-

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

January 21 -

Total loans at Regions Financial fell slightly last year, but executives say a shift in consumer lending priorities and more aggressive C&I lending will start to pay off this year.

January 17 -

Citizens Financial Group’s fourth-quarter results highlight the challenges regionals face in generating top-line growth.

January 17 -

The Southeast banks expect to complete their merger by midyear, hit their savings targets and still be able to invest in growth, according to Bryan Jordan.

January 17 -

A tough fourth quarter seemed to foreshadow challenges in the year ahead for the nation’s fifth-largest bank.

January 15 -

CEO William Demchak said the bank has witnessed "a lot of mischief" among customers who open checking accounts to collect bonuses and then never use the accounts again.

January 15 -

Stateside banks are starting to play catch-up to banks worldwide that are incorporating environmental, social and governance factors into their underwriting. Pressure from big shareholders is a driving force.

January 13 -

The regional bank, formed from the merger of BB&T and SunTrust, will begin marketing its new brand in conjunction with next month's Super Bowl.

January 13 -

Clients will have an active role in testing new products and services at the regional giant formed by the merger of BB&T and SunTrust, says Chairman and CEO Kelly King.

January 7 -

Though there were several high-profile mergers of equals among bigger banks, deal activity rose only slightly, and the vast majority of transactions involved the smallest of institutions. Here's an overview of those trends and others that stood out in bank dealmaking last year.

January 5 -

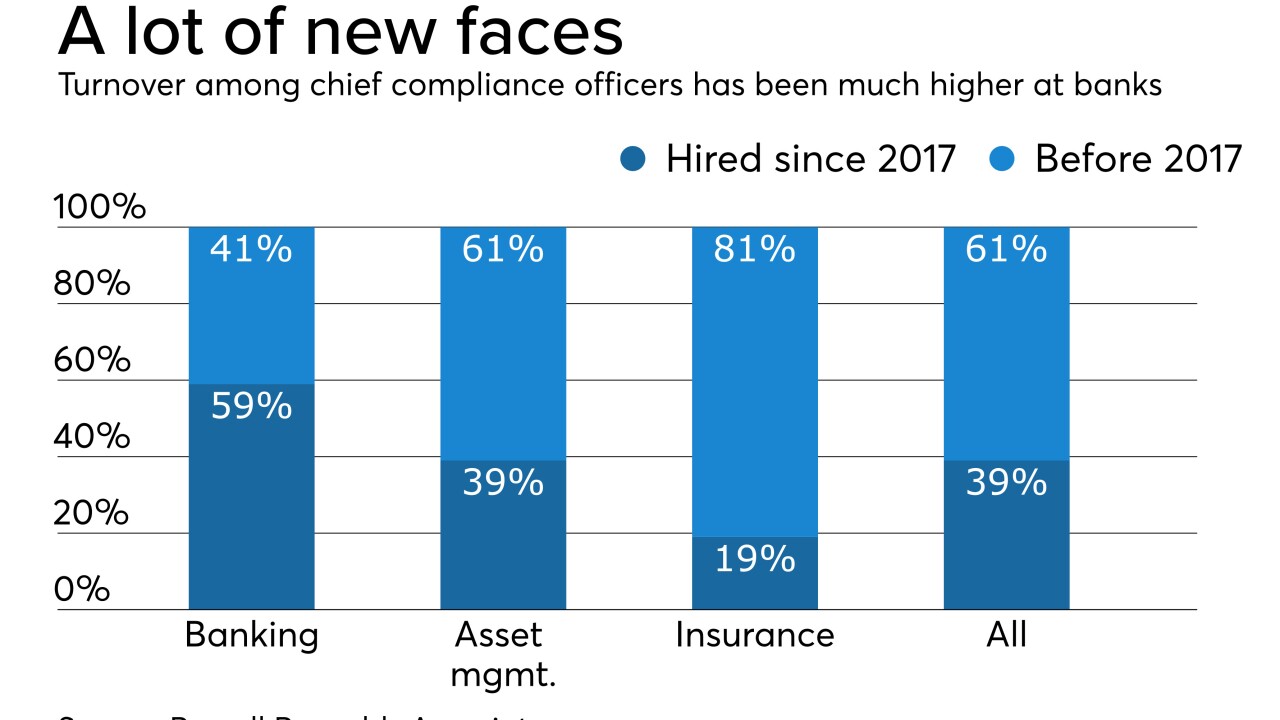

Banks had the highest turnover of chief compliance officers among the 100 largest financial services firms in the world, according to a recent study. Recruiters say that’s a function of changing job demands, high pressure and poaching by fintechs — plus old-fashioned demographics.

January 3 -

While his focus is on organic growth in Texas and California, Curt Farmer says he would consider a deal in those states if the right one comes along.

January 2 -

Political uncertainty, sector-specific concerns as well as interest rate and labor trends may continue to depress commercial and industrial lending in the coming months.

December 31 -

With adjustments to the post-crisis regulatory framework now complete, the Federal Reserve may begin the decade year with a focus on supervisory and examination processes.

December 25 -

The fresh optimism is starting to outweigh some of the worries hanging over the sector heading into the new year.

December 19 -

Fintechs want access to customers’ financial data, but banks are resisting, on security concerns; Deutsche Bank may cut bonus pool 20% after 14% drop last year.

December 16 -

In addition to overseeing the bank’s lines of business, technology and operations, Kevin Blair will now be responsible for human resources, credit administration and all customer-facing support functions.

December 13 -

Though details of a potential pact with China aren't clear, bankers are hoping it could convince leery customers to finally go through with delayed investments.

December 13 -

The average price of a previously owned car has fallen in two consecutive months, and if the trend continues, lenders could see losses mount, Richard Fairbank said this week.

December 12 -

Many business customers are putting off expansion because they can’t find enough workers to fill available jobs.

December 11