John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

As banks accept new applications for the paycheck program, they are dogged by complaints that they prioritized wealthy borrowers. But lenders likely fast-tracked clients they knew best under difficult circumstances, observers say.

April 27 -

Lenders are being urged to prepare applications for the latest version of the Paycheck Protection Program.

By John ReostiApril 24 -

The energy business alone faces immense challenges and the overall economy may not bounce back until 2022, Stephen Steinour says.

By John ReostiApril 23 -

A backlog has formed since the first round of Paycheck Protection Program funding dried up, threatening to further strain a platform that struggled to handle the initial workload.

By John ReostiApril 22 -

The Los Angeles regional bank recorded the $1.5 billion noncash charge after its stock price ended March below its tangible book value.

By John ReostiApril 21 -

The Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.

By John ReostiApril 16 -

The Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.

By John ReostiApril 16 -

PayPal, Intuit QuickBooks Capital and Square Capital have been named direct lenders in the Paycheck Protection Program, and more await the go-ahead. They could be crucial to reaching the smallest firms trying to survive the economic toll of the coronavirus pandemic.

By John ReostiApril 13 -

Many banks were hitting their limits for lending to small businesses devastated by the coronavirus outbreak. They say the Fed's decisions to help fund additional loans and relax capital requirements will resolve many of their problems.

By Paul DavisApril 9 -

The agency overhauled its system for the Paycheck Protection Program on Wednesday. Lenders hope it addresses the access issues and a crash that bedeviled the effort’s first week.

By John ReostiApril 8 -

The Small Business Administration said lenders approved $71 billion in loans from the Paycheck Protection Program in less than five days.

By John ReostiApril 7 -

Lenders must balance the financial risk of extending credit without explicit backing from the Small Business Administration against the reputational risk of delaying aid for needy borrowers.

By Paul DavisApril 6 -

Many bankers find crucial parts of the SBA effort to help businesses hurt by the coronavirus outbreak to be unclear and onerous. If those issues go unresolved, participation could suffer.

By John ReostiApril 2 -

The pandemic may force the Small Business Administration to rely more on fintechs and digital channels to hasten loan approvals, a shift that could stick.

By John ReostiApril 1 -

The Treasury Department and Small Business Administration are responsible for distributing $350 billion in coming months.

By John ReostiMarch 31 -

Motivated by the entrepreneur and TV celebrity, Citizens Bank of Edmond is offering an overdraft line to give customers quick access to cash they will eventually receive from the federal government.

By John ReostiMarch 30 -

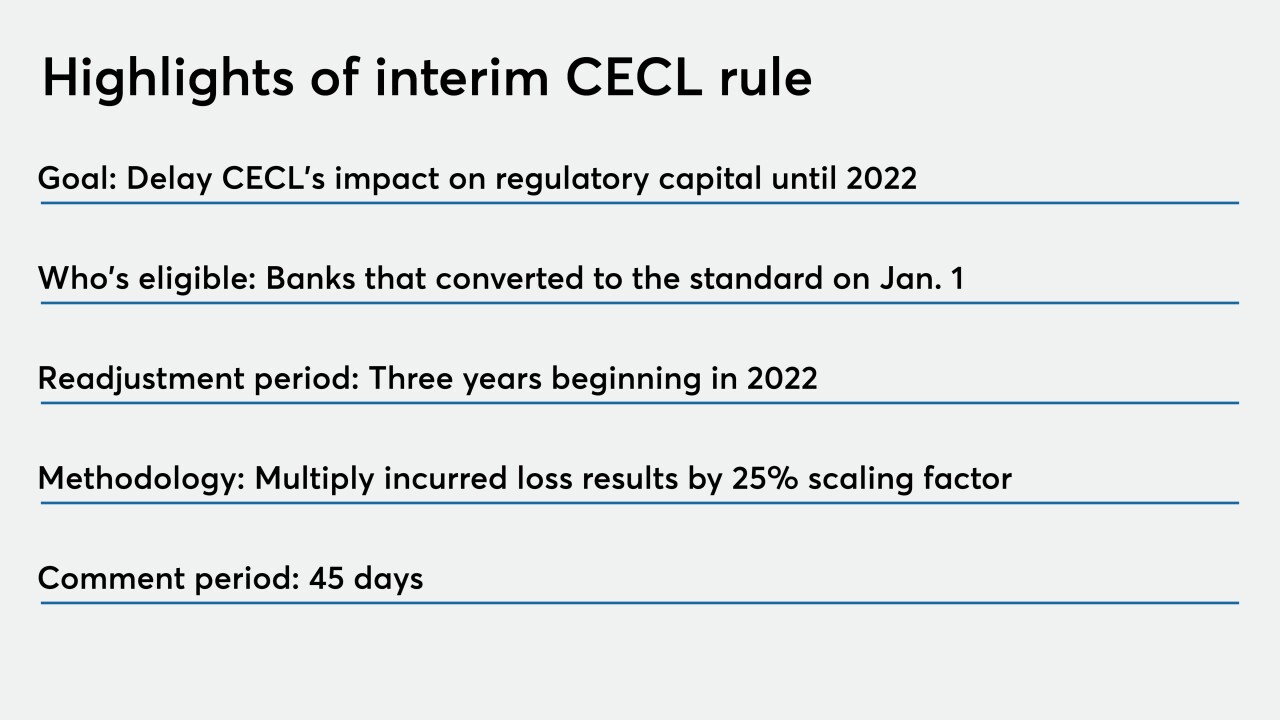

Lawmakers and regulators opted to delay compliance for banks that have implemented the credit loss standard, sparing them near-term capital hits.

By John ReostiMarch 27 -

Regulators are allowing banks that implemented the loan-loss standard to forestall any capital hits until 2022.

By Paul DavisMarch 27 -

No online lenders are approved for the agency's traditional programs, but they could make loans under the COVID-19 stimulus package if they get special approval.

By John ReostiMarch 26 -

Regulators' decision to delay reporting for troubled-debt restructurings should allow banks and credit unions to be more nimble modifying loans impaired by the coronavirus outbreak.

By John ReostiMarch 23