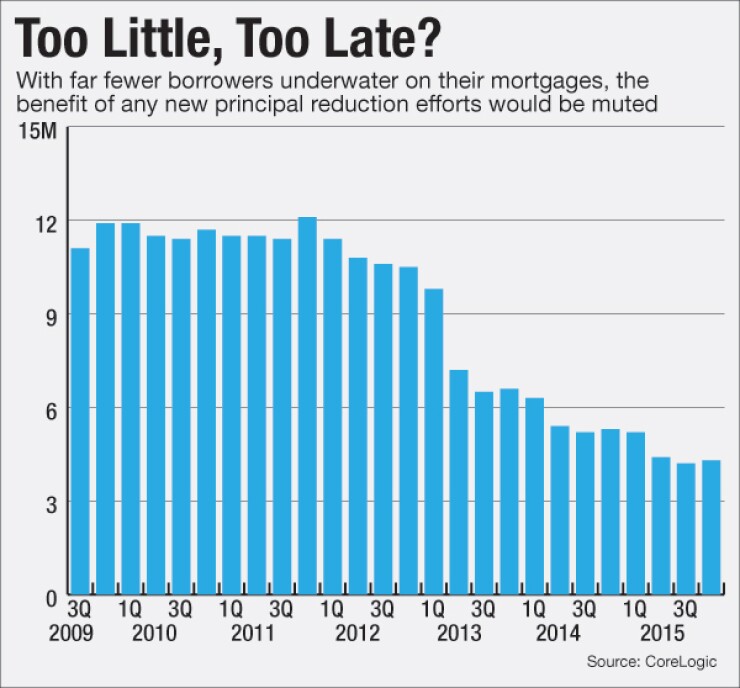

WASHINGTON — Nearly 10 years after the mortgage market cratered, after every other loss mitigation strategy has been tried, and after underwater borrowers are much fewer thanks partly to rebounding prices, now is when the government-sponsored enterprises' regulator is seriously mulling principal reductions?

In a speech Tuesday, Federal Housing Finance Agency Director Mel Watt said an answer on whether struggling borrowers can write off pieces of Fannie Mae or Freddie Mac loans will come in 30 days. While it is unclear which way the agency will go — Watt said the FHFA could "take principal reduction off the table" — many believe the agency will announce a limited program of writedowns only for cases where they would cost less than a foreclosure.

But besides the limited economic impact of a targeted program, some observers were also scratching their heads over the timing after earlier opportunities to help more borrowers came and went. In September, the number of underwater borrowers was down 59% since 2012 to 4.1 million, according to CoreLogic. And home values have rebounded to pre-recession levels.

-

Only eleven months after cheering Federal Housing Finance Agency Director Melvin Watt's confirmation, Senate Democrats are fed up with the pace of reforms at the agency.

November 19 -

The Federal Housing Finance Agency is launching a 10-day social media campaign, #HARPNow, to alert struggling homeowners in 10 states that they can still refinance via the program before it expires at year-end.

February 17 -

Remember those homeowners who walked away from their underwater mortgages even though they could still afford their loans? They're back, this time as prospective borrowers.

February 5

"Given the appreciation we have seen and job growth we have seen, it is hard to look at the aggregate numbers and think this is the point where it makes sense to do this," said Mark Calabria, director of financial regulation at the Cato Institute.

Yet others say there were real reasons why the FHFA waited this long, including concerns over the mortgage giants losing the upside from a price recovery, while there is still an opportunity for principal reductions to help a narrow slice of still-underwater borrowers who are trying to avoid foreclosure. The FHFA is said to favor a limited principal reduction plan for fewer than 50,000 borrowers, according to a

"For the homeowners who are going to get principal forgiveness, this is the probably the only thing at this point that's going to work," said Edward Mills, a policy analyst at FBR Capital Markets. "And the only way that the FHFA would allow this if the GSEs are going to lose less by doing this than other alternatives."

Up to now, the FHFA has avoided support for principal reductions in the agency's initiatives to help struggling borrowers. The two primary GSE-backed loss mitigation efforts have been through the Home Affordable Modification Program, meant to encourage loan workouts for troubled borrowers, and the Home Affordable Refinance Program to try and move borrowers into safer, lower-cost loans. Both are set to expire this year.

As housing prices plunged nearly 35% between 2008 and 2012, Watt's predecessor, then-acting FHFA Director Edward DeMarco, ruled out the use of the principal reduction despite constant urging from Democratic lawmakers and consumer groups. Watt, a former Democratic lawmaker, was seen as potentially more sympathetic to the idea, but he too has

Mills said a limited principal forgiveness effort could be seen as a solution after other steps to mitigate losses have failed.

"Is there a subset of borrowers where if you look at all of the tools available, you still wish you had an additional tool which is principal forgiveness?" Mills said. "In certain cases where all other tools have been exhausted, there is a discussion: should there be another tool available. And it seems that the FHFA is leaning towards yes."

Yet such a small-scale approach may do little to winning over any of the FHFA's critics who wanted more aggressive action. A targeted plan could disappoint consumer advocates, while angering conservative lawmakers who see any principal reduction as going too far.

"I suspect it will be so narrowly targeted that John Taylor will think it is inadequate and [House Financial Services Committee Chairman] Jeb Hensarling will think it is horrible and sets a bad precedent," Calabria said.

Industry groups that had opposed principal reduction before say they now could support a targeted program.

David Stevens, president and chief executive of the Mortgage Bankers Association, said that, while the MBA has generally been against the idea, "In a targeted, select process that results in a lower loss outcome for the investor, I think that's got to be an option."

Stevens expects servicers will have to determine if a troubled homeowner is committed to staying in the home but can't afford it without the benefit of a writedown. "It's why people should expect a very measured, probably conservative program," he said.

Even though home prices have rebounded in most parts of the country, consumer advocates say there are still pockets of borrowers who need more extreme action than has so far been offered.

John Taylor, president and chief executive of the National Community Reinvestment Coalition, said new loss mitigation standards will need to be adopted as HAMP and HARP both expire.

"Let's transfer into a sensible principal reduction program that puts people in a position where they have the ability to stay in their homes and pay on the mortgage what makes sense based on their income," Taylor said in an interview Wednesday.

Yet some industry insiders say the same risks that made principal reduction a hard sell before could be at play in any effort going forward.

"It is hard to envision a scenario where principal reduction would result in a win-win for the marketplace overall," said Carrie Hunt, executive vice president for the National Association of Federal Credit Unions. "NAFCU strongly supports protecting consumers, but principal reduction sets a dangerous precedent."

Robert Davis, an executive vice president for the American Bankers Association, said the FHFA is still unlikely to support any broad steps to support principal reduction on a large scale. "It's safe to say that the notion that it's good public policy just to spend the taxpayers' money on debt forgiveness when borrowers have the ability to pay their debt isn't really a good idea," he said.

Yet, Davis added, there could still be limited room to allow writedowns on a small scale. "The issue now is: Are there smaller groups of borrowers who may be behind on their mortgages" and does a writedown make more sense to Fannie and Freddie as investors? "That's a different question."

Joe Adler contributed to this article.