-

Prospective borrowers for single-family homes will be required to make a minimum down payment of 15% of the purchase price, down from 20%. The borrower must have a minimum FICO score of 680, down from 740.

August 5 -

WASHINGTON Four more Federal Home Loan Banks have won regulatory approval to participate in a program that allows member institutions to sell jumbo mortgage loans through a conduit to Redwood Trust.

August 14 -

After it all but stopped making real estate and development loans following the housing crash, Farmers & Merchants Bank has increased its real estate loans by more than 61% over the last two years. It's a figure that's likely to keep rising as California's real estate market heats up and the $5.6 billion-asset bank continues to add commercial real estate, construction and mortgage lending specialists to keep pace.

July 1

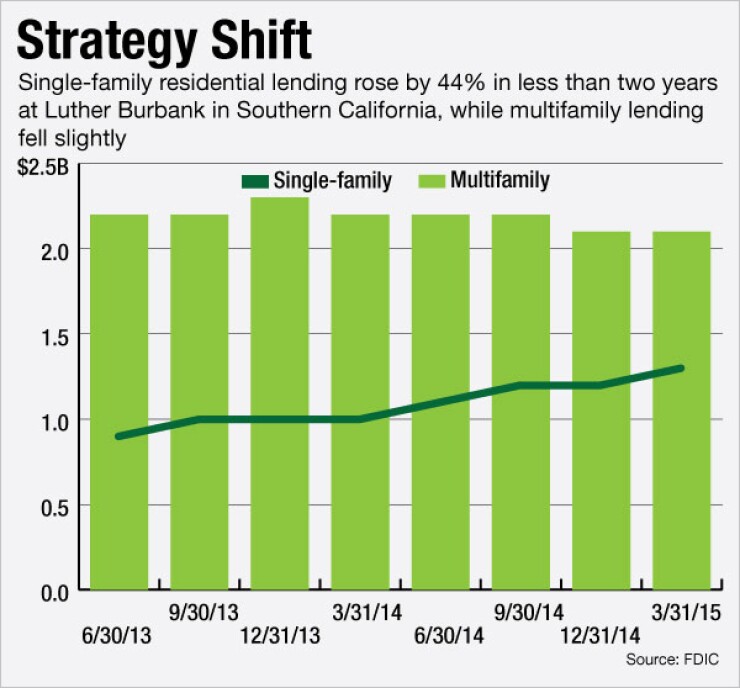

Luther Burbank Savings is a household name only in Santa Rosa, Calif., but its new strategy speaks volumes about the direction of banking in the closely watched Southern California market.

To put it simply, the $3.9 billion-asset has embraced two things that would have been anathema just a few years ago: mortgages and bricks and mortar. It is betting heavily on jumbo loans and opening new loan offices to make it easier to market them.

The bank has opened retail loan origination offices in Santa Monica, Newport Beach and Del Mar, Calif., in addition to its nine full-service branches, and it has an eye on expansion in Portland, Ore., and Denver. John Biggs, the bank's president and CEO, even opened a branch this month in the tony beach town of Belmont Shore, in Long Beach, Calif., down the block from his second home.

Because of the density of its real estate and higher loan amounts, Southern California is often viewed as the most desirable lending market in the country. Banks do not have to originate that many loans to be profitable. Branches also might be considered a minimal cost given that jumbo loans skew to an older demographic that banks want to cross-sell other products.

Still, jumbo lending is fiercely competitive especially with Bank of America, JPMorgan Chase and Wells Fargo very aggressive on rates, which can come in under 4% for a 30-year conforming loan of up to $2 million. Many community banks and even credit unions that got burned from the housing crisis are waking up to the opportunity of jumbo lending as well.

Jason Pendergist, the bank's executive vice president and chief lending officer, said there is no shortage of demand for jumbo loans. Robust population growth, a diverse economy and what he calls a "resiliency in the market," are among the reasons why the bank is so bullish, he said.

"We believe strongly in the West Coast markets," said Pendergist, who joined Luther Burbank a year ago from JPMorgan Chase, where he had been head of its Eastern U.S. region for commercial lending. "We think we've built the right guardrails and we don't see a likelihood of a repeat of the severity of the last crisis."

Union Bank, Banc of the Internet and Farmers & Merchants Bank are among the lenders originating nonqualified mortgages, many of which are held on balance sheet though some are sold off to investors. Luther Burbank is currently building out a servicing infrastructure, which has hit some snags because of regulatory standards around vendor management, executives said.

Sam Khater, the deputy chief economist at CoreLogic, said lenders have gravitated toward jumbo loans because it offers more flexibility on underwriting.

"Historically jumbo has performed the best out of any mortgage segment, so the credit risk is low, especially in this credit cycle," Khater said.

Yet much of it is heavily concentrated in California so it is not without risk.

"There is significant geographic risk in jumbo," Khater said.

Luther Burbank has deep roots in the area. Its name is distinctly Santa Rosa, gracing nearly a dozen schools in the area. The 32-year-old bank is named after the American botanist Luther Burbank, who settled in Santa Rosa at the turn of the century and developed the Shasta daisy and the Burbank potato (which are used to make most McDonald's french fries).

Long a powerhouse in multifamily lending, where it ranks among the top five lenders in Southern California, Luther Burbank decided two years ago that it needed to diversify. Jumbo lending was the clear choice since it has been the best performing mortgage segment since the housing downturn in 2007.

Jumbo lending allows banks to create customized products for wealthy clients that do not conform to the guidelines of Fannie Mae, Freddie Mac or the Federal Housing Administration. Prime jumbo mortgages typically cannot be sold to Fannie or Freddie because they exceed the conforming-loan limit of $729,750.

For example, Luther Burbank has a cross collateralization loan program that allows high-end borrowers to use two properties to leverage the loan amount on one loan. Pendergist described it as "a nice, clean, easy way to trade up or down without having to do multiple mortgage transactions."

The bank's departing residence program is a niche loan product that allows rental income to be used to offset the housing expense on the applicant's current residence.

But Luther Burbank has other priorities, too.

Three years ago, the bank

Many of the high-end areas in Southern California are just a few miles from low and moderate-income neighborhoods, so there is plenty of opportunity for non-jumbo purchase transactions. As part of its consent order, Luther Burbank is investing in low-and moderate-income communities including providing consumer education programs.

Luther Burbank had been a wholesale mortgage lender, working with independent mortgage brokers and loan officers to originate loans. Since it began its expansion two years ago, home lending has jumped 44% to $1.25 billion as of March 31. Meanwhile, multifamily lending has declined about 5% to $2.1 billion in the same period, according to FDIC data.

Still, California's real estate market continues to heat up and the bank plans to add more residential loan offices and mortgage lending specialists to keep pace. California continues to lead the nation for home purchases. In the second quarter, Los Angeles, San Jose and San Diego all saw a 50% jump in home lending, according to RealtyTrac.

Having a loan officer in every branch gives the bank an edge, Pendergist says, particularly for walk-in customers or older customers who prefer to meet directly with a loan officer. It's also part of a compliance strategy of always having a loan officer available who can talk terms and conditions at the point of sale.

"We like all of the markets we're in because of strong population drivers," Pendergist said. "From first-time homebuyers to beachfront properties in Santa Monica, as long as the employment drivers are here, we believe the demand drivers are here for real estate."