It used to be that if you wanted to take out a personal loan from Citizens Financial Group you had to show up at a branch and apply in person.

That changed in March of this year, when Citizens, of Providence, R.I., began offering a digital application process. Now, customers looking to borrow between $5,000 and $50,000 can apply online and get an instant response, and they can sign the required documents electronically and upload them for a fast closing. Funds are available as early as the next business day.

The purpose of the new product, said Brendan Coughlin, the head of consumer lending at the $149 billion-asset Citizens, is to compete directly with offerings from Lending Club and Prosper, two of the biggest marketplace lenders. While some banks have entered the online lending sphere by partnering with fintech upstarts — JPMorgan Chase offers small-business loans in tandem with OnDeck Capital, for example — other institutions see an opportunity in marketplace lending that is just too good to pass up.

Wells Fargo recently began offering business loans online in amounts ranging from $10,000 to $35,000 and borrowers who are approved can receive their funds within 24 hours. Citizens, too, has opted to build the technology itself rather than team with an existing nonbank lender.

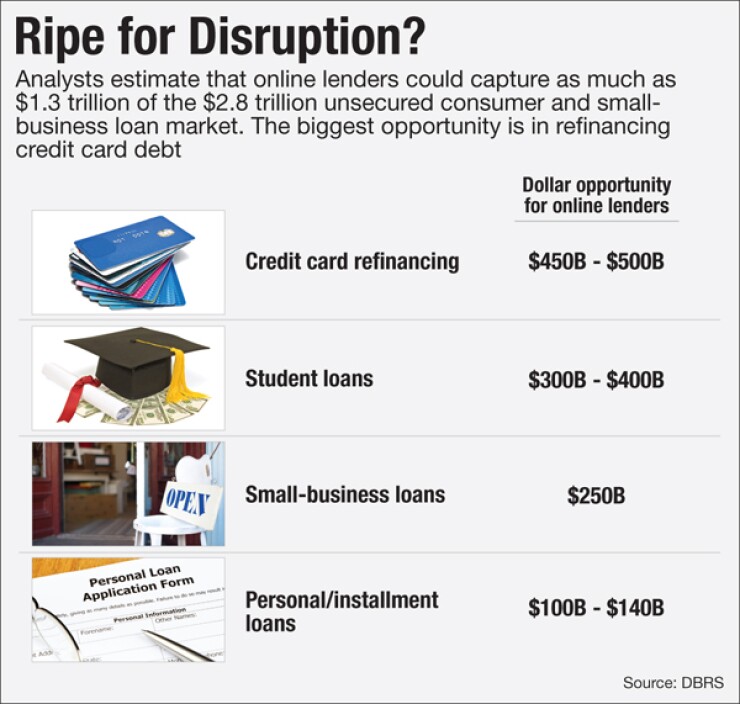

Marketplace lenders have been growing loans at an astonishing clip — a compounded annual rate of 163% between 2011 and 2015. Yet as of the end of, 2015 still had captured only 1.5% of the total outstanding unsecured consumer and small-business loan markets.

The industry has suffered some setbacks this year as credit quality began to suffer and some investors began to sour on the sector. Still, a new report from the ratings agency DBRS concludes that online lenders are nowhere close to maxing out their potential market share. The firm's analysts estimate that the market for credit card refinancing is $450 billion to $500 billion, or more than 50% of all revolving credit balances in the U.S. as of December 31, 2015. Similarly, DBRS estimates the potential market for personal loans to be $100 to $140 billion and the addressable market for student loans to be $300 billion to $400 billion.

"The sheer size of the global consumer credit industry means that marketplace lending has plenty of room for growth," said Nat Hoopes, the executive director of the Marketplace Lending Association.

Though their business models have been tested of late, DBRS said that marketplace lenders can still succeed by continuing to serve subprime borrowers and a fast-growing segment of borrowers that values the smoother service they get from online lenders. Marketplace lenders "do not necessarily have to succeed with all segments, just those that value what MPLs have to offer," DBRS said in a September report on the state of the industry.

Banks looking to get in on the action have two choices: team up with these established players that have already perfected the technology or try to beat them at their own game. At the heart of the divide lies the question of just how innovative — and, for traditional financial institutions, irreproducible — marketplace lenders' technology really is.

While Coughlin called the online lenders "formidable competitors," he said their technology is not that difficult to replicate. "In this case, all 'innovation' means is 'simple,'" he said. "It's not rocket science. With the right focus, [banks] can easily compete" with marketplace lenders.

Maybe so, but other bankers wonder if it makes sense to reinvent the wheel. BBVA Compass is widely viewed as one of the industry's most innovative banks, but when it comes to online lending it has opted to partner with Prosper by buying loans Prosper originates. The $87 billion-asset company is also developing what its chief executive, Manolo Sanchez, calls "banking-as-a-service" to provide support to the fintechs that are out to disrupt the banking industry.

Sanchez, who has been open about his respect for marketplace lenders, said his bank didn't build an online lending platform because "we didn't see the opportunity. We were working on mobile apps, we were working on our purchase of Simple," the online consumer bank.

Many other banks have also decided against building their own online lending platforms and opted instead to team with existing players. The two most common types of partnerships, according to Rohit Arora, the co-founder and CEO of the online lender Biz2Credit, involve banks buying loans originated by alternative lenders and using these companies' platforms to do their own lending — so-called white-label deals.

Biz2Credit has just such a deal with Customers Bancorp in Wyomissing, Pa. And Macquarie, the international megabank headquartered in Sydney, Australia, approached Arora's company last year to propose a joint program: equipment financing for small businesses. The origination, closing and servicing of the loans is handled by Biz2Credit, while Macquarie puts up all the money.

Thanks to such partnerships, Biz2Credit is on track to originate about $400 million of loans this year, up from an annual average of $210 million or so over the past seven years.

Twelve to 18 months ago, most banks were insisting that they would build their own online-lending platforms, but they are now "showing a tremendous amount of interest in partnering with marketplace lenders," Arora said. "That's a big change in the mindset that I'm starting to see."

Even Citizens, which competes with the alternative lender SoFi in student-loan refinancing and has its own fully digital refi product, has bought some of SoFi's loans — making SoFi both a competitor and an ally.

When Citizens entered the student-loan refinancing game less than two years ago, its balance sheet for student loans was only $1.5 billion, and it wanted to pump up its loan book quickly, so it bought loans from SoFi while originating some of its own. Of the $6 billion of student debt now on Citizens' books, however, the majority hasn't come from SoFi.

"My personal view," said Coughlin, "is if you can do it yourself that's a much better long-term strategy for a bank than buying it from somebody else."

While it remains to be seen how much banks adopt from the platforms and processes of marketplace lenders, "it's not going to be one wins, one loses," said Dave Laterza, a senior analyst at DBRS. "These are big markets." Some borrowers, he said, clearly put a premium on the relatively frictionless experience that alternative lenders provide, but "others value their relationships with banks and will still choose to use their bank for certain lending products."

There are unanswered questions about the long-term viability of marketplace lending. Having grown to prominence in the post-crisis period, most marketplace lenders have yet to go through a full credit cycle, said Laterza. The question is whether their earnings can offset the credit losses that will inevitably come with a recession.

There have been scandals too. Lending Club's founding CEO, Renaud Laplanche, was forced out in May after the company's board discovered that executives had falsified loan data in order to fit a buyer's specifications.

Lending Club is the nation's largest online lender by dollar volume. Most of Lending Club's borrowers are using their loans to consolidate credit card debt, and the regional and community banks that buy many of these loans see them as a way "to take back some of the market share that credit card companies took from them over the last three decades," said Andrew Deringer, Lending Club's head of financial institutions. "It's a way to repatriate some of that consumer credit that they've lost. We're giving them an opportunity to compete."

Still, some of that capital has dried up since the scandal broke in May. Lending Club's loan originations fell by 29% between the first quarter and the second quarter of this year, to just under $2 billion, and the company reported an $81.4 million loss between April and June.

Deringer expressed optimism about Lending Club's future prospects, but added that growth would be pursued "in a very disciplined way. We're not going to crank it up right away. We're going to make sure that we're on solid ground first."

Sanchez, for one, wouldn't bet against them. The digital platforms created by Lending Club and its peers represent "the Uber of lending," he said, using the common shorthand for providing a great customer experience. "But so many processes in traditional banking are the antithesis of Uber."