Community banking

Community banking

-

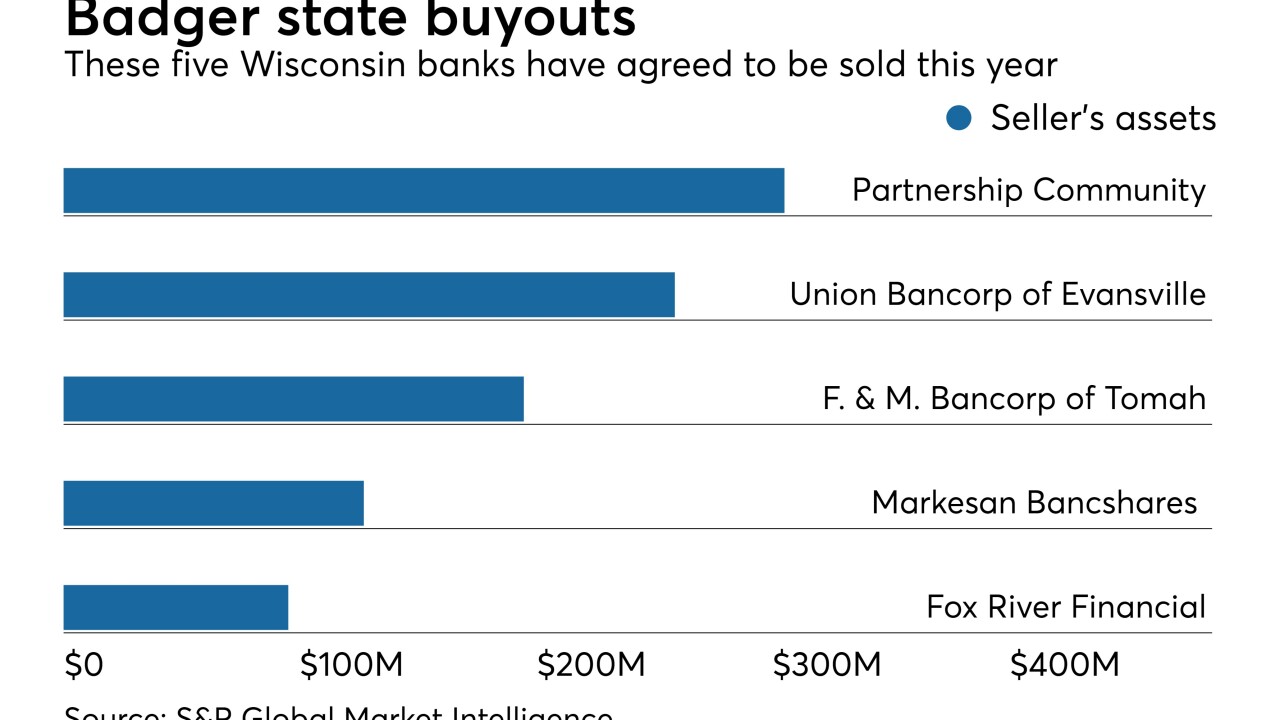

On Dec. 31, 2018. Dollars in thousands.

March 18 -

On Dec. 31, 2018. Dollars in thousands.

March 18 -

The $35 billion deal could create "a global payments giant"; with the number of community banks dropping as low as 5,477, it may be time for new ones.

March 18 -

The federal government's more active role in GDP, payroll and other vital statistics produced by the island could hasten its recovery from Hurricane Maria and lift lending and bank valuations at the same time.

March 17 -

Mechanics, owned by a fund tied to investor Gerald J. Ford, will pay $2 billion for Rabobank in California.

March 15 -

Industry lawyers say the agency’s decision could have implications for other bankers looking to change jobs.

March 15 -

The California banking company has two loans tied to DC Solar that are on nonaccrual status.

March 15 -

The small Wisconsin city features a vibrant economy, low employment and a growing population, but banks that want to buy their way into the market have their work cut out.

March 14 -

Community bankers and state regulators want the FDIC and other agencies to rethink their approach to a simplified capital ratio for smaller institutions.

March 14 -

The Connecticut bank, which has been unable to complete a pending deal for an SBA platform, has managed to build the business anyway.

March 13 -

Big bank mergers have historically been a catalyst for startups. Experts say it could happen again.

March 12 -

Loyal Trust Bank will have a large number of Asian-American investors and board members.

March 12 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

The legendary Atlanta banking lawyer played a special, often behind-the-scenes role that was part diplomat, mentor and seer during his 50-year career. He died last week at 76.

March 11 -

Year to date through Dec. 31, 2018. Dollars in thousands.

March 11 -

Year to date through Dec. 31, 2018. Dollars in thousands.

March 11 -

The new accounting standard won’t make community institutions safer, though implementation is proving burdensome and could restrict access to credit, argues Rep. Blaine Luetkemeyer.

March 11 -

Just nine bank merger pacts were announced in February, down from 17 in January. But they included the biggest deal in years and some other interesting storylines.

March 10 -

Franklin Financial, which was recently freed from a memorandum of understanding, has installed interim leaders after its founding CEO's retirement and his son's resignation.

March 9 -

Six senior executives at Chemical and TCF will move into similar roles when the merger closes later this year. Chemical Bank's current CEO, Tom Shafer, will become president of the combined bank, reporting to CEO Craig Dahl.

March 8