Community banking

Community banking

-

Summit Financial Group in Moorefield, W.Va., has agreed to buy First Century Bankshares in Bluefield, W.Va.

June 1 -

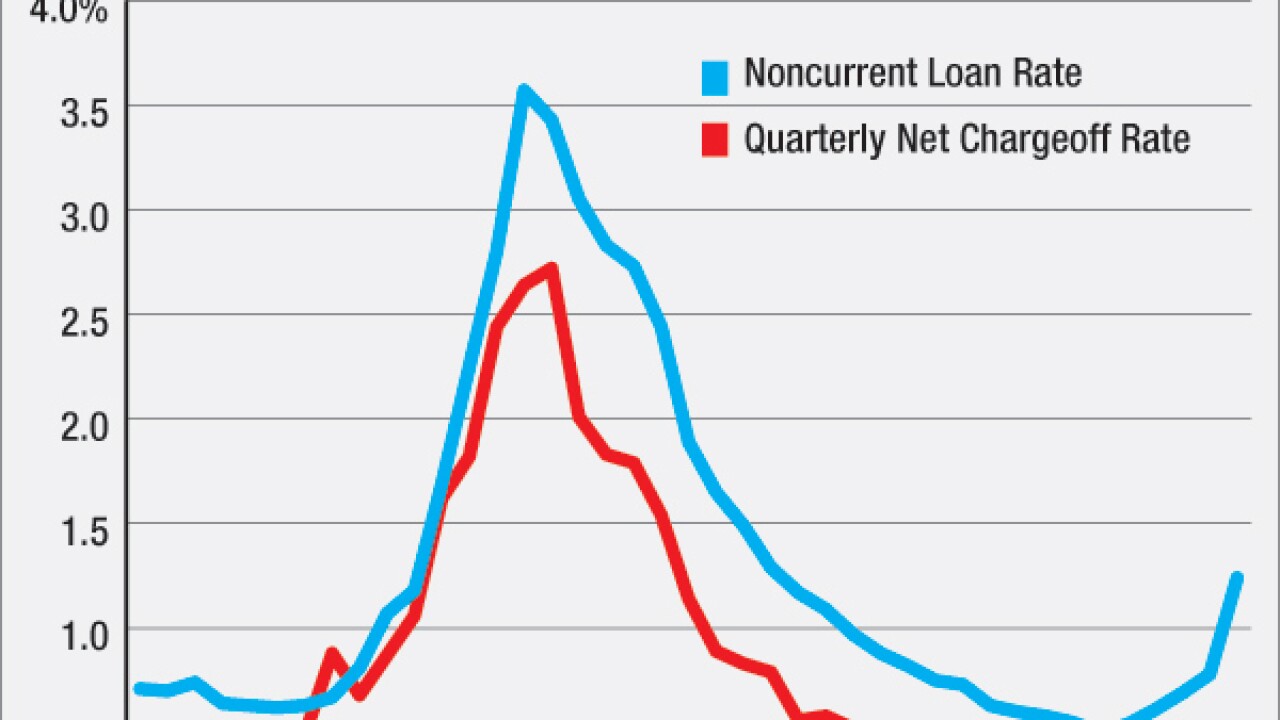

While there were positive signals like loan growth and improved interest margins in the Federal Deposit Insurance Corp.'s first-quarter report card, there were also signs of trouble for the future, including larger institutions' ongoing exposure to the energy sector.

June 1 -

The Independent Community Bankers of America said that it agrees with the Office of the Comptroller of the Currencys support for responsible innovation in fintech but that it worries marketplace lenders have a regulatory advantage.

June 1 -

FirstBank Florida in Miami has recruited five bankers from area competitors to bolster its commercial banking department.

June 1 -

Banks announced 41 mergers through May 31, representing a 16% decline from the same period in 2015, according to data from Keefe, Bruyette & Woods and S&P Global Market Intelligence.

June 1 -

Ties to the energy sector hurt the banking industry in the first quarter as earnings fell 1.9% to $39.1 billion compared with a year earlier, the Federal Deposit Insurance Corp. said Wednesday.

June 1 - Ohio

Civista Bancshares in Sandusky, Ohio, will record a gain of roughly $1.5 million in the second quarter after a nonperforming loan was fully repaid.

June 1 -

Achieving high performance is a challenge. But these five traits help the elite banks drive such impressive results.

June 1 -

Community Business Bank in West Sacramento, Calif., has finally put the Troubled Asset Relief Program in the past.

May 31 -

The latest crop of prohibition orders includes one against an employee involved in the fraud that led to the failure of Taupa Lithuanian CU.

May 31 -

The Consumer Financial Protection Bureau will unveil sweeping federal regulations Thursday for payday lenders that could open the door for competition from banks, while forcing lenders to move toward longer-term installment loans. Here's what to track when the plan is released.

May 31 -

At least three community banks have hired lenders who once worked at banks bought by BB&T. The question is whether those lenders can coax their clients to also make a switch.

May 31 -

Wellesley Bancorp in Massachusetts has recruited a State Street executive to succeed its outgoing chief financial officer and treasurer.

May 31 -

First South Bancorp survived a close vote on a shareholder proposal to "immediately" take steps to sell the Washington, N.C., company.

May 31 -

Institutional and private-equity investors are more demanding of regular face time with decision makers like CFOs, who better be prepared to answer questions not just about balance sheets and income statements, but also underwriting standards, loan concentrations and accounting methods.

May 31 -

Carver Bancorp in New York has entered into a formal agreement with the Office of the Comptroller of the Currency that includes mandates tied to the Bank Secrecy Act and commercial real estate.

May 27 -

Paragon Commercial could raise up to $29 million when the Raleigh, N.C., company conducts its initial public offering.

May 27 - Virginia

The $2.5 billion-asset company disclosed in a regulatory filing Friday that Martyn Pell, president of its First Community Bank, had resigned, effective immediately.

May 27