Charles Schwab CEO Walt Bettinger delivered forceful pushback on Monday against what he called short seller-fueled speculation about the company following Silicon Valley Bank's failure.

Worries about the brokerage giant have been "fraught with inaccuracies" and "speculative information" from "less-than-savvy alleged researchers and analysts," Bettinger said on an investor call after the brokerage firm reported its first-quarter earnings.

The company's stock price has fallen sharply in the wake of Silicon Valley Bank's failure, with some investors worrying that Schwab could be in trouble since its large securities portfolio is also underwater.

Bettinger batted down those concerns, saying that Schwab hasn't changed its conservative risk profile, that it's able to meet customers' liquidity needs without absorbing losses and that its business remains strong.

Though deposits in Schwab's banking operations fell 11% from last quarter, clients opened 1 million new brokerage accounts and added some $132 billion of core net new assets. That total included more than $50 billion last month, when Silicon Valley Bank's failure prompted worries over banks with underwater bond portfolios.

"We are winning in the marketplace among clients. Anyone suggesting otherwise is mistaken," Bettinger said. "Simply put, our franchise strength and financial model remain very much intact."

Investors appeared to like his message, as the company's stock rose more than 2% to $52.12 in midafternoon trading. The firm also laid out opportunities to cut expenses more than it had forecasted after its TD Ameritrade

Schwab's securities portfolio has

Though Bettinger didn't mention Silicon Valley Bank often by name, he laid out ways in which Schwab's approach is different. The company "did not go out and load up our securities portfolio with long-dated bonds," Bettinger said, meaning its exposure to rising interest rates was smaller.

Roughly 86% of Schwab's deposits are covered by the Federal Deposit Insurance Corp., and the deposits are spread across tens of millions of accounts, Bettinger added. Silicon Valley Bank mostly had large deposits that were above the FDIC's $250,000 insurance limit, and its deposits were heavily concentrated in the technology sector.

Bettinger also said that Schwab didn't stray from its usual approach to managing clients' cash — making relatively few loans and instead investing in high-quality securities backed by the U.S. government and agencies.

In hindsight, he said, Schwab could have ditched its usual approach and invested in fewer securities so that it had more cash.

"If we would have known that the Federal Reserve was going to raise rates faster than they ever have in history, in retrospect, that would have been a brilliant move to make," Bettinger said.

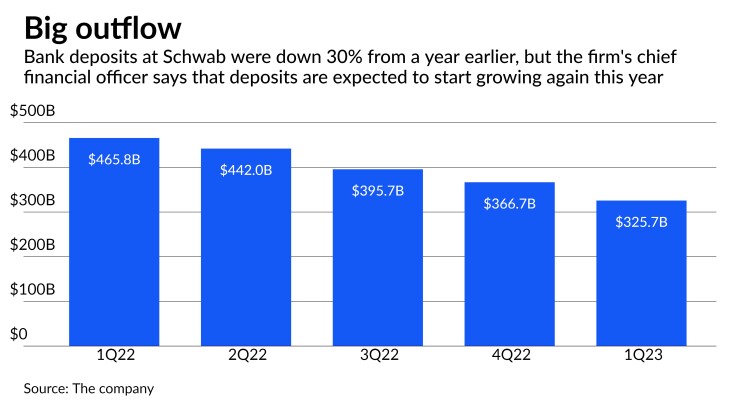

As rates have risen, Schwab's clients have found higher-yielding options for their spare cash, either within the Schwab universe or elsewhere. As a result, the volume of deposits sitting at Schwab's bank subsidiaries have fallen substantially.

The company had $325.7 billion in bank deposits at the end of March, down 11% from $366.7 billion a quarter earlier and 30% from a year earlier. Peter Crawford, Schwab's chief financial officer, said Schwab is seeing the pace of "client cash allocation activity" start to moderate and that the company expects to grow deposits again this year.

Though regulators have taken steps to ease such concerns, a massive outflow of deposits would raise the risk that Schwab could sell off part of its underwater securities to raise cash. Selling the securities at a loss would prompt Schwab to absorb what thus far are only on-paper losses.

Bettinger said Schwab executives "cannot foresee any plausible scenario where we would have to sell securities to meet the liquidity needs of our clients." The bank has always planned for periods "where high liquidity needs exceed our available cash," including by ensuring it has significant room to borrow if it needs cash.

Schwab has dialed up its borrowing in recent months. In addition to issuing more certificates of deposit, the bank had $45.6 billion in borrowings outstanding at the

Tapping those borrowing sources, which are more expensive than taking deposits, will be a temporary strategy, Bettinger said. The company expects to wind down the borrowings "over the next seven quarters" and to largely pay them off by the end of 2024, he said.

"I would certainly hope that by this point in time, the short-driven speculation that we would find ourselves in a position where we would be forced to sell securities that have temporary paper losses has been put to bed," he said.

Still, the company announced Monday that it has decided to pause its share buyback program, citing recent developments in the banking sector and "resulting regulatory uncertainty." Among the changes regulators