When CIT Group lays out a plan to divest its aircraft leasing business — possibly later this week — the company will take a big step forward in its yearlong effort to shrink.

CIT is reportedly nearing a deal to sell its aircraft leasing unit to

The divestiture is expected to shrink the $67 billion-asset CIT to just over the $50-billion-asset mark, the point at which financial services companies are subject to heavier regulation as systemically important financial institutions. Staying that size for long could be a challenge, with the company lacking the necessary heft to absorb the costs of being a SIFI.

But it is unclear where the company will go next. In her first few months as chairwoman and chief executive, Ellen Alemany has not provided a clear plan on how big (or small) she would like CIT to be — or whether she intends to ultimately shed its SIFI status. Doing so would require further divestitures, and there are a number of highly complicated factors at play.

So when CIT ultimately announces how it plans to get out of the aircraft business, investors will be looking for more detailed information, observers said.

"Once the sale is announced, they need to have a plan," said Vincent Caintic, an analyst with Macquarie, discussing the looming aircraft sale. "This is a way for her to reset expectations."

Caintic — who supports the idea of shrinking below $50 billion — said investors had expected Alemany to lay out a "grand plan" for the company months ago, during a call with investors in March to discuss strategic plans. But many observers viewed the call as a "bit of a disappointment" after Alemany declined to say whether CIT will remain a SIFI over the long term.

Since then Alemany has declined to clarify the matter in public. She has told investors that she is not "managing the company to a specific asset level" but is focusing instead on risk-adjusted returns, she told investors in late July.

"CIT has arrived at a crossroads," Caintic said. "Are they going to get bigger or are they going to get smaller?"

Any way you cut it, the looming shrinkage of CIT, following the aircraft separation, is a remarkable change in course for a company that once had big ambitions to grow.

Alemany's predecessor, Wall Street icon John Thain, had planned to transform the once-bankrupt commercial financing company into a large retail bank. Before announcing his resignation

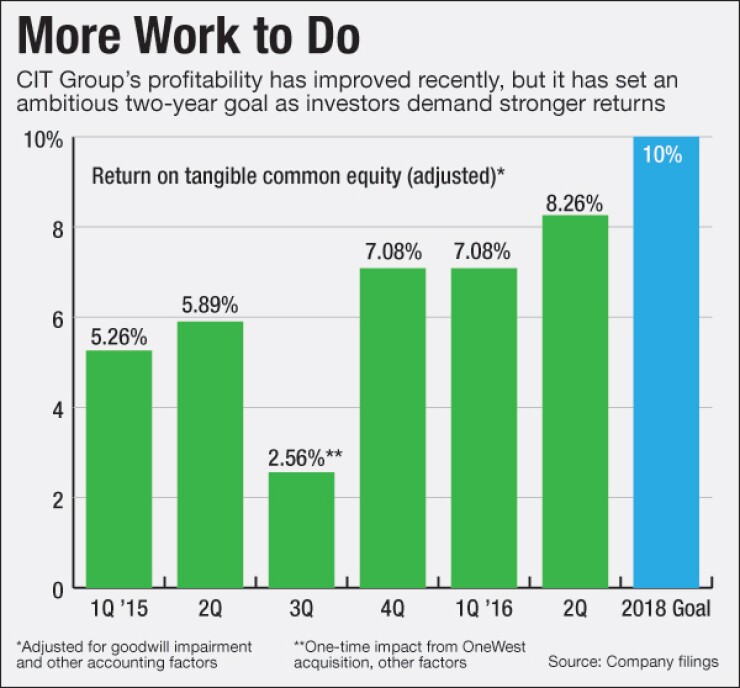

However, CIT's performance has been meager in recent years but has improved. Return on tangible common equity during the second quarter of 2016 was 8.26% on an adjusted basis, compared with 5.89% a year earlier. Profits have also been squeezed by a host of problems in the company's reverse-mortgage servicing unit.

A number of investors, including the high-profile Hudson Executive Capital, have called for the breakup of CIT, arguing that the sale of its struggling railcar unit would boost shareholder returns. The company, meanwhile, has committed to boosting profitability, setting a target of 10% adjusted return on tangible common equity by 2018.

"Part of what we're seeing now is the response to activist investors that got involved," said Arren Cyganovich, an analyst with D.A. Davidson. He added that, all things considered, investors would "react positively" to the sale of the aircraft unit if CIT can sell the business at a premium.

CIT has also explored a possible spinoff of the aircraft unit, though most analysts agree that a sale would be preferable.

Alemany did not respond to a request to comment for the story.

Ask a handful of analysts what the company will look like in the next few years, and you'll get a wide range of answers.

Some say the company could shrink to around $35 billion in assets if it sells its struggling railcar unit and pays down additional debt. That would make it a more streamlined commercial bank — and a potential acquisition target.

Others say that the company will likely boost its asset size over time by redoubling its efforts in classic commercial lending. There is also some discussion in the industry that if CIT punts on the issue long enough, it could get relief from Congress, which has debated raising the SIFI threshold above $50 billion.

"I don't think they've figured that out yet," Cyganovich said, discussing the company's plans for managing its SIFI status.

But most analysts agree that shrinking the company further would take time. Under current regulations, the earliest that CIT can shed its SIFI status would be in 2018, Alemany said on a recent call with investors.

In the meantime, Alemany has a long list of pressing problems. In addition to the aircraft sale, CIT needs to remedy the qualitative objection it received from the Federal Reserve on its capital plan and get approval to buy back shares, according to Brian Klock, an analyst with Keefe, Bruyette & Woods.

Add to that the ongoing, behind-the-scene stresses of integrating CIT and OneWest, two companies with notably different cultures and strengths.

While investors would clearly like to hear a detailed plan on whether Alemany plans to de-SIFI the company, they likely will not get clarity anytime soon.

"The real question is, two years from now, if they aren't getting close to hitting the 10% [return on tangible common equity] target, are investors really going to give management three more years?" Klock said.

Boosting profitability is Alemany's top priority in the near term.

"They have a lot of different things going on," Cyganovich said. "It's just baby steps toward their final goal."