-

Most muni bond exchange-traded funds performed noticeably worse in the fourth quarter than the indexes they were designed to track.

By Dan SeymourJanuary 13 -

Investors kept pulling cash from municipal bond mutual funds at a record pace last week as frightened money continued to flee the market.

By Dan SeymourJanuary 10 -

The return of bank profitability, coupled with some of the provisions of the federal stimulus, coaxed banks to buy state and local government debt in the first half.

By Dan SeymourSeptember 29 -

The Basel III bank capital requirements proposed earlier this month threaten to eviscerate the supply of eligible investments for tax-free money market funds — an industry already struggling with a severe supply shortage.

By Dan SeymourSeptember 24 -

The unit investment trust has quietly blossomed into the dominant investing vehicle for Build America Bonds, the taxable municipal debt created under last year's stimulus legislation.

By Dan SeymourSeptember 3 -

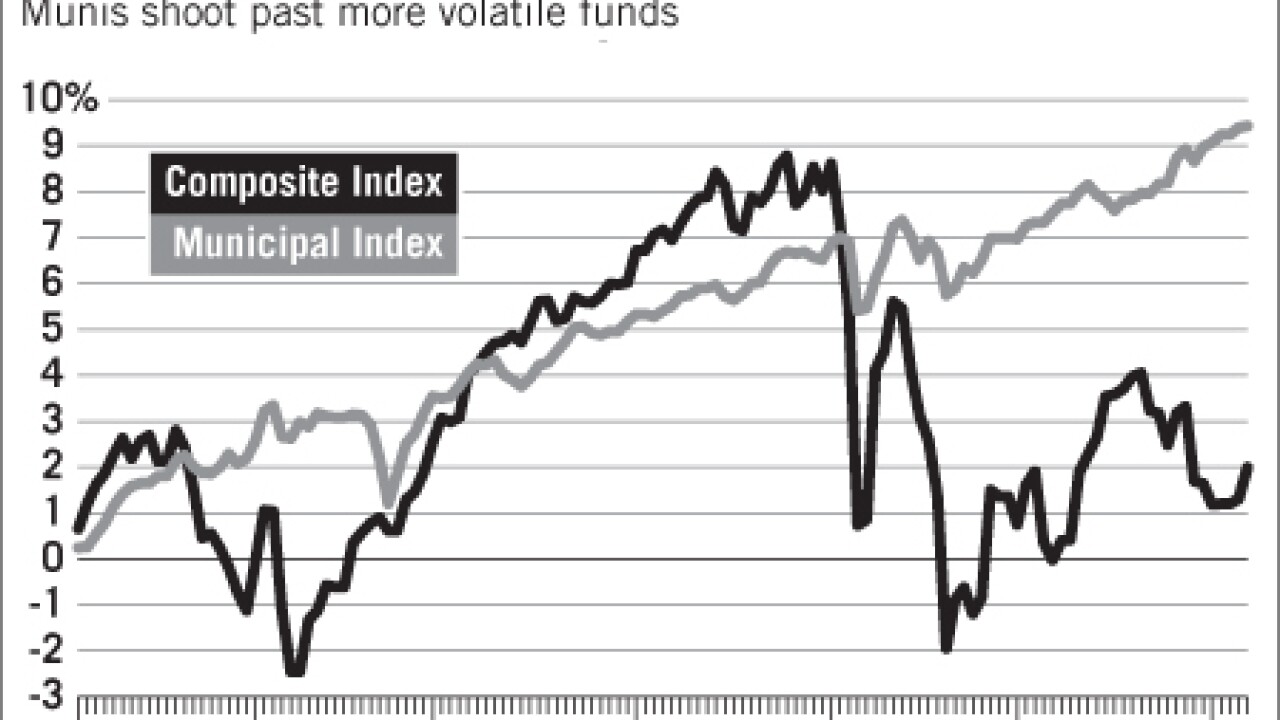

Closed-end funds devoted to stocks, bank loans and taxable bonds have taken a wild ride this year, but closed-end municipal bond funds have avoided the turbulence.

By Dan SeymourJuly 14 -

Investors pulled cash out of municipal bond mutual funds last week for just the third time in a year and a half, despite a strong week for state and local government debt.

By Dan SeymourJuly 6 -

Invesco PowerShares plans to roll out its second exchange-traded fund devoted to Build America Bonds, highlighting both the proliferation of municipal ETFs and the growing importance of taxable state and local government debt.

By Dan SeymourJune 18 -

Charles Schwab Corp. has formed a partnership with Pacific Investment Management Co. to offer wealthy clients in or approaching retirement a managed municipal bond laddering product.

By Dan SeymourMarch 16