Alan Kline is the former editor-in-chief of American Banker. Previously he oversaw its consumer finance and national/regional banking coverage. He also helped direct coverage of the annual Most Powerful Women in Banking rankings.

-

A partnership with a firm that makes consumer loans through Home Depot stores is exceeding all expectations at Regions Financial. The company is counting on arrangements with two other alternative lenders to further drive loan growth.

By Alan KlineApril 15 -

Regions Financial in Birmingham, Ala., posted a double-digit gain in its first-quarter profit as strong revenue growth more than offset continued deterioration in its energy-loan portfolio.

By Alan KlineApril 15 -

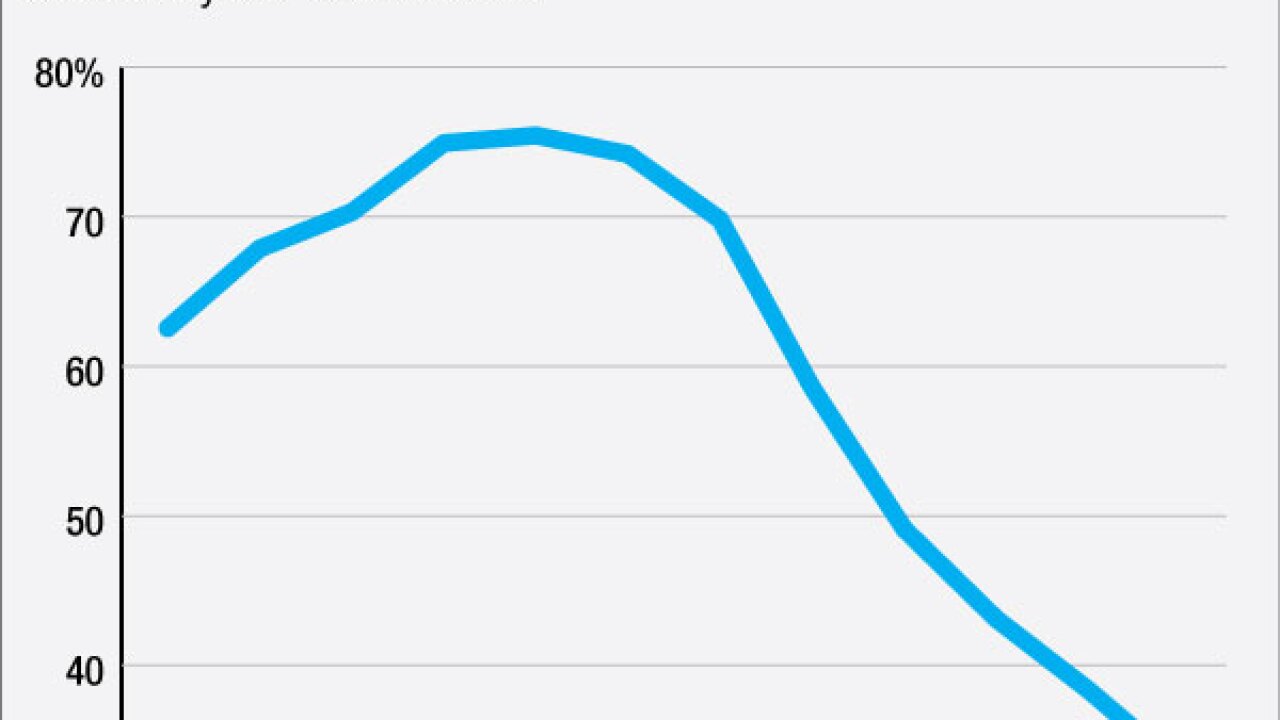

Bank earnings season is just getting underway, but a consistent theme around energy lending is already emerging credit quality is going to get worse and weigh on profits the rest of the year.

By Alan KlineApril 14 -

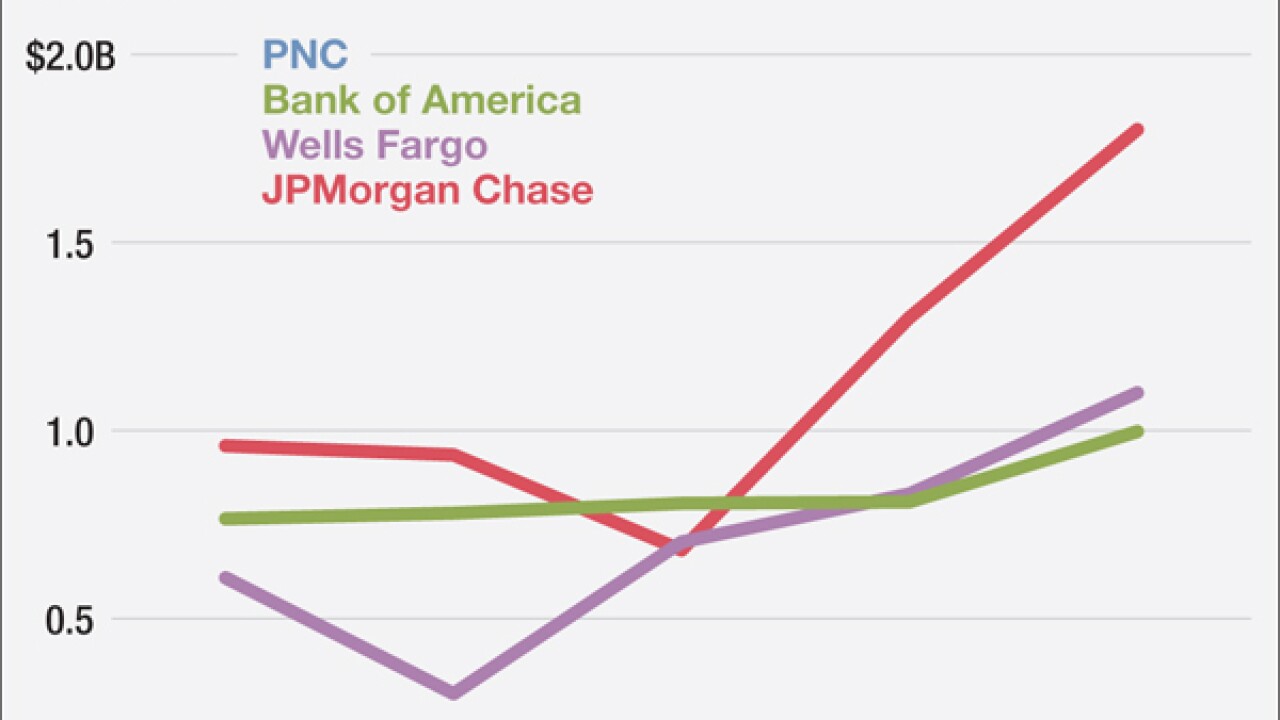

Weakness in the energy sector is weighing on PNC Financial Services Group's profits. The Pittsburgh company said early Thursday that it earned $943 million in the first quarter, a nearly 6% decline from the same period last year.

By Alan KlineApril 14 -

Affirm, a three-year-old online lender that finances consumer purchases at the point of sale, has raised a $100 million in equity funding to help it boost distribution and develop new products and services.

By Alan KlineApril 13 -

HarborOne Bank is proving that financial education really can improve the bottom line.

By Alan KlineMarch 30 -

Hancock Holding is warning of more pain in its energy portfolio as low prices continue to hamper oil and gas firms ability to repay their loans.

By Alan KlineMarch 29 -

Bakhshi, who takes over as CEO in June, brings with her a track record of innovation and a reputation for getting the most out of her teams.

By Alan KlineMarch 22 -

Bank of the West in San Francisco announced Wednesday that it has named TD Bank executive Nandita Bakhshi as its next president and chief executive.

By Alan KlineMarch 16 -

The San Rafael, Calif., company has stayed at roughly the same asset size for six years now, even though it has the capacity and desire to become much larger. The reasons speak to the competitiveness among lenders and the fickle nature of bank M&A.

By Alan KlineMarch 15