Ebrima Santos Sanneh covers the Treasury, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency for American Banker. He is a native of Providence, R.I. and a 2020 graduate of UCLA. Before joining American Banker he worked as a staffer for Sen. Jack Reed, D-R.I.

-

The banking industry's public reputation recovered moderately in 2024 after a string of regional bank failures depressed confidence in the industry the year prior.

September 10 -

After months of anticipation, Federal Reserve Vice Chair for Supervision Michael Barr is set to lay out the path forward for the interagency regulatory capital reform effort known as the Basel III endgame on Tuesday.

September 9 -

Morgan Stanley will have to pay $2 million for failing to flag trading in First Republic Bank by its former CEO. The transactions happened in the lead-up to the regional bank's collapse.

September 6 -

Net income climbed more than 11% from the first quarter, even as banks set aside more money for possible bad credit and wrestled with deteriorating office markets.

September 5 -

The American Bankers Association says a proposal to replace its own financial security identifier with one owned by Bloomberg exceeds the agencies' statutory authority and could disrupt financial markets.

September 5 -

Acting Comptroller of the Currency Michael Hsu called for a more risk-based approach to supervision to prioritize pressing issues and improve agility in monitoring large banks.

September 3 -

The FDIC board chose to have another federal agency handle investigations of senior leaders based on allegations unearthed in an independent review published this spring. The move is aimed at ensuring accountability but was criticized for potential delays.

August 30 -

The Federal Reserve finalized its capital requirements for large banks Wednesday based on June's stress test outcomes.

August 28 -

New rules from Treasury's Financial Crimes Enforcement Network will mandate reporting for non-financed real estate transfers and expand anti-money-laundering requirements for investment advisors.

August 28 -

Appointed by Janet Yellen in 2021, Michael Hsu has served as acting Comptroller of the Currency longer than any predecessor. That arrangement is lawful and born out of political pragmatism, but some observers say it's a shortcut around Senate confirmation.

August 28 -

Cohen, a partner with law firm Morrison Foerster and seasoned expert in workplace monitorships and diversity initiatives, will audit and report on the agency's efforts to overhaul a culture characterized by patriarchy and insularity.

August 22 -

A coalition of financial industry groups is calling on the Federal Deposit Insurance Corp. to provide more data and extend the comment period on proposed brokered deposit restrictions, warning the changes could disrupt banking practices and harm consumers.

August 21 -

New standards forwarded by the Public Company Accounting Oversight Board and approved by the Securities and Exchange Commission bolster auditor responsibilities and introduce enhanced technology use, impacting over 350 publicly traded banks.

August 21 -

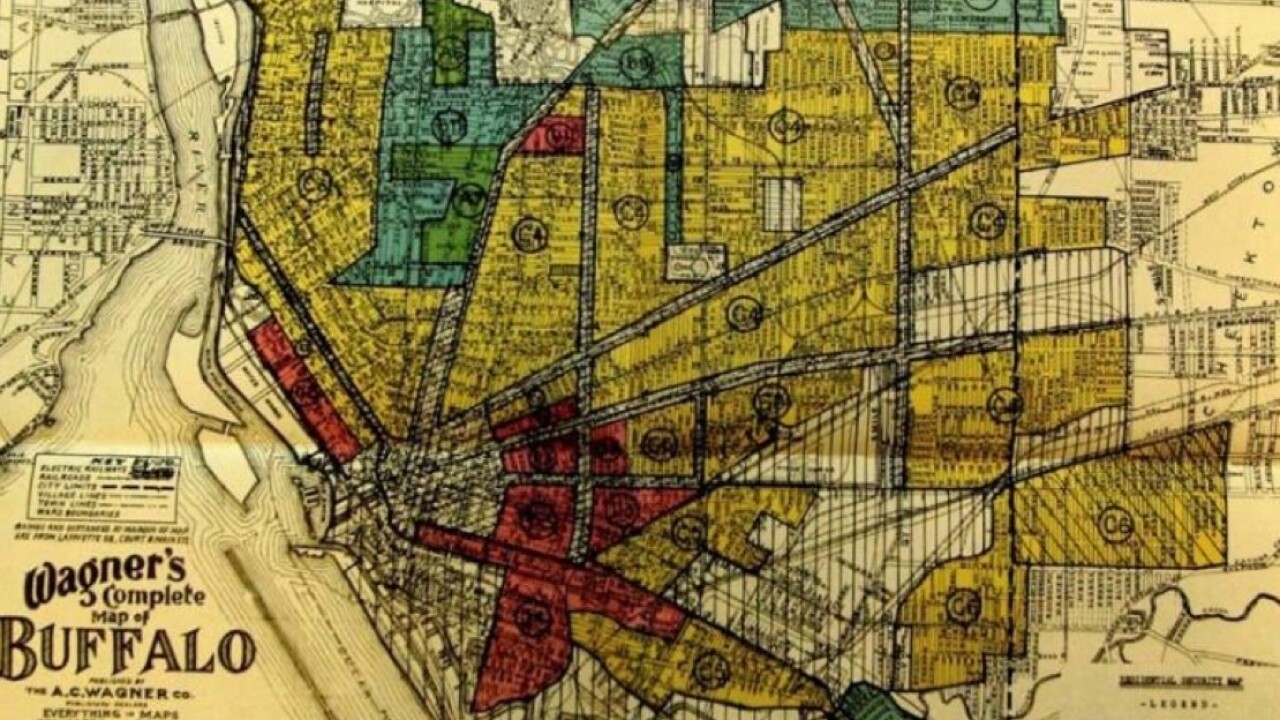

The industry-led legal challenge to new anti-redlining rules is opposed by some banks and consumer protection groups, who say the changes are necessary.

August 20 -

An amicus brief filed in a lawsuit challenging newly finalized implementing regulations for the Community Reinvestment Act argues that the court was chosen because plaintiffs believe the court is more likely to rule in their favor.

August 16 -

A bipartisan group of ex-inspectors general is pushing Senate leaders to quickly confirm Christy Goldsmith Romero to chair the Federal Deposit Insurance Corp. despite scheduling delays and the upcoming election.

August 13 -

Beneficial State Bank — which was joined by various civil rights groups — said in an amicus brief that the regulatory reforms are much-needed and that banking groups' legal challenge to the Community Reinvestment Act rules should be dismissed.

August 9 -

Democrats Ritchie Torres and Gregory Meeks called on the New York Home Loan bank to follow the lead of its peers and use alternative credit scoring models for collateral to improve consumers' access to homeownership.

August 9 -

Industry experts argue that the Federal Deposit Insurance Corp.'s recent brokered deposit proposal, which would expand the classification of brokered deposits and reverse key elements of a 2020 rule, reflects outdated thinking and may discourage banks from holding such deposits.

August 7 -

Governor Tim Walz, whom Vice President Kamala Harris selected as her running mate Tuesday, has a slight but progressive record on financial policy, suggesting a potential leftward shift in banking policy in a prospective Harris administration.

August 6