John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

The Iowa company said the coronavirus outbreak and litigation against AimBank will postpone the deal's completion by a few months.

By John ReostiAugust 28 -

Mike Duncan had kept a low profile as chairman of the U.S. Postal Service’s board of governors until it hired Louis DeJoy as postmaster general. Now he is sharing an unwanted spotlight with the embattled DeJoy.

By John ReostiAugust 28 -

The St. Louis company is gaining a sizable Small Business Administration platform and several niche deposit teams. Keeping those specialists in the fold will be key to the acquisition's success.

By John ReostiAugust 21 -

The Dallas regional is placing deposits in several minority depository institutions, providing each with low-cost funds that can be redeployed in underserved communities.

By John ReostiAugust 19 -

Observers say the rare denial is rooted in skepticism that a new bank can succeed under current economic conditions and a signal to other proposed banks to hit the pause button.

By John ReostiAugust 18 -

Ulule is working with Bank of the West to build name recognition. It hopes to collaborate with other banks and credit unions as it vies with larger companies such as Kickstarter and GoFundMe.

By John ReostiAugust 13 -

The Small Business Administration began accepting applications Monday, but lenders such as JPMorgan Chase are holding off in hopes that Congress will grant blanket forgiveness for smaller Paycheck Protection Program loans.

By John ReostiAugust 10 -

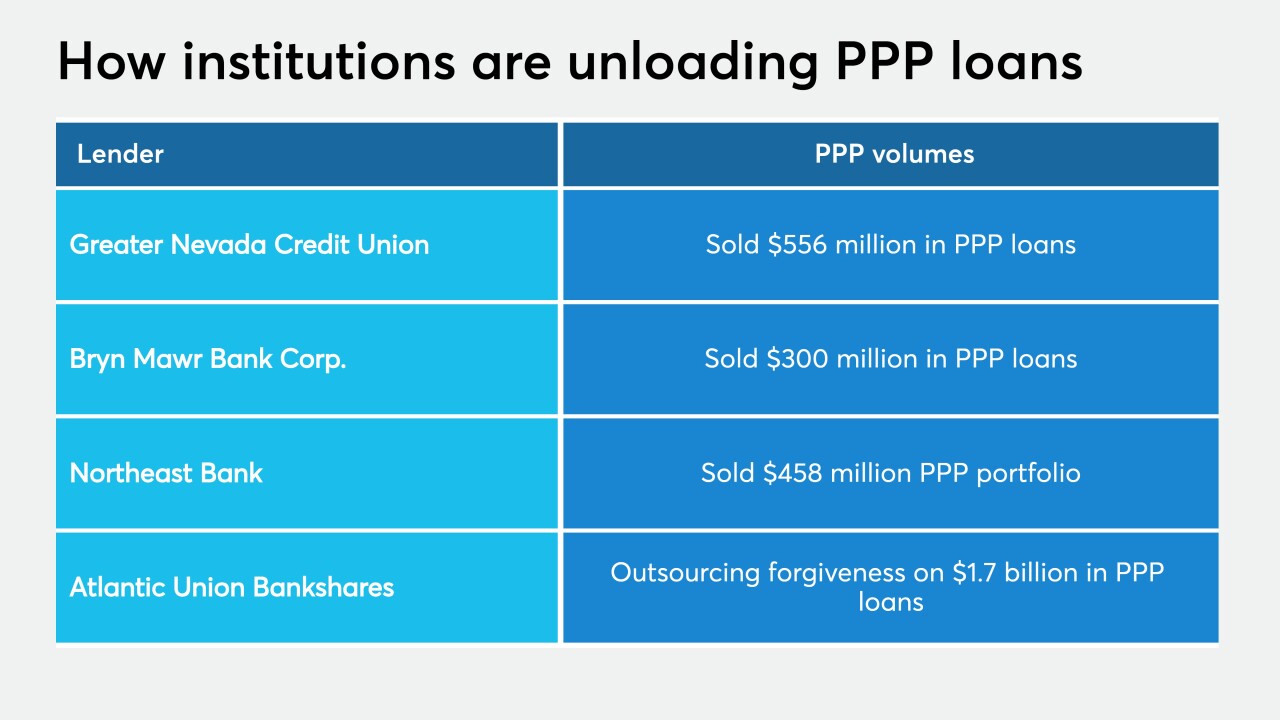

Many sellers are ditching the loans to avoid the cumbersome forgiveness process. For others, the Paycheck Protection Program was never a strategic fit.

By John ReostiAugust 5 -

No two properties are alike, so lenders are tailoring their approaches for modification, forbearance and repayment of loans to a sector devastated by the pandemic.

By John ReostiAugust 2 -

The regulator approved a proposal that mirrors a rule banking regulators implemented in February 2019 to cushion the Current Expected Credit Losses standard's impact on capital levels.

By John ReostiJuly 30 -

A proposal to expand credit unions’ access to subordinated debt drew plenty of fire from bankers, but there are also concerns the regulation could be problematic for the institutions it aims to help.

By John ReostiJuly 27 -

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

By John ReostiJuly 24 -

The Ohio company, which has beefed up its loan-loss reserves, raised the possibility of more sales of oil and gas credits and talked up strong retail segments such as its marine and RV loans.

By John ReostiJuly 23 -

Many bankers want to focus more on the forgiveness process, assessing the status of deferrals and pursuing traditional lending opportunities.

By John ReostiJuly 21 -

While rival banks reported increases in loans and deposits, thanks largely to their participation in the Paycheck Protection Program, State Street and Bank of New York Mellon saw their balance sheets shrink in the second quarter.

By John ReostiJuly 17 -

The proposed Chicago de novo would focus on serving female entrepreneurs.

By John ReostiJuly 16 -

The South Carolina-based credit union will buy two locations from Arkansas-based Bank OZK as it moves to exit the Palmetto State.

By John ReostiJuly 16 -

The Arkansas bank is selling two South Carolina branches to a credit union just two weeks after announcing plans to divest its branches in Alabama.

By John ReostiJuly 16 -

Greater Nevada Credit Union, like a number of community banks, agreed to sell its Paycheck Protection Program loans to avoid having to navigate the complicated forgiveness process.

By John ReostiJuly 15 -

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

By John ReostiJuly 15