-

Starved for growth, several community banks are putting aside distrust from the financial crisis to seek out partners for bigger commercial loans.

March 14 -

Promontory Interfinancial Network is adding Bank Assetpoint to its suite of products, a service designed to be a one-stop shop for bankers and real estate investors to exchange loans and REO.

February 4 -

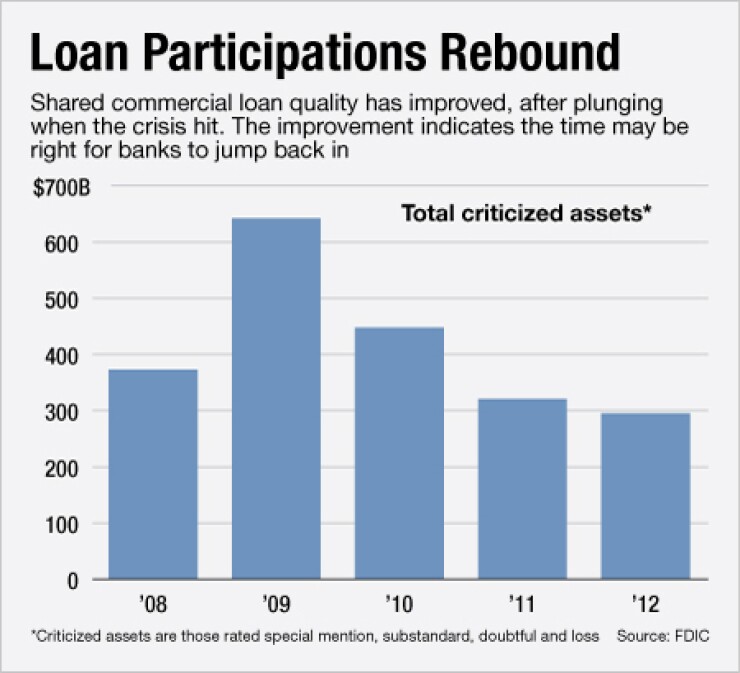

With credit quality still improving in corporate loans shared by multiple banks, the financial industry produced the first increase in shared credits in three years. Yet deterioration is still higher than norms.

August 27

Executives at smaller banks are understandably

A number of new business ventures are determined to convince community bankers that their services are a safe way to spur loan growth.

Groups such as StoneCastle Partners, Promontory Interfinancial Network and BancAlliance have started offering loan participation services in the past year, all targeting smaller banks. Each group approaches the market differently while offering their own spin on risk management.

Those organizations must convince potential clients that their products offering some level of protection from risk, says Jeff Smith, chairman of Ohio Valley Banc (OVBC) in Gallipolis, Ohio.

"In the pre-crisis period, things were humming along and moving so fast," Smith says. "Community banks thought they were doing the best due diligence possible, but I don't think we did. Now we're going to be far more careful and diligent about any participation."

After all, it has been less than four years since

Recent data for

StoneCastle's launched its venture last year after it hired Randy Cameron, a former executive in Zions Bancorp's (ZION) correspondent banking unit. The New York company offers community banks an option to join loan assignments, rather than participations.

Assignments offer more protection for a community bank than a participation, says Joshua Siegel, StoneCastle's managing partner and chief executive. "It's a very big legal distinction [because] an assignment grants you all the rights and remedies of a direct lender," he says.

When a participation loan goes bad, a smaller bank can find itself in a junior position to a hedge fund or other group that takes on the lead agent role. "That's good for the hedge funds, but bad for the banks," Siegel says.

StoneCastle also requires any community bank that signs up for its assignment service to first receive extensive training on how to draft policies and procedures for booking loan assignments, Siegel says.

It's somewhat akin to a bank hiring a consulting firm. "Before you get a seat at our table, we have to train you," Siegel says.

Promontory

Central to Promontory's pitch on risk management is that the service lets community banks deal directly with brokers or borrowers in a secure environment, says Steve Kinner, the company's senior managing director. "It's up to the community bank to do its own analysis on these credits," he says.

Promontory is not a party to any loan transactions posted on the Assetpoint platform. The Arlington, Va., company requires participants to register for access to the site; many loan participation opportunities require banks to sign electronic nondisclosure agreements before they are provided with access to key loan documents.

At BancAlliance in Chevy Chase, Md., member banks agree to join in traditional loan participations. BancAlliance lists itself as the direct lender on its loans, and each member receives an equal vote on all relevant matters, says Lori Bettinger, the group's executive vice president.

"We have a very defined way of handling liability," Bettinger says.

Community banks are looking for extensive details on how participation services are screening loans, who will be listed as the lender of record, and other assurances, Smith says.

Banks will turn their backs on these providers if things aren't handled properly. "It won't take community banks very long to drop out if these loans go bad and they aren't protected," Smith says.