Texas Capital Bancshares in Dallas hopes its new digital bank can succeed by focusing on a narrow customer segment.

The $33 billion-asset company

The idea is to offer a unique incentive to distinguish Bask's products from traditional savings accounts, said Matt Quale, the digital bank's president and a former chief marketing officer at Brighthouse Financial.

"What you're building is a business for consumers, but you're also building additional capability that you'll be able to leverage back to Texas Capital," he said.

The challenges for Bask, and other niche platforms, will be establishing name recognition and finding enough customers to justify the effort, industry experts said.

Bask "has low market awareness and this works against them," said Ron Shevlin, director of research at Cornerstone Advisors.

"Going after American Airline customers might be a good match for Texas Capital’s geographic footprint, but I’d bet one of the reasons for creating the online bank is expanding that footprint," Shevlin added. "To do that effectively, Bask is going to need to expand the number of airlines in the program."

To be sure, several digital brands are built around a narrow client segment.

TransPecos Banks operates BankMD for doctors, while Joust, a challenger bank, targets freelancers. BankMobile, operated by Customers Bancorp, and Laurel Road, which KeyCorp acquired last year, focus heavily on students.

American Airlines fliers could be much smaller than those other groups, though the airline operates hubs in cities such as Chicago, Dallas, New York, Miami and Los Angeles.

Texas Capital will largely focus on consumer clients who are comfortable having a secondary bank account.

"I think people are going to open this up as another account and just put it in their portfolio of financial tools," Quale said. "It's one more bank product that people are going to manage off of their phones."

Depositors will have to look at the trade-offs between a Bask account and that of another bank.

The median U.S. household has $11,700 in savings, which would equate to 11,700 air miles points, Shevlin said, adding that Marcus, operated by Goldman Sachs, currently offers a 1.7% interest rate, plus a $100 bonus.

Shevlin warned that, while few depositors will read the fine print, mileage points accrued from the savings account are taxable. "When customers get hit with a 1099 they won’t be happy," he said.

Texas Capital, for its part, is touting the ease of opening a Bask account.

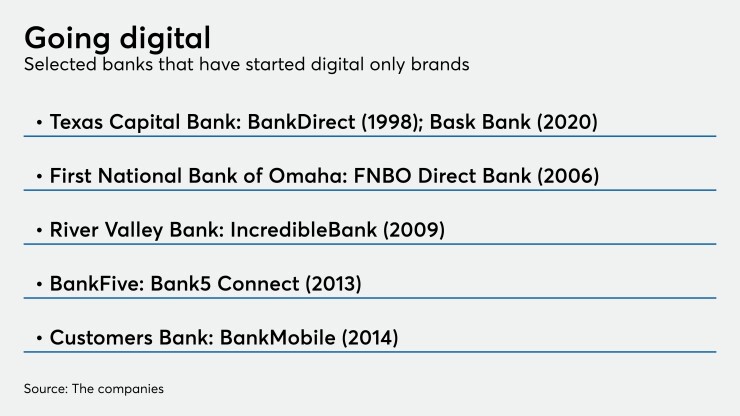

While Texas Capital already had a digital bank — it helped pioneer the concept with BankDirect in December 1998 — Quale said the company wanted to build a separate platform using new technology. Customers, for example, cannot join BankDirect online and it is not mobile-enabled in the way that Bask is.

"BankDirect is actually a full-service bank with checking and debit cards," Quale said. "But we wanted to make this travel-specific."

The effort is "forward-looking" as Texas Capital looks to capitalize on consumer behavior, said Brady Gailey, an analyst at Keefe, Bruyette & Woods.

"I think this is a very clever way to gather some relatively-cheap consumer deposits," Gailey added. "I think the strategy is a home run for Texas Capital."

Gailey said Bask has the potential to bring in $1 billion to $2 billion over the next few years without having the costly overhead of a physical branch. While Bask is doing a gread job with its initial marketing, he said it will be challenged to find traction and widespread consumer adoption among so many other savings product choices.

The initiative bears watching, particularly among banks with high loan-to-deposit ratios, industry experts said.

Bask has 25 employees, or roughly 1.5% of Texas Capital's work force, though Quale said he expects that number could double based on demand. Most of those employees will work in marketing and IT, but the bank will also have compliance and human resources functions.

Bask isn't the only big change happening at Texas Capital.

The company agreed agreed in December

Quale said the merger, expected to close in mid-2020, should accelerate Bask's growth and provide it with more resources.