-

Seacoast Banking Corp. of Florida, which has bought 10 banks over the past decade, has agreed to acquire community banks in Sarasota and Melbourne.

By Jim DobbsAugust 23 -

Bankers are hopeful that the rebound in oil prices and a spike in natural gas use are precursors to more borrowing. But banks are maintaining above-average levels of reserves in case the delta variant stifles economic momentum.

By Jim DobbsAugust 20 -

Minnwest Bank, which focuses largely on agriculture lending, said it will “become more sophisticated" with its mortgage and consumer lending services by acquiring Roundbank.

By Jim DobbsAugust 16 -

The Arkansas bank has hired an 11-member team to develop its new operation. Much of the team joins from TCF Financial, which was sold to Huntington Bancshares in June.

By Jim DobbsAugust 10 -

Alabama Credit Union's agreement to buy Security Federal Savings Bank, a small commercial lender, renews lingering questions about whether small banks are prey for tax-advantaged credit unions.

By Jim DobbsAugust 5 -

Stacy Kymes, the bank's chief operating officer and a 25-year company veteran, will succeed the retiring Steven Bradshaw.

By Jim DobbsAugust 4 -

“You need scale to keep up with necessary technology spend and regulatory costs,” CEO James Hillebrand said in explaining why the bank agreed to buy Commonwealth Bank & Trust just three months after it bought Kentucky Bancshares.

By Jim DobbsAugust 3 -

First Hawaiian and Bank of Hawaii are warning that a global spike in coronavirus cases could stunt the state's momentum and threaten credit quality.

By Jim DobbsAugust 2 -

The high cost of living in the state's bigger markets is limiting growth and turning off buyers. CVB Financial and TriCo Bancshares found sellers in the more affordable cities of Visalia and Bakersfield.

By Jim DobbsJuly 28 -

Wintrust has developed a specialty financing insurance premium payments for companies and individuals while PacWest and Signature Bank are meeting strong demand for loans to venture funds that invest in technology firms.

By Jim DobbsJuly 27 -

The Aurora, Illinois-based buyer said it would pay $297 million to acquire West Suburban Bancorp in Lombard, Illinois.

By Jim DobbsJuly 26 -

The company has long focused on customers with ties to the two states. But as it emerges from the pandemic seeking new lending opportunities, CEO Rajinder Singh says, “We are looking at markets from Boston all the way down to Atlanta.”

By Jim DobbsJuly 22 -

Consumers are booking rooms at levels not seen since early 2020 and loan delinquencies have fallen sharply as a result. Still, business travel remains sluggish and new COVID variants are spreading, threatening the hotel industry’s recovery.

By Jim DobbsJuly 19 -

The Tennessee company said merger costs tied to its Iberiabank acquisition are up $40 million from previous estimates. However, savings from additional branch closings and unexpected revenue gains should soften the blow.

By Jim DobbsJuly 16 -

United Community Banks in South Carolina and Blue Ridge Bancshares in Virginia have each struck agreements to buy or merge with banks in major metropolitan markets, where they will aim to siphon business from larger rivals.

By John ReostiJuly 15 -

Bank of America expects interest income to rise as stronger borrowing outweighs the impact of low rates. The upbeat forecast is in contrast with remarks from JPMorgan Chase executives.

By Jim DobbsJuly 14 -

Lakeland is paying $244 million for 1st Constitution Bancorp. The combined bank would be the fifth largest by deposit market share in New Jersey.

By Jim DobbsJuly 12 -

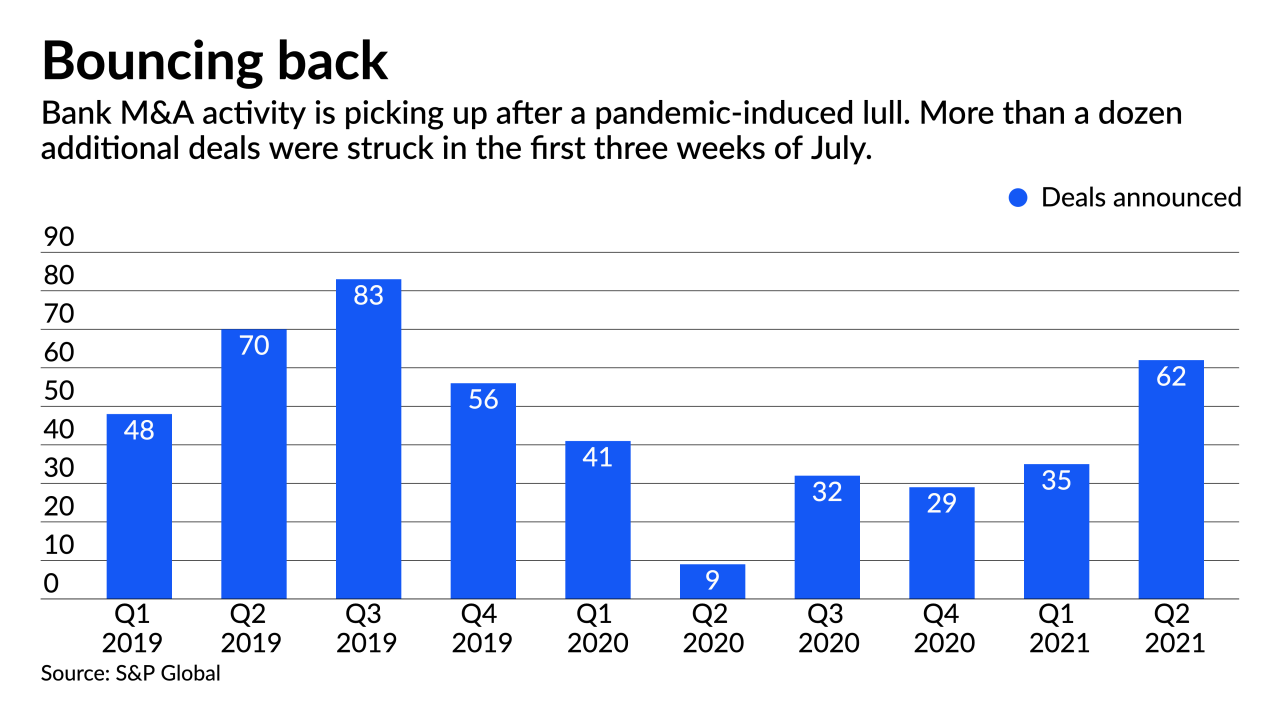

The economic forces driving dealmaking will overcome any regulatory risk posed by the president's call for stricter vetting of bank merger applications — especially among community banks, experts say. The White House push could even nudge some executives to cut deals sooner.

By Jim DobbsJuly 12 -

HoldCo Asset Management opposed the $900 million deal, arguing that Boston Private failed to consider other potential buyers and did not attract an acceptable price.

By Jim DobbsJuly 1 -

Banks such as Santa Cruz County Bank are now trading shares over the counter to capitalize on investors' bullish outlook for small lenders.

By Jim DobbsJuly 1