Bank of America had much to crow about in its first quarter, but so many of the questions CEO Brian Moynihan fielded on Tuesday boiled down to one: What happens if things slow down?

That question has lingered for many banks since the end of last year, and it has gained some legs in recent weeks now that the Federal Reserve says it plans to pause rate hikes for the rest of the year, or potentially longer — a move that would threaten growth in net interest income.

For that reason, Moynihan had to answer questions from analysts about revenue risks going forward tied to net interest margins, fee income and lending.

“If you're telling me you're predicting a recession, we'd handle the company differently as would everybody else, but that's not what we think,” he said when asked whether Bank of America could tap into new products or customer segments to pump up results in the event of a slowing economy.

“As I think about it overall, we just think this is a great franchise, and we're just grinding out the growth that's embedded,” Moynihan said, adding that operating earnings could rise in the mid to upper single digits on a percentage basis.

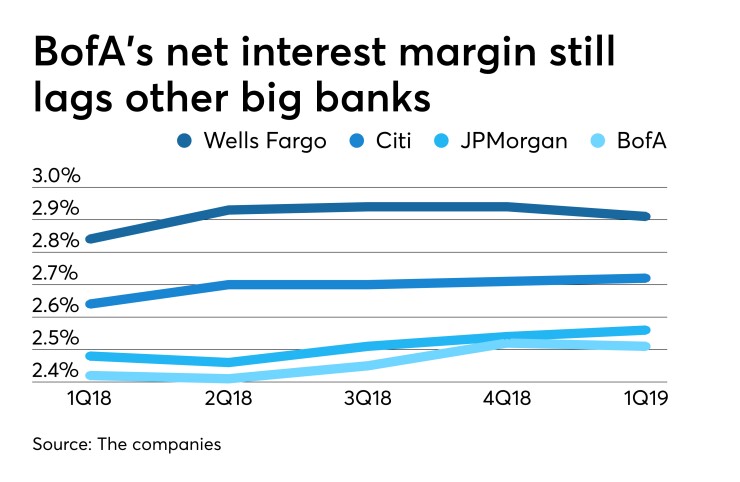

Bank of America is projecting its net interest income to expand at “roughly half the pace of 2018,” Chief Financial Officer Paul Donofrio said. The bank’s net interest income expanded 6% last year.

Analysts pressed Moynihan and Donofrio for details about how Bank of America will manage its rate sensitivity, particularly if there are no more rate hikes this year.

“There may come a point in the future where we would do something to modify the asset sensitivity of the company,” Donofrio said, but he added that there would be a risk in doing so — especially if rate trends shift again at some point. “There may come a time we'll adjust that, but right now we feel comfortable.”

Another analyst wanted to know: If there are no further rate hikes, will deposits immediately stop shifting from non-interest-bearing to interest-bearing?

Moynihan pointed to growth in consumer deposit balances, with much of that happening in noninterest and low-interest checking accounts. He added that he anticipates commercial balances to also stop shifting to interest-bearing accounts.

“When rates stop rising, which really has happened, that stabilizes and we have seen that and expect that to continue,” he said.

Bank of America sacrificed some fee income for the sake of customer relationships, Moynihan said. Service charges on deposit accounts declined 4% from a year earlier to $1.6 billion in the first quarter, in part because the bank has softened some of its policies on overdraft fees.

But Moynihan said the decline in fee income was tied to better customer relationships in general. In other words, more customers chose to do most of their banking with Bank of America and therefore kept balances high enough to minimize fees on their accounts.

“The real driver of that is the fact that we have primary households,” he said.

Moynihan highlighted a 7% year-over-year increase in revenue in Bank of America’s consumer banking segment to $9.6 billion in the first quarter. And, he pointed out, consumer deposits rose by 3% to $696.9 billion, with much of that growth happening in checking accounts.

The bank’s total loans rose just 1% to $945.6 billion, though some segments performed better than that. For example, on the domestic side of the bank’s businesses, total commercial loans and leases increased 4% to $498.5 billion, and consumer loans and leases rose 5% to $292 billion.

Bank of America increased its provision for loan losses 21% to just over $1 billion. Net charge-offs increased 8% to $991 million and represented 0.43% of average loans.

Asked by an analyst “how will you know if we are entering a new credit cycle?” Moynihan chose to highlight the ways the organization has changed since the 2008 financial crisis. The bank has shifted its mix of business to an even split between consumer and commercial, for instance, and most of the consumer lending it does now is secured, he said.

He also said that the bank has stuck to strong underwriting principles and that charge-offs have remained fairly low. While Moynihan did not explain how he would anticipate a shift in the credit cycle, he expressed optimism in the near-term outlook.

“Credit’s in good shape, and we just don't see that changing a lot,” he said.

Credit card volumes began to slow, however. Bank of America’s credit card portfolio totaled a little over $95 billion in the first quarter, essentially flat from the year-ago quarter and down slightly from the prior quarter. Executives said they expect low-single-digit growth this year, partly because the bank is trying to avoid customers who apply for credit cards in order to game the rewards that come with them.

But when pressed for details, Donofrio said that elevated payment activity was also a factor.

He said, “I just think that it's a good economy and we have high-quality customers in our card portfolio, and they're taking some of their excess deposits and paying off their balances.