As if high default costs haven't been challenging enough for mortgage servicers, a growing number of seriously delinquent loans are Federal Housing Administration products, which require significant upfront investment to resolve.

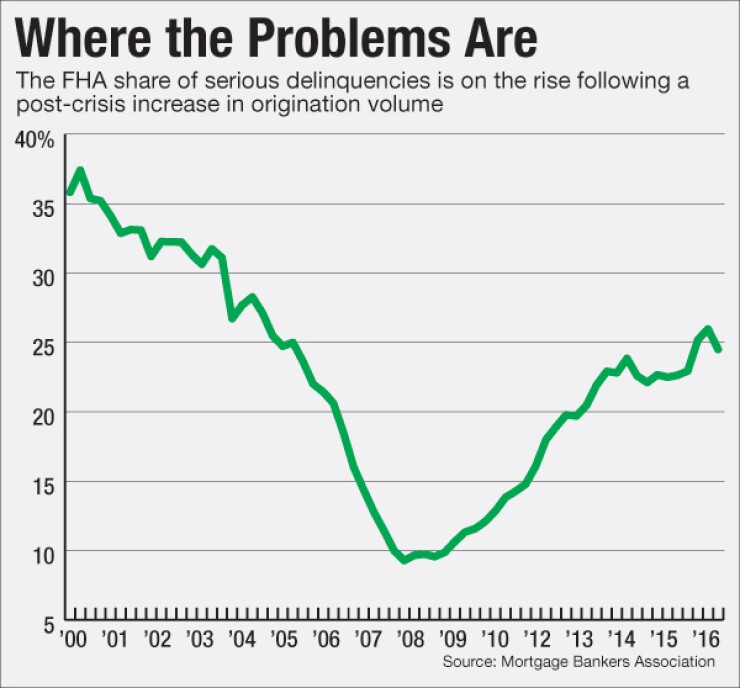

An estimated 25% of all outstanding mortgages that were seriously delinquent at the end of the first quarter of this year were insured by the FHA, up from less than 20% in the first quarter of 2012, according to the Mortgage Bankers Association.

FHA loans typically tend to default more than loans backed by the government-sponsored enterprises Fannie Mae and Freddie Mac because they are designed to be more affordable to borrowers by offering lower down payment and credit score requirements. But market conditions that changed during the most recent housing boom-and-bust cycle have made the trend more pronounced.

-

Federal Housing Administration borrowers have been refinancing faster than expected, creating a drag on efforts to build up the capital reserves of the agency's mortgage insurance fund.

July 19 -

The Senate approved a bill Thursday by unanimous consent that includes major reforms to the Federal Housing Administration condominium loan program and the Rural Housing Service loan program.

July 15 -

WASHINGTON Republican lawmakers put Department of Housing and Urban Development Secretary Julian Castro on the hot seat Wednesday, criticizing his decision to allow nonprofit community groups to bid on more nonperforming Federal Housing Administration loans.

July 13

At one point during this cycle, the FHA's share of defaults dropped below an estimated 10%. So the increase in FHA default share to nearly a quarter of the market has been a shock to the servicing industry, particularly those servicers that entered the market when FHA defaults were low.

"They don't know how to service FHA loans, and it's hitting them in masses," said Matt Martin, CEO of Chronos Solutions, a mortgage industry vendor that offers FHA foreclosure property services.

The root of the problem is twofold. The FHA's share of origination soared as subprime and other mortgage products that competed with the FHA disappeared after the housing crisis; the rise in default share is a natural reaction to that. Second, the combination of longer foreclosure timelines and loss mitigation options that didn't exist before the crisis have extended historical timelines for defaults to peak in a given vintage of loans.

Distressed servicing in general has become so much of a challenge that even experienced banking giant JPMorgan Chase is feeling the pain. "If we had our druthers, we would never service a defaulted mortgage again," CEO Jamie Dimon said in an April letter to shareholders.

"We do not want to be in the business of foreclosure because it is exceedingly painful for our customers, and it is difficult, costly and painful to us," he added.

FHA servicing is particularly challenging, Dimon said. JPMorgan Chase has been dealing with the concern by scaling back FHA originations, in part to avoid FHA-specific requirements for servicing delinquent loans.

"By making fewer FHA loans, we have helped reduce our foreclosure inventory by more than 80%, and we are negotiating arrangements with Fannie Mae and Freddie Mac to have any delinquent mortgages insured by them be serviced by them," Dimon said.

While Fannie and Freddie do not require servicers to advance funds during default, FHA loans require more of an upfront outlay of cash that is later reimbursed.