-

Organizers of Riverside Bank of Dublin will need to raise $18 million before opening.

March 13 -

The move come a day after the Bank of England cut rates and introduced a series of emergency measures, including capital requirements and a lending program for smaller companies.

March 12 -

Banks with the most exposure to oil and gas companies say they’ve added capital and changed their borrower mixes since the 2015 market fall. But skeptics question whether they can stave off losses if low prices endure.

March 10 -

E-Trade could add about 30 basis points to a key capital ratio once the deal closes, Jonathan Pruzan says.

February 27 -

Though the agency plans to give more credit unions authority to issue subordinated debt, limited investor appetite and other factors could hamper activity.

February 27 -

The banking group issued lawmakers a guide on questions to ask as credit union executives visit Capitol Hill for two days.

February 26 -

Want to satisfy regulators and better compete with the big banks? Here's where to start.

February 14 Oak Tree Business Systems, Inc.

Oak Tree Business Systems, Inc. -

Organizers of Triad Business Bank have raised enough capital and have received approval from the FDIC.

February 5 -

The Mississippi company will pay $49 million for Traders & Farmers Bancshares.

February 5 -

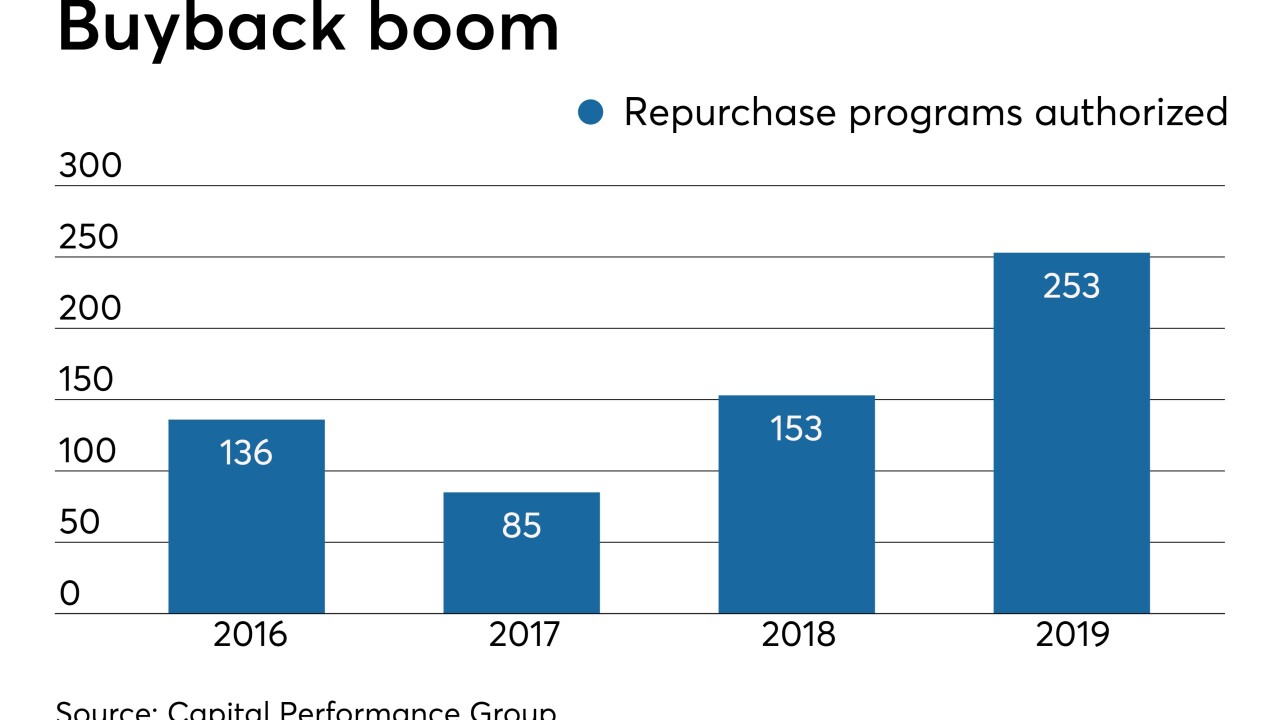

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

February 5 -

The regulator said the investment bank and financial services company will help in the process of strengthening Fannie Mae and Freddie Mac’s capital standing for their eventual exit from conservatorship.

February 3 -

The California company will pay $1 billion for Opus, a once highflying bank that struggled with credit issues in recent years.

February 3 -

Kenneth Lehman, a former banking attorney who acquires large stakes in small banks, will buy BankFlorida, which lost $555,000 through the first nine months of 2019.

January 30 -

The new regulation aims to standardize the process for determining if those owning less than a quarter of a bank must comply with holding company requirements.

January 30 -

CenterState and South State are the latest regionals to announce a deal driven heavily by the need to compete with larger banks that can afford to spend more on cutting-edge technologies.

January 27 -

The company will acquire the parent company of First National Bank of Manchester and Bank of Waynesboro for $85 million.

January 23 -

Two major banking organizations objected to a proposal by the agency that would expand the pool of investors in subordinated debt issued by credit unions. They fear it could provide credit unions more financing to buy banks.

January 23 -

The company will pay $64 million to significantly increase its scale in the Tampa Bay area.

January 23 -

There are no provisions in a new NCUA plan that outright bar credit unions from leveraging subordinated debt to acquire a bank. The long-awaited rule on bank purchases, also released Thursday, merely clarifies existing regulations rather than adding new components.

January 23 -

The National Credit Union Administration plans to unveil new capital proposals on Thursday. It's a given that bankers won't like them, but credit unions could also find themselves disappointed.

January 22