Ian McKendry is the Congress reporter for American Banker. He previously covered the Federal Deposit Insurance Corp., anti-money laundering and cybersecurity. Before joining American Banker he was an economic reporter for Market News International.

-

Republican lawmakers agree with Obama that outdated regulations need to be changed, but were pessimistic that the administration would support efforts to roll back the compliance burden on banks.

By Ian McKendryJanuary 13 -

Republican lawmakers agree with Obama that outdated regulations need to be changed, but were pessimistic that the administration would support efforts to roll back the compliance burden on banks.

By Ian McKendryJanuary 13 -

Legislation to audit the Federal Reserve's monetary policy fell short of the 60 votes necessary to win a key procedural motion in the Senate on Tuesday.

By Ian McKendryJanuary 12 -

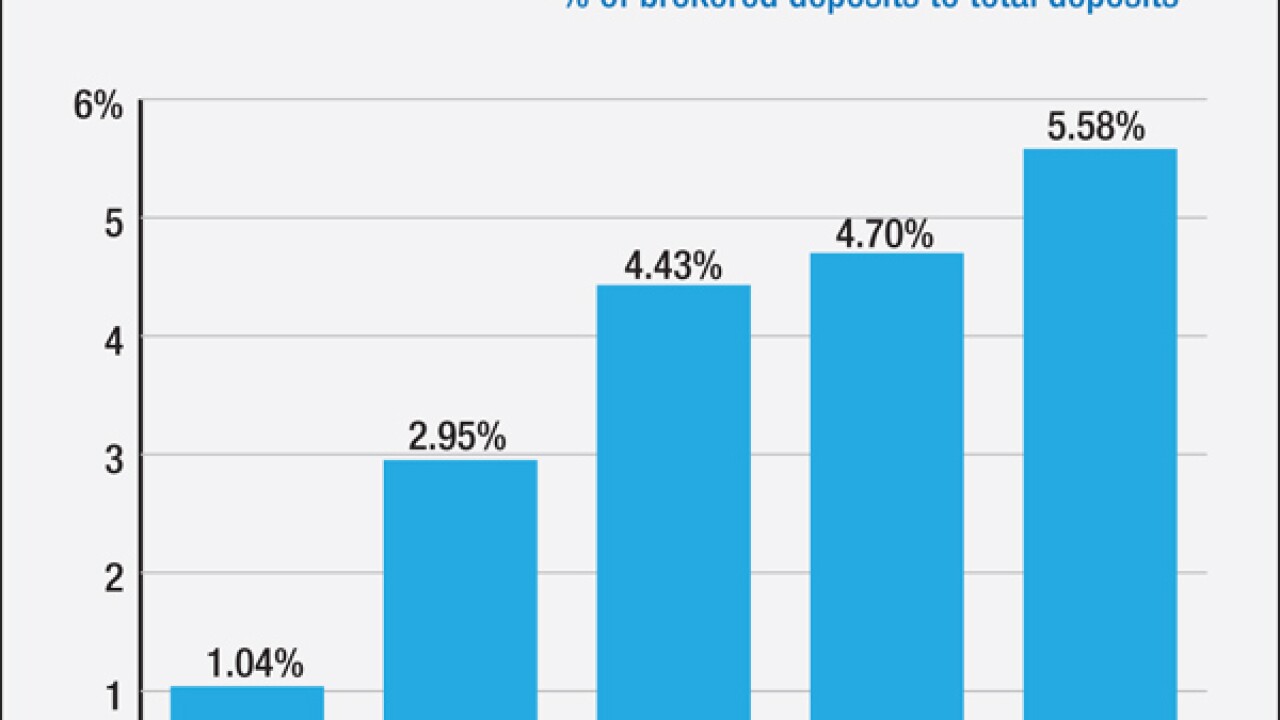

The Federal Deposit Insurance Corp. is using outdated methodologies to define "brokered deposits," stigmatizing stable sources of funding and forcing banks to pay higher premiums, according to bankers and several outside groups.

By Ian McKendryJanuary 11 -

Vows to turn credit rating agencies into nonprofits, allow the U.S. Postal Service to offer financial products, and cap interest rates banks charge consumers -- just like credit unions.

By Ian McKendryJanuary 6 -

In a speech in New York City, Sanders vowed to remove the ability of the Federal Reserve to pay interest to banks for their excess reserves, turn the credit rating agencies into nonprofits, allow the U.S. Postal Service to offer bank products, and cap ATM fees and interest rates for loans.

By Ian McKendryJanuary 5 -

A new digital currency backed by gold is billing itself as a more compliant, liquid and ultimately reliable store of value than decentralized systems such as bitcoin.

By Ian McKendryDecember 30 -

Regulators and institutions appear far apart when it comes to so-called "de-risking," in which banks drop businesses for fear of enhanced regulatory scrutiny, even while policymakers are stepping up their scrutiny of terrorist financing prevention in the wake of recent attacks.

By Ian McKendryDecember 30 -

The Treasury Department took a step forward Wednesday toward finalizing a highly anticipated customer due diligence rule that is expected to cost financial institutions and their customers between $700 million and $1.5 billion over the next 10 years.

By Ian McKendryDecember 23 -

WASHINGTON Third quarter bank trading revenue fell 5% from last year to $5.3 billion as equity trading underperformed, according to a report issued Monday by the Office of the Comptroller of the Currency.

By Ian McKendryDecember 21 -

House Republicans attacked the Consumer Financial Protection Bureau on Wednesday, arguing the agency is not able to safely secure the anonymous bulk data it collects on consumers' financial activities.

By Ian McKendryDecember 16 -

News that two suspected terrorists took out a loan with a prominent marketplace lender has fueled fears online lending could be more susceptible to terrorist financing.

By Ian McKendryDecember 16 -

A decline in bank failures and improving stability across the financial industry helped persuade the Federal Deposit Insurance Corp. to approve a 4.7% reduction in its 2016 operating budget on Tuesday.

By Ian McKendryDecember 15 -

News that two suspected terrorists took out a loan with a prominent marketplace lender has fueled fears online lending is more susceptible to terrorist financing. Yet experts said that the criticism directed at the industry appears unfounded. Here's why.

By Ian McKendryDecember 11 -

The upcoming release of the evaluations for the largest banks' resolution plans won't just reflect on the institutions themselves, but the regulators as well. Here's why.

By Ian McKendryDecember 7 -

If a forum hosted by the Treasury Department this week on economic inclusion showed anything, it was that bankers, financial technology firms and policymakers continue to struggle with how to bring more people into the financial mainstream.

By Ian McKendryDecember 4 -

WASHINGTON New York Governor Andrew Cuomo proposed a requirement on Tuesday that could put bank compliance officers on the hook if a bank's anti-money-laundering system fails to meet state standards.

By Ian McKendryDecember 1 -

The prepaid card giant Green Dot is getting into the matchmaking business.

By Ian McKendryDecember 1 -

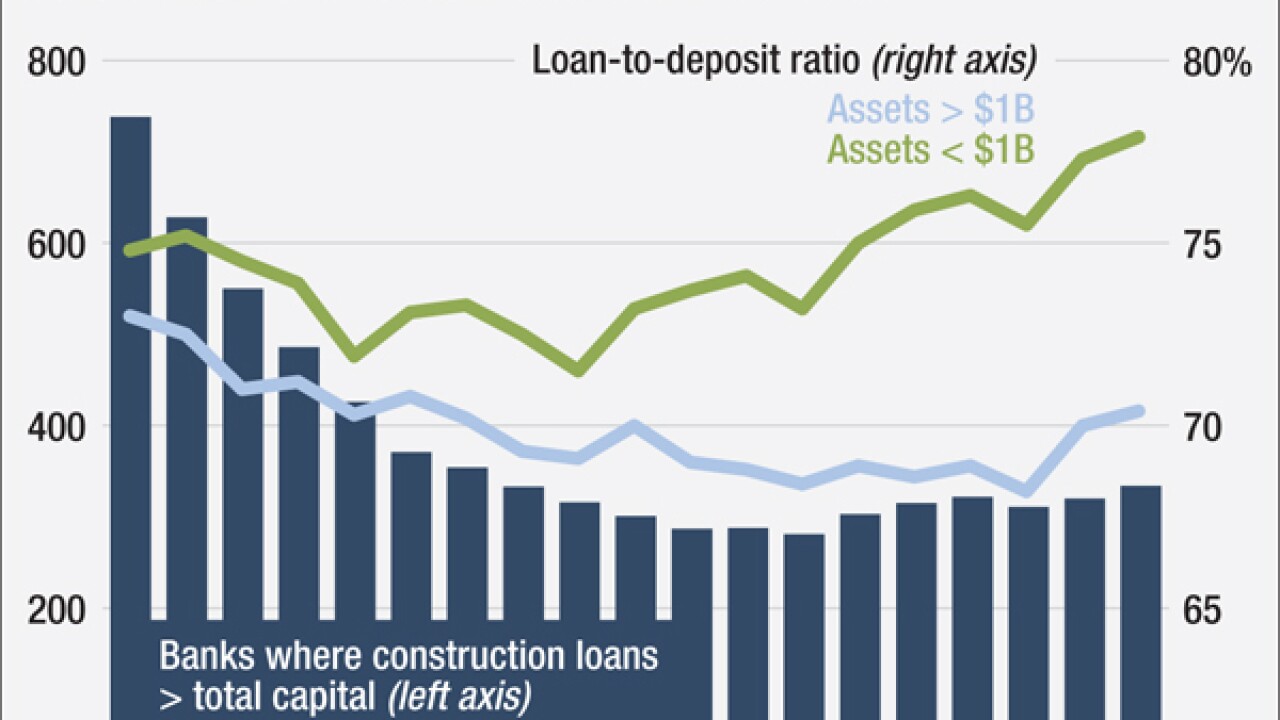

The Federal Deposit Insurance Corp.'s third-quarter industry update pointed to signs of banks expanding their risk profiles despite slow revenue growth.

By Ian McKendryNovember 24 -

U.S. bank earnings increased 5% in the third quarter from a year earlier to $40.4 billion as a few large banks recorded lower litigation expenses, the Federal Deposit Insurance Corp. said Tuesday.

By Ian McKendryNovember 24