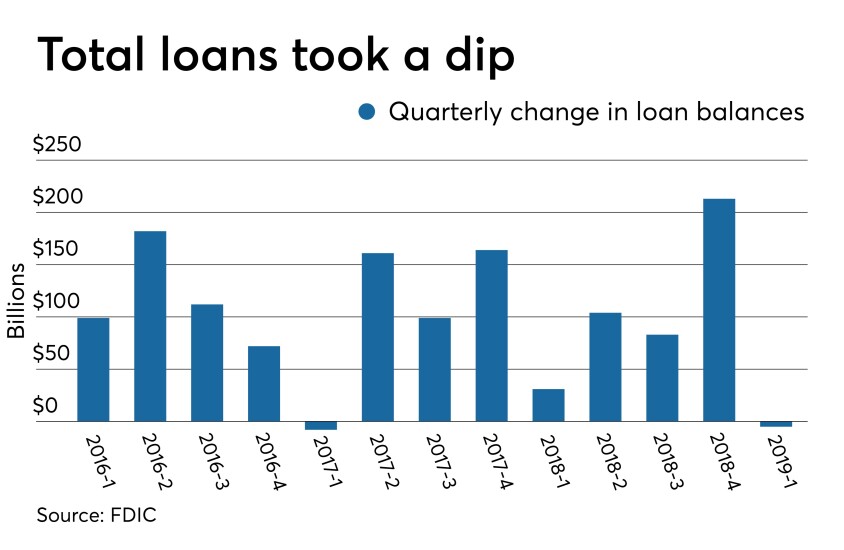

Wider net interest margins compared to a year earlier helped make up for a slight decline in loan balances, as nearly two-thirds of banks reported higher profits in the first quarter, the FDIC said in its Quarterly Banking Profile. Here are key takeaways from the report.

Loan balances fall for second time in five years

Consumer loans, including credit card balances, fell by $37 billion, or 2.1%, from last quarter, while commercial and industrial loans increased by $37.7 billion, or 1.7%.

All of the major loan categories reported year-over-year increases, with commercial and industrial loans leading — up $155.6 billion, or 7.6%. At the same time, consumer loans grew $71.3 billion, or 4.4% since a year earlier.

Net income grew nearly 9% from a year earlier

The average net interest margin for banks — the amount banks earn from interest against the amount they pay out — grew to 3.42% from 3.32% a year ago. More than 79% of the 5,362 insured banks reported higher net interest income.

Community bank loan growth outpaced the industry at large

“Annual loan growth was broad based as every major loan category increased, and nearly eight out of ten (79 percent) community banks reported higher loan balances year over year,” the FDIC report said.

Noncurrent, charge-off rates remained unchanged