Allissa Kline is a Buffalo, New York-based reporter who writes about national and regional banks and commercial and retail banking trends. She joined American Banker in 2020 and previously worked for more than a decade at Buffalo Business First, where she covered banking and finance, insurance and accounting. Kline started her journalism career at the Observer-Dispatch in Utica, New York. She graduated from Colgate University and the S.I. Newhouse School of Public Communications at Syracuse University.

-

Prosperity Bancshares finalizes the second of three acquisitions it's announced since July; Sumitomo Mitsui Banking Corporation appoints a new chief information security officer for its American operations; Huntington Bancshares, Third Coast Bancshares and Heritage Financial completed acquisitions; and more in this week's banking news roundup.

February 6 -

Unlike some of its expansion-minded regional bank peers, Montana-based First Interstate is reconfiguring its business model to be smaller and more focused on relationship banking. The blueprint is the work of CEO Jim Reuter, who joined the bank 15 months ago.

February 5 -

The Spanish banking giant is accelerating its U.S. growth plans with the pending acquisition of Webster Financial in Connecticut. The combined entity will be the second-largest foreign-owned bank operating in the country.

February 4 -

The Spanish banking giant, which has been trying to grow its U.S. business, plans to acquire the Connecticut-based parent company of Webster Bank.

February 3 -

The Long Island-based bank returned to profitability during the fourth quarter of 2025. The results mark "a significant milestone" in the bank's turnaround plan, CEO Joseph Otting said.

January 30 -

The Minneapolis-based company will return to its former governance structure when it installs CEO Gunjan Kedia as board chair. Andy Cecere had served as chair during his tenure as the company's chief executive, and then became executive chair when he stepped down as CEO last year.

January 28 -

Julia Carreon is suing the bank, alleging she suffered race and sex discrimination, including sexual harassment by Andy Sieg, the bank's head of wealth management. On Tuesday, Citi hit back by filing a petition to compel arbitration and accusing Carreon of making false claims.

January 27 -

CEO Gunjan Kedia joined nearly 70 chief executives of Minnesota-based companies in calling for "an immediate de-escalation of tensions" in Minneapolis, where a second resident was fatally shot by federal immigration agents on Saturday.

January 26 -

The Boston bank, which has been targeted by an activist investor over its M&A strategy, isn't pursuing deals, CEO Denis Sheahan said Friday. Instead, the company is focused on organic growth and share buybacks.

January 23 -

Three weeks after completing its "merger of equals" with Synovus Financial, Pinnacle Financial Partners said it plans to hire 225 to 250 revenue-generating bankers in 2026 across its newly expanded Southeast footprint.

January 22 -

The regional bank recorded $130 million of legal charges during the fourth quarter in connection with the resolution of a legal battle involving overdraft fees. Its earnings also took a hit from $63 million in employee severance costs.

January 21 -

The Cleveland-based bank announced changes Tuesday to its board of directors, including the appointment of a new lead independent director. Last month, activist investor HoldCo Asset Management urged the bank's board to not re-nominate its longtime lead independent director.

January 20 -

The Huntsville, Alabama-based regional bank is well positioned to defend its Southeast footprint, according to CEO John Turner. It's hiring more bankers in growth markets, it has strong brand recognition and it has a long history in its core markets, he said.

January 16 -

The investment banking giant reported an 18% increase in net income for the fourth quarter and stuck to its 2-year-old financial targets, even as it exceeded some of them.

January 15 -

A week after President Trump demanded a 10% cap on credit card interest rates, top executives at big banks protested the idea in blunt terms.

By Nathan PlaceJanuary 14 -

The megabank's net income declined by 13% during the fourth quarter as a result of a $1.2 billion pretax loss on sale related to the divestiture of its remaining operations in Russia.

January 14 -

The custody bank reported a strong fourth quarter, as it continued to push forward with its new operating model. The momentum contributed to the bank's decision to lay out new financial targets, including a goal to achieve a return on tangible common equity of 28% in the next three to five years.

January 13 -

Banks will start reporting their fourth-quarter earnings on Tuesday. But it's what bankers say about the next 12 months that will probably attract the most interest from industry observers.

January 12 -

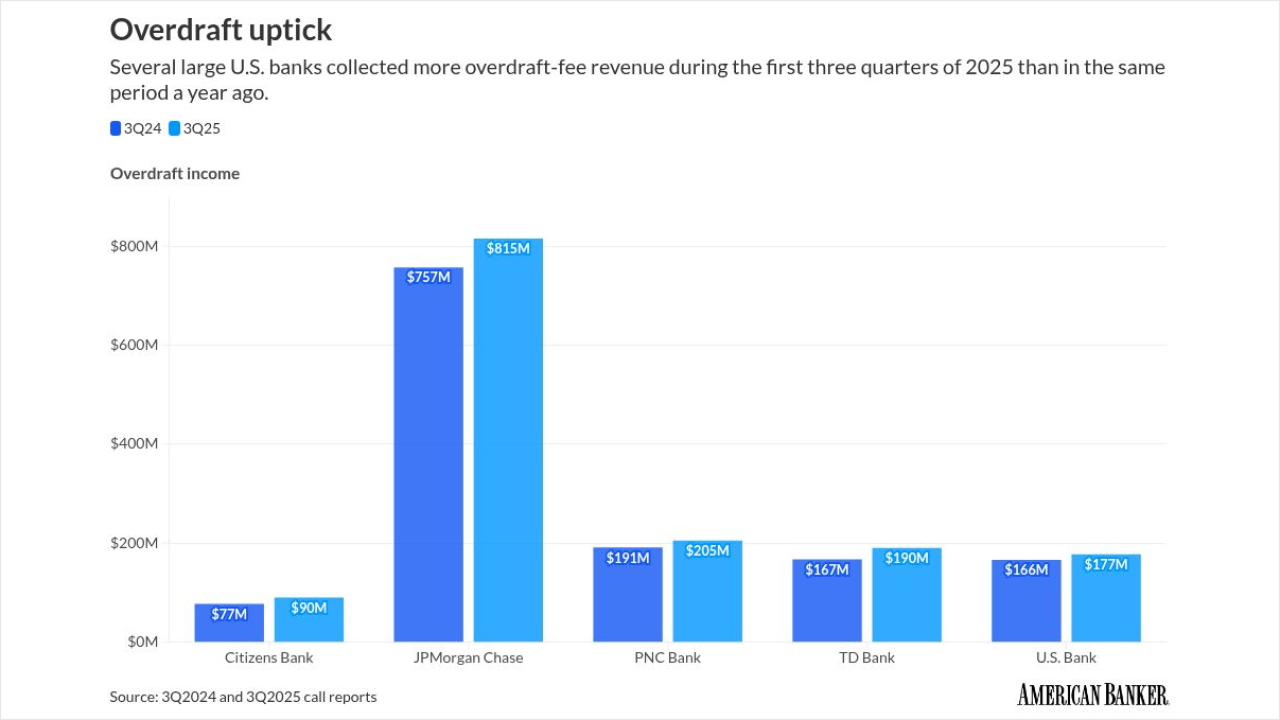

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

The Kansas City, Missouri-based bank completed its first bank acquisition in 12 years on New Year's Day. Now it's focused on retaining and growing FineMark Holdings' high-net-worth clients in markets such as Southwest Florida, South Carolina and Arizona.

January 7