Sometimes a bank has to do a deal to do the deal.

The $1.1 billion-asset Bridgeview Bancorp

Bridgeview’s first attempt to find a buyer — in October 2017 — fell flat when every bank it contacted, including the $15 billion-asset First Midwest, showed no interest in taking over the bank’s mortgage division. At that time, the business was originating about $2.5 billion in mortgages annually. However, noninterest income from the sale, securitization and servicing of one- to four-family residential mortgage loans in 2018 fell by 15% from a year earlier to $86.5 million, according to call reports filed with the Federal Deposit Insurance Corp.

Bridgeview, as a result, agreed last fall to transfer its

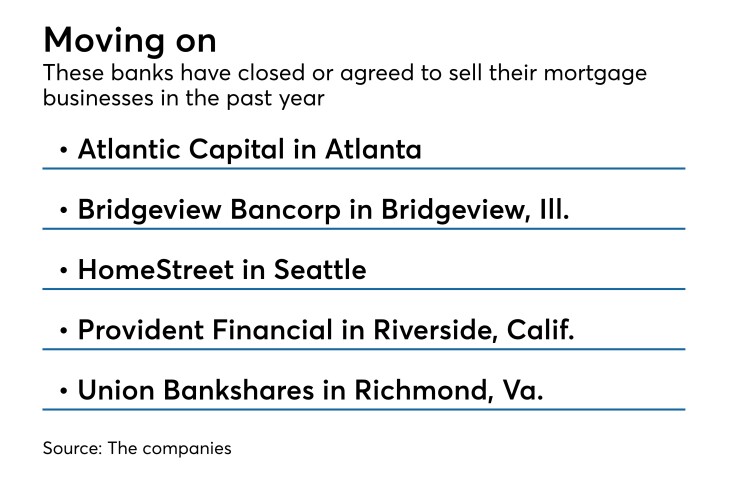

The moves show just how much national mortgage lending has fallen out of favor with many banks, largely due to intense competition, regulatory requirements and reduced borrower demand. HomeStreet in Seattle recently announced plans to

Bridgeview initially sought bids from 14 banks, according to a

The tepid response forced Bridgeview to suspend its efforts to find a buyer in January 2018.

In March and April, Bridgeview reached out to eight potential acquirers, this time making it clear that it would consider selling, dissolving or spinning off the mortgage business. First Midwest was one of five banks to sign a confidentiality agreement to conduct due diligence.

Two banks provided preliminary bids in early May, ranging from $8 to $8.64 a share. First Midwest sent word that it was interested and hoped to provide a preliminary indication of interest by late May.

In mid-June, First Midwest proposed paying $9.17 to $9.57 a share, cautioning that certain accounting adjustments to Bridgeview’s fixed assets and foreclosed properties could alter the price. At the same time, one of the original bidders revised its offer to $8 to $8.50 a share, warning that “specific areas of their due diligence … could potentially decrease the purchase price,” the filing said.

After reviewing each offer with its financial and legal advisers, Bridgeview's senior management determined that First Midwest had presented the superior offer. From June through mid-August, Bridgeview marketed its mortgage division to third parties for a potential sale.

First Midwest, after more due diligence, said on Aug. 22 that it was willing to pay $8.76 a share in cash and stock. The offer’s final value hinged on Bridgeview selling its mortgage business, an agreement on the value of certain fixed assets and potential pricing adjustments tied to certain foreclosed properties, among other things.

First Midwest also wanted to conduct more due diligence on Bridgeview’s life insurance contracts.

The companies agreed to a 60-day exclusivity period on Aug. 22.

Bridgeview on Oct. 30 struck a deal to sell its mortgage operations to Synergy.

By late November, First Midwest and Bridgeview were close to an agreement. They agreed that the cash consideration could change based on the sale of the mortgage business and Bridgeview’s ability to shed foreclosed properties, specified premises and identified life insurance contracts. Bridgeview owns life insurance contracts for three unnamed individuals, the filing said.

First Midwest’s board unanimously approved the acquisition on Nov. 14. Bridgeview’s board unanimously voted in favor of the deal on Nov. 29. In early December, certain Bridgeview investors executed voting agreements to back the sale.

First Midwest announced the acquisition on Dec. 6. The deal, which is expected to close in the second quarter, priced Bridgeview at 130% of its tangible book value.

Bridgeview has 13 branches, $1.1 billion in deposits and $800 million in loans.

First Midwest said the deal should be 5% accretive to its 2020 earnings per share. It should take about three years to earn back any dilution to First Midwest's tangible book value. First Midwest plans to cut about 40% of Bridgeview’s annual noninterest expenses.

“Bridgeview is a well-established and trusted financial institution with deep client and community relationships, which we look forward to continuing,” Michael Scudder, First Midwest’s chairman, president and CEO, said in a press release. “Joining forces with Bridgeview brings to all of our clients an expanded footprint across Chicago."