Lenders seeking licenses to originate Federal Housing Administration-insured mortgages — one of the few viable products in today's home loan market — can take a number.

The Department of Housing and Urban Development says its staff has been working overtime and on weekends, something it has never done before, to process applications by lenders and brokers for FHA licenses.

The typical turnaround time is about two months, but approvals can take up to 12 weeks.

"Brokers are flocking to get FHA approval, or they're going out of business," said Scott Dodson, the president of the Dallas consulting firm Federal Mortgage Licensing Inc.

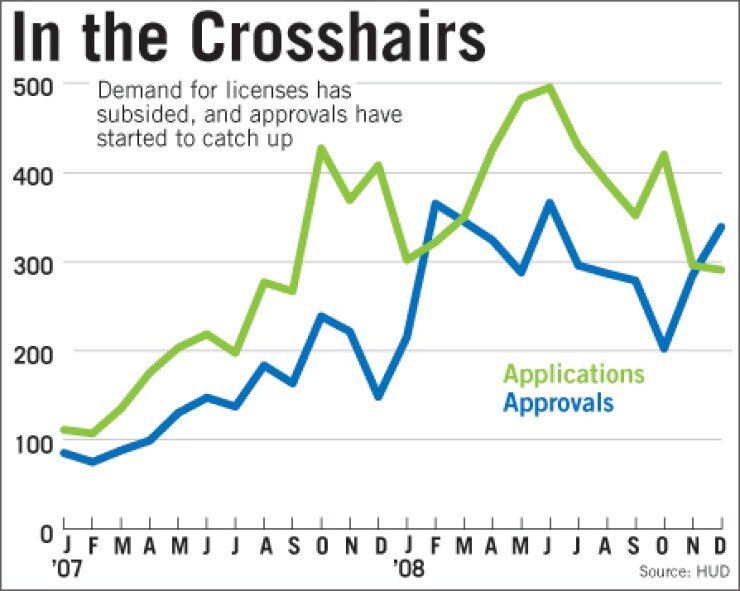

Still, the agency has cleared a backlog of applications, which just last spring were taking up to five months to process.

Mr. Dodson said one problem is that many applications submitted by brokers in the past year were "poorly put together packages that slowed the process down" for all applicants, including lenders.

HUD spokesman Brian Sullivan said the agency is "severely limited in burning the midnight oil" until Congress approves a new budget.

Though delays occur, he said, HUD ultimately signs off on 90% of applications after deficiencies are corrected.

In the fiscal year that ended Sept. 30, HUD approved 3,297 applications, triple the number approved the previous fiscal year. About 70% of the applications were from mortgage brokers, many of whom were scrambling to adapt after lenders stopped making subprime loans.

Once licensed, a lender may close loans headed for the FHA without the agency's prior approval. But before receiving this right — known as "direct endorsement" — it must submit 15 mortgage applications as test cases.

Daniel Fischer, the chief executive of Urban Trust Bank, a $171 million-asset Orlando start-up, said the FHA initially did not respond when he submitted seven such loan applications.

"So when a realtor calls with a deal and you say you don't have direct endorsement, they take the loan somewhere else because it can take a month to underwrite it," he said. However, Mr. Fischer said that after he complained about the holdup at a conference in Washington last month, he got a call from HUD's Atlanta office, which expedited his loan requests.

Before the resurgence in FHA lending, HUD used to explain specifically how license applicants had erred. Mr. Dodson said it has stopped doing so, making it more difficult for rejected applicants to figure out what HUD wanted.

"There are a hundred ways where you can go wrong in putting together an application package, and HUD does not make it perfectly clear even if you read the guidelines, so it takes a lot of back-and-forth and trial-[and]-error," he said.

Howard Glaser, a mortgage industry consultant and former HUD official, said the agency has been acting "prudently and deliberately" in approving applications.

The FHA is not immune to the risks of bad loans, and because of its limited resources, it needs to better manage these risks as the economy sputters, Mr. Glaser said. "The gate should not be wide open for lenders to walk in the door and get rubber-stamped," he said.

Brian Chappelle, another industry consultant and former HUD official, said the agency is evaluating large lenders for the performance of loans bought from brokers and correspondents, with the threat of shutting them out of certain states if their loans perform worse than average.

And in some ways, he said, "the marketplace has imposed some pretty tight restrictions so there are checks and balances, compared with the old days when money was cheap." For example, warehouse lenders have cut back on credit lines and typically only offer credit commensurate with a mortgage lender's net worth.