Comerica expects solid loan growth to support its net interest margin; the challenge will involve funding those loans.

Executives at the $71 billion-asset company said they believe they can rely on a variety of sources to support a loan portfolio that grew by 2.3% in the first quarter from a year earlier, to $50.3 billion.

Deposits fell by 6.1%, to $54.1 billion. The loan-to-deposit ratio was 93% at March 31.

Several factors were behind the decline in deposits, Ralph Babb, Comerica’s chairman and CEO, said during the Dallas company’s quarterly conference call. While some of it was seasonal, he said some commercial clients were tapping their deposit accounts to fund acquisitions and make capital expenditures.

“Some are also choosing our off-balance-sheet offerings,” Babb added. “We continue to closely monitor our deposit base and have adjusted standard rates for certain products … to manage deposit pricing to attract and retain customers.”

“We want to make sure that we are taking care of our customers, particularly on the rate front,” added Muneera Carr, Comerica’s chief financial officer. “From what we see, there are still some customers who continue to seek yield. … The good news there is that we are able to retain our customers.

Comerica’s securities portfolio “remains a reservoir of liquidity,” Carr said, adding that the company has access to market index deposits and Federal Home Loan Bank advances. “We should be able to fund any loan growth we generate without too many issues on the funding front.”

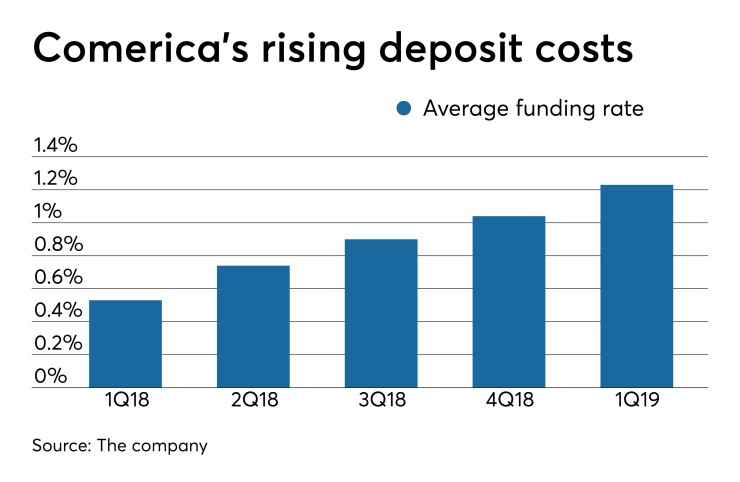

To that end, funding costs rose by 70 basis points from a year earlier, to 1.23%. The good news is that the net interest margin still widened by 38 basis points, to 3.79%.

Comerica reported that its net income increased by 23%, to $334 million, or $2.11 a share. The results were 18 cents higher than the mean estimate of analysts surveyed by FactSet Research Systems.

Comerica executives were generally upbeat about lending opportunities and credit quality in coming months.

Carr said the company has a positive view of the economy and is not expecting a recession in the near term. While the economies in California and Texas are doing well, Babb said, Michigan's is slowing because of the automotive industry.

Comerica is facing some challenges enlarging its portfolio of loans to technology and life sciences companies.

Curt Farmer, Comerica's president, said the issue is tied to a focus on lending to early stage companies and “sticking to a granular strategy.” Farmer noted that all of Comerica's deals are small, typically between $1 million and $3 million, so a lot of volume is necessary to move the needle.

At the same time, banking those companies is helping Comerica with its funding needs.

“We do feel like we've got the right strategy overall,” Farmer said. Technology “continues to be a very attractive business for us … especially on the depository side and the fee income side.”

Paul Davis contributed to this report.