The Senate passed a bipartisan housing bill in an 89 to 10 vote, but how quickly and easily the bill can pass the House remains unclear.

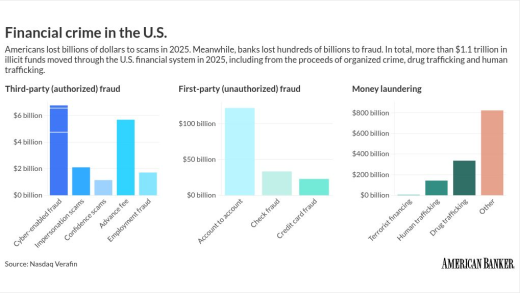

Criminals are using AI and professional crime networks to scale attacks, yielding massive operational risks for banks, according to a new report from Nasdaq.

-

The bank-owned instant payment network has added a new use for its seldom-mentioned disbursement business.

-

Noelle Acheson argues that banks' focus on deposit tokens rather than stablecoins is a clear example of the "innovator's dilemma" at work: few economic incentives to embrace the innovation happening at the periphery.

-

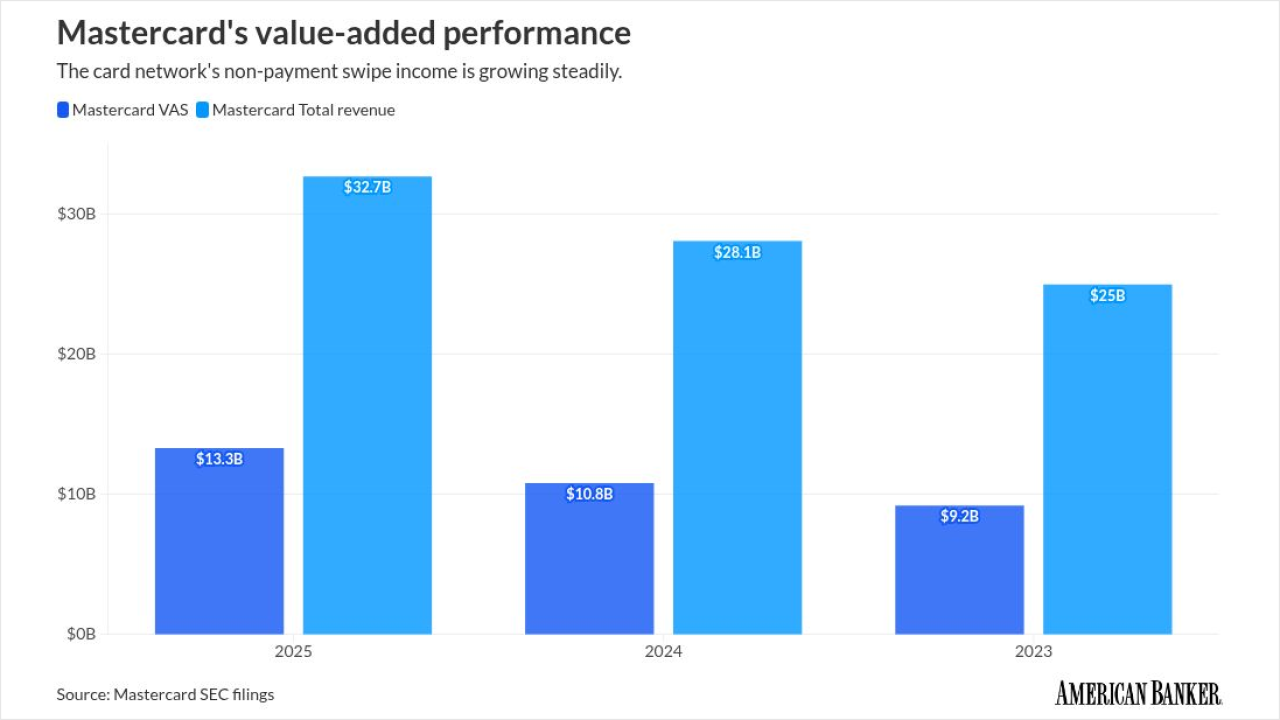

The card network hopes to increase revenue from non-card payments and is tapping two major technology trends.

The bank is partnering with a French software company to upgrade its usage of the emerging forms of artificial intelligence. Plus, Ripple plans to buy a local payment company to secure a license in Australia, and more in American Banker's global payments and fintech roundup.

The New York-based bank, which serves plaintiff law firms, agreed to pay $348 million for a Windy City community bank.

A New York state bill would reduce the barrier for minority-bank and community-bank participation in the state's long-standing Banking Development District program.

-

The war may put a damper on bank mergers; and financial crime has become a global industry -- a big global industry

-

There's a huge difference between short-term volatility and true systemic risk. The current rash of redemptions from private credit funds betrays a misunderstanding of the strengths underlying the business model.

-

Kraken's limited account with the Fed raises as many questions as it answers; bank executives worry about the war; Nubank hires a TikTok executive; and M&T CEO Rene Jones joins the Leaders series

-

The New York-based bank, which serves plaintiff law firms, agreed to pay $348 million for a Windy City community bank.

-

A New York state bill would reduce the barrier for minority-bank and community-bank participation in the state's long-standing Banking Development District program.

-

A threat that was probabilistic is now official. An Iranian military spokesperson warned of a "painful response" against U.S.-linked banks.

-

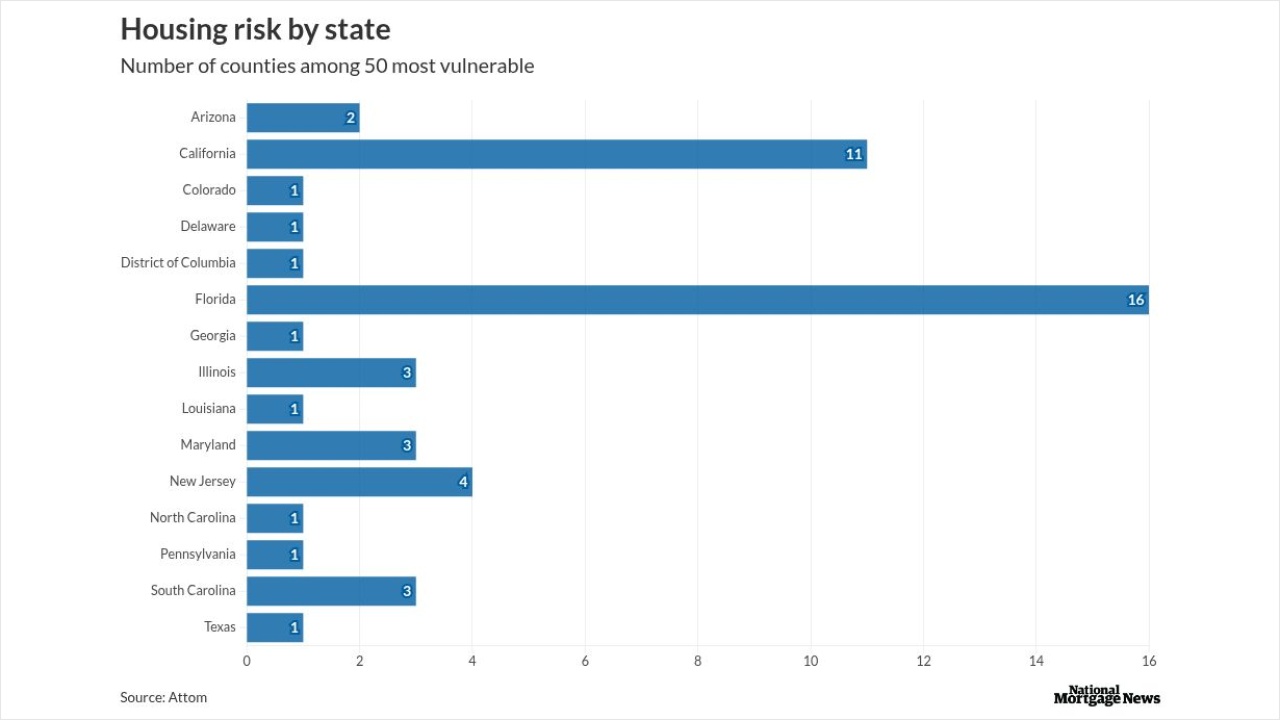

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

-

Cameron Bready, the firm's CEO, noted the company's clients include 12 large Middle Eastern airlines, and the closed airspace "isn't ideal."

-

- Daily BriefingDelivered Every WeekdayIdeas that impact your business delivered to your inbox every day.

- TechnologyWednesday, ThursdayThe latest industry developments from digital banking to cybersecurity to AI.

- PaymentsDelivered Every WeekdayAn early-morning roundup of important headlines from the past 24 hours.

- Best of the WeekFridayThe most important and widely read stories from the previous week.

-

The annual rankings honor the notable performances of individuals in banking and finance and as teams.

-

Call for submissions for women 40 years and younger who are rising leaders at their bank or financial institution.

-

Think your credit union has one of the best workplaces in the country? Here's how to apply for American Banker's ranking of the Best Credit Unions to Work For.

The 23rd annual ranking of women leaders in the banking industry.

-

-

- Partner Insights from Visa Direct

-