest to answer and the only one she punts on. There is a strong possibility she could stay on several more years at Bank of America in her beloved Charlotte.

Whichever path she takes, she will keep taking herself out of her comfort zone with physical and mental challenges like she did with climbing Mount Kilimanjaro. And she will keep focusing on causes she personally cares about, such as accommodating people with disabilities.

The worst piece of advice she’s ever gotten, Bessant tells the interns in her morning fireside chat, is “fake it until you make it.”

“A lot of people say it,” Bessant says. “I just don’t believe it, and every time I’ve tried to fake it or act like I knew something I didn’t, it didn’t work out. I refuse to fake it.”

Photos by: Peter Taylor