Syndicated lending showed resiliency in the first half, topping the record volume of a year earlier.

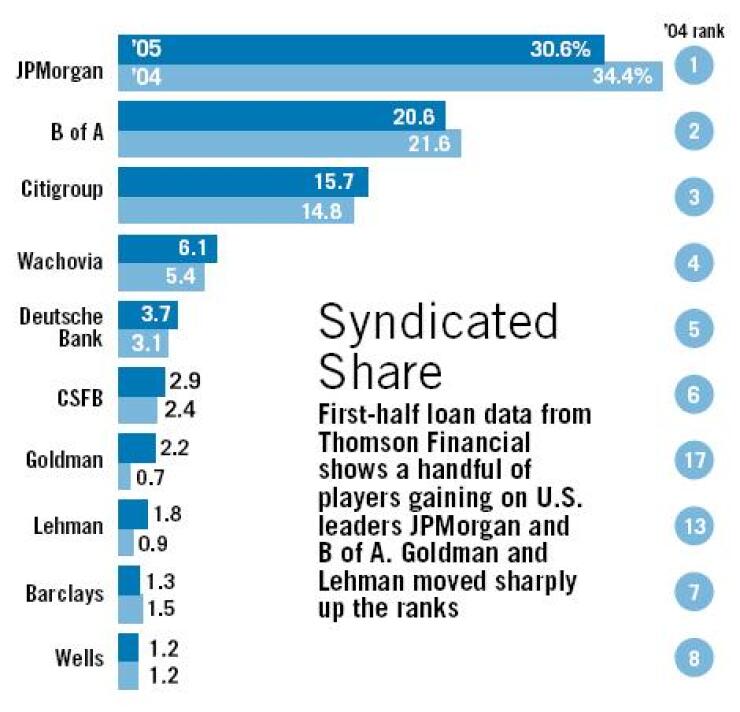

The four largest banks maintained their top rankings in the United States, according to data compiled by Thomson Financial.

Citigroup Inc. and Wachovia Corp., which ranked third and fourth, respectively, slightly increased their market share. Those of JPMorgan Chase & Co. and Banc of America Securities LLC, respectively the leader and runner-up, declined; it was the second straight down quarter for JPMorgan Chase.

Goldman Sachs & Co. rose from 17th to seventh in market share; Lehman Brothers climbed from 13th to eighth, gains that some attributed to a robust merger and acquisition environment.

Daniel Toscano, head of syndicated lending at Deutsche Bank Securities, described the syndicated lending market as lying "in the eye of the storm," remaining "calm and tranquil" despite volatility within the high yield bond market.

"Within this asset class, things are great," Mr. Toscano said. "There is money pouring in at almost record levels, defaults are low and ... [pricing] has been increasing fairly steadily," he added.

The first half's 1,674 deals were 4% more than a year earlier, and volume of $728.7 billion was up 14%, according to Thomson Financial. The second quarter had 57% more deals than the first quarter, and their value was 88% higher. (In the first quarter, deals were down 23% from a year earlier, though dollar volume was up 5.4%.)

There were 5% more investment-grade deals in the first half than a year earlier, and dollar volume increased 3%, according to Thomson. But the market is starting to cool. Second-quarter volume of $290 billion was more than double the first-quarter figure but down 6% from a year earlier."

"The investment-grade market is a victim of its own success," said Meredith Coffey, the director of analytics at Loan Pricing Corp., a division of Reuters Group PLC. Ms. Coffey said borrowers already had taken advantage of low rates to convert 364-day loans to five-year loans, leaving little need to refinance. There were only 38 deals involving 364-day loans in the second quarter, down from 170 a year earlier.

The investment-grade "market has moved rather dramatically," said Andrew O'Brien, a managing director and head of loan syndication at JPMorgan Chase. "A lot of investors last year shifted" to longer-term loans.

JPMorgan Chase handled 30.6% of the syndicated loan volume in the half, down from 34.4% a year earlier, according to Thomson Financial. Its investment-grade market share fell during the same period to 35.5%, from 42.6%. The company declined to discuss the numbers, but analyst Jeffery Harte of Sandler O'Neill & Partners said JPMorgan Chase is "making a conscious effort" to pare back its market share in investment-grade loans, partly because of "razor thin" margins.

"They're trying to be a little more selective in what deals they participate in," Mr. Harte added.

Banc of America Securities had market share of 20.6% in the first half, down from 21.6% a year earlier. Its decline was largely due to leveraged loans, where its share dropped to 18% from 22.3%, according to Thomson.

A spokeswoman for Bank of America Corp. declined to discuss the dip. Sandler's Mr. Harte said Banc of America Securities could be facing more pressure from other companies that focus more on mergers and leveraged buyouts. M&A activity may also explain Goldman Sachs' and Lehman's gains, he said.

A Wachovia spokesman said executives were unavailable for comment, and calls to Citigroup were not returned.

In the leveraged loan market, there were 3% fewer deals in the first half than a year earlier, but the dollar volume was up 14%. Second-quarter volume of $167 billion was up 56% from the first quarter and up 39% from a year earlier.

"The LBO sponsor activity was strong," added Glenn Stewart, head of the syndicate desk for syndicated finance at Banc of America Securities. Borrowers also were turning to leveraged finance to fund dividend and recapitalization initiatives, he said. Competition remains fierce, Mr. Stewart said, and demand continues to outweigh issuances.

Spreads are starting to expand in the syndicated market, according to Loan Pricing. Spreads on some BB-rated loans to nonbank investors increased to 194 basis points above the London interbank offered rate in the second quarter, versus 165 basis points in the first quarter.

Mr. Toscano of Deutsche Bank Securities said banks are becoming much more involved as investors in the leveraged market, "gobbling up BB paper like its going out of style."

He said spreads will increase further in coming months, though such expansion should be limited to 25 to 50 basis points. Second-half volume will depend largely on the institutional market, where "a handful of good-sized deals are really going to set the tone," he said.

"The market is bidding on a lot of new deals," Mr. Stewart said. "I think the pricing is relatively stable, though I think we've probably put the low points behind us. I think we're going to have a good second half and that it will look a lot like the first half."