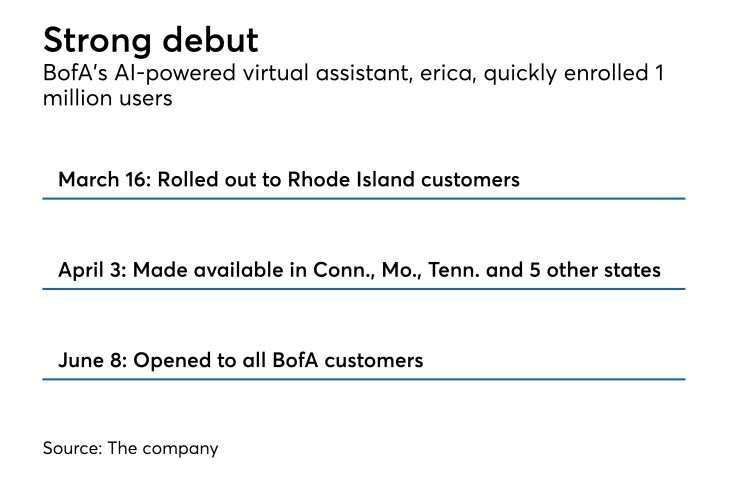

Bank of America's erica, an artificial-intelligence-based virtual assistant, is off to a hot start — 1 million users in 3 months.

It was rolled out in Rhode Island in mid-March, was made available in eight more states the next month, and then was opened to all of Bank America's 25 million mobile app customers last week.

What's behind the strong debut? Easy-to-use transaction-search functions and financial advice have been big hits, bank officials say.

“It goes to show how quickly we can grow, and we expect the numbers to continue to grow,” said Michelle Moore, head of digital banking at Bank of America.

The bank deserves credit for telegraphing that the product was on its way and for explaining how to use it once it arrived, according to Emmett Higdon, director of digital banking at Javelin Strategy & Research.

“They’ve had email campaigns for some time saying erica is coming, here’s what it is,” he said. “They have done a good job prepping the audience for its introduction," including showing new users what erica can do and how to phrase their questions.

But, to sustain erica's growth, Bank of America will have to handle a variety of challenges, including: protecting consumer privacy, improving its ability to understand everyday speech, and staying ahead of the tougher demands users are expected to put on the service as they grow accustomed to it.

Popular functions

Moore did not share user demographics, but she gave information about what users are doing with erica.

The top thing customers use erica for is to search transactions — especially those with popular merchants such as Amazon, Target, Walmart, Costco and Uber.

“You can go into erica and say, ‘Show me all my Amazon transactions,’ ” Moore said. “It will tell you all your credit and debit card transactions, and if you wrote a check, that would show there, too."

Moore made that very query last month and said she was impressed with the results.

"In the past I’d go through all my statements and add [the transactions] up on a calculator," she said. "I don’t have to do that anymore because I can ask erica. So, transaction searching has been a huge hit.”

Search could provide a real edge for virtual assistants that do it well, Higdon said.

“We found through our research for our mobile banking rankings that most of the large banks do a pathetic job allowing customers to search or sort their transactions,” he said. “When you log into online banking, you have five or six column headers; you can click on description, date, amount, type, and sort your whole list by that criteria. In mobile banking, you can’t even tap on the list of transactions and sort them from top to bottom by dollar amount.”

And in the banking apps that do have transaction-search capability, the feature is, somewhat ironically, hard to find.

Erica can also be used to obtain account balances, account numbers or routing numbers or to pay bills.

“We know customers are searching for pending transactions, processing transactions — they’re asking: 'Did my paycheck post?' " Moore said.

The bank has integrated its Better Money Habits financial literacy content into erica.

“If you ask erica about credit scores, she will give you back an answer about Better Money Habits and provide a video,” Moore said. “If you type in ‘learn about credit scores,’ you’ll receive Better Money Habits videos. If you type in ‘how can I stick to a budget?’ you will receive content and information back from Better Money Habits.”

It can also integrate with the bank’s spending and budgeting tools. And it connects with customer service agents’ consoles in call centers. So while customers are using erica, they can tap to talk to an agent. They are fully authenticated, and the agent can see what is been happening in erica. Customers do not have to re-identify themselves or explain their situations.

There are three ways to communicate with erica: by voice, text, or tap and gesture. Tap and gesture has been the most popular so far, Moore said. Voice and text are used equally after that.

“I like [tap and gesture] myself — I can have an entire conversation with erica just by pressing buttons on the screen,” Moore said. “I don’t have to type anything, I can talk if I want to. We talk a lot about today being the voice generation, I think we’re probably on the cusp of the voice generation.”

What's next

By late summer, Bank of America will introduce insights and proactive notifications through erica.

Here customers will be told if they have upcoming bills due, if their balances are too low to cover those bills, if a subscription is expiring, or if their credit score has changed dramatically.

“I have a subscription to Restoration Hardware I’ve been meaning to cancel for years,” Moore said. “I finally got the insight from erica — these are your upcoming subscriptions. I can finally cancel.” Bank of America employees receive new erica features ahead of customers, so they can test them out.

Every now and then, in the public conversation about chatbots, someone will complain that too many virtual assistants are female, including Apple’s Siri, USAA’s EVA and Amazon’s Alexa. There is a feeling that this is sexist.

“We’ve had a few random questions about that,” Moore said. She emphasized, however, that the name erica is just the last five letters of “America.”

“We did not think about male or female,” she said. “We just thought about having a connected environment and having a great way for customers to remember who is the AI solution Bank of America has provided.”

She suggested that in the future, erica might be customizable and could become "eric" to customers that prefer a male bot.

“Our first goal was to get something up and running and understand how customers would use it,” Moore said.

Growth challenges

The big question is: Will customers keep using erica?

“That’s the biggest problem with most early chatbot implementations,” Higdon said. “How broadly will consumers turn to erica? Will they think of it as yet another tool to find static information? Any bank faces a bit of an uphill climb training users to be more self-sufficient.”

Issues can range from broad policy matters like privacy to more technical ones like programming erica to understand a wide range of speech patterns.

Cathy Bessant, the bank’s chief technology and operations officer, pointed out recently that erica does not eavesdrop the way Amazon’s Alexa does. You have to open mobile banking, then hit the erica button for a session to start.

Moore said that bank officials have been surprised by the language people are using to ask their questions, using slang like “dough” instead of “cash.” Attempts are being made to adapt the product.

“That’s how people talk to each other every day,” Moore said. “We sometimes ask ourselves, why didn’t we think of that?”

To keep customers coming back, chatbots need to give customers more than they ask for, Higdon said. For instance, a bot might tell a customer not only how much she spent on Uber last month, but, " 'By the way, that’s twice as much as you’ve spent in the last three months, is there something wrong here?' Something that gets the customer to go hmmm, and think more about their financial health overall.”

For all these challenges and more, it seems unlikely that many more large banks will launch chatbots this year.

“This is tough stuff,” Higdon said. “It requires enormous amounts of data to feed even a simple chatbot. To make it more proactive is tougher still.”

Editor at Large Penny Crosman welcomes feedback at penny.crosman@sourcemedia.com.