-

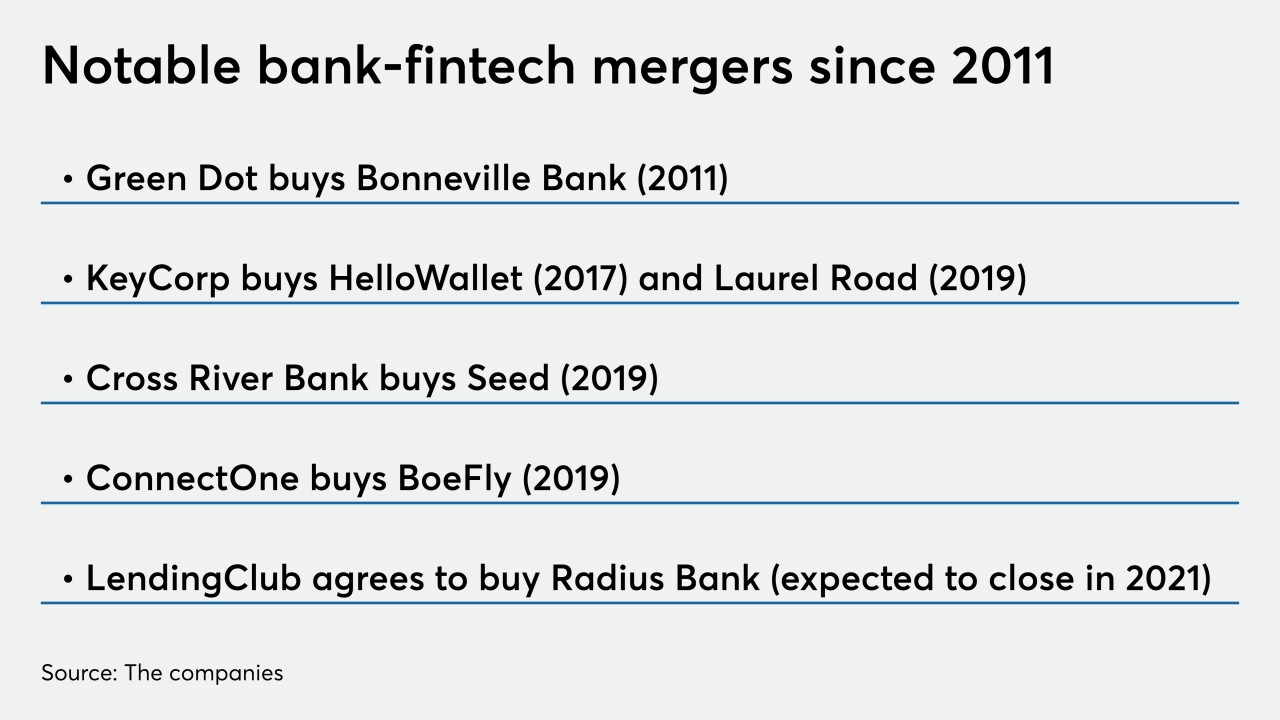

Compliance, risk management and staffing will likely come under added scrutiny as regulators lay out a framework for future fintech-bank mergers.

By Jim DobbsMarch 4 -

Recovery from a massive storm that touched down near Nashville is in its early stages, but bankers are looking at fee waivers and increased access to cash for those who were affected.

By Jim DobbsMarch 4 -

The companies spent much of the past decade completing smaller deals that created complementary footprints in the Southeast.

By Jim DobbsFebruary 26 -

Community banks are entering the business as intermediaries to counter the pinch of low loan yields and intense competition on spread income.

By Jim DobbsFebruary 23 -

The challenge for other fintechs will be to find banks that are as compatible as Radius Bank, an online-only lender, is for LendingClub.

By Jim DobbsFebruary 19 -

Regulators are alarmed about banks' rising exposure to high-risk corporate credits and want more data on how they would perform in a recession.

By Jim DobbsFebruary 11 -

Organizers of Triad Business Bank have raised enough capital and have received approval from the FDIC.

By Jim DobbsFebruary 5 -

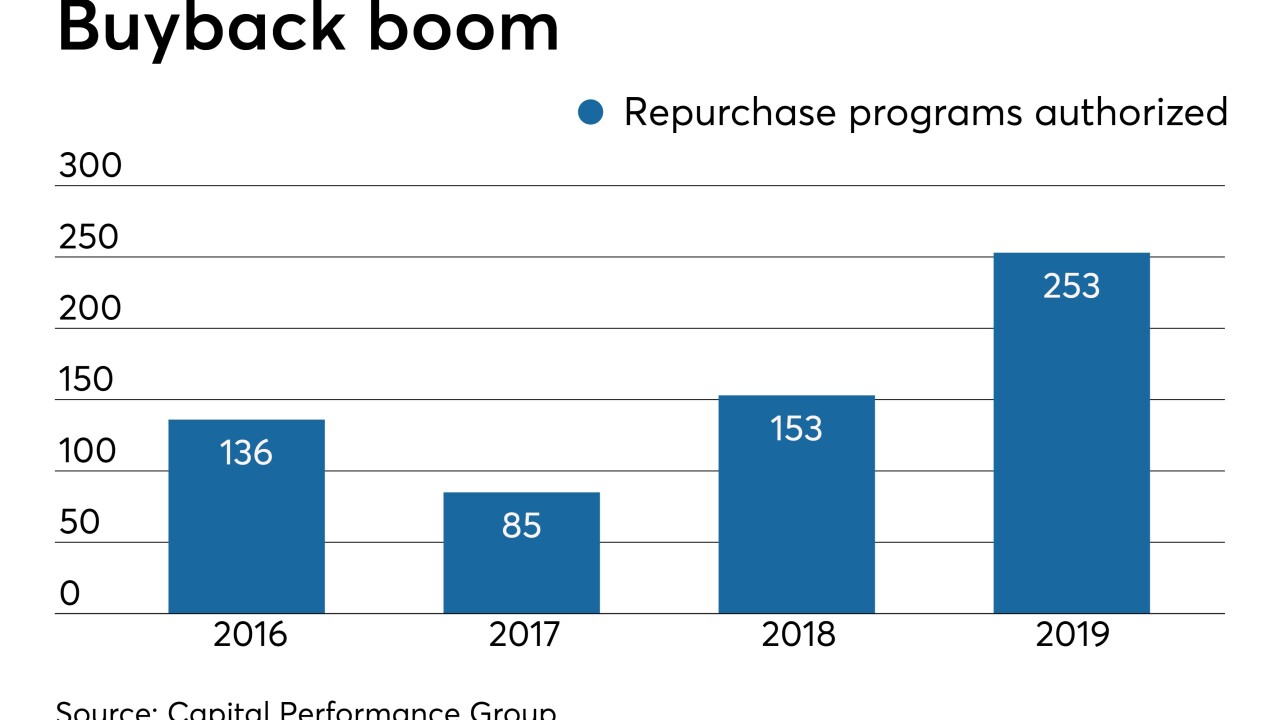

Anticipating a weaker economy and added pressure on stock prices, banks authorized more repurchases of outstanding shares last year.

By Jim DobbsFebruary 5 -

Certain loan segments are showing signs of deterioration, but consumer lending and digital banking are bright spots. Meanwhile, bankers are eyeing opportunities to improve efficiency, add scale and take advantage of M&A disruption. Here's what to expect from smaller regionals in the year ahead.

By Jim DobbsFebruary 3 -

Mortgages, auto loans and credit cards should perform well for the next two quarters. Beyond that, all bets are off.

By Jim DobbsJanuary 31 -

CenterState and South State are the latest regionals to announce a deal driven heavily by the need to compete with larger banks that can afford to spend more on cutting-edge technologies.

By Jim DobbsJanuary 27 -

The Georgia bank's operating costs rose in the fourth quarter, but executives sought to assure shareholders that investments will produce revenue growth in the long run.

By Jim DobbsJanuary 24 -

Commercial lending was sluggish in 2019, but leaders at Huntington, KeyCorp and M&T are encouraged that rates are stabilizing and business sentiment is improving.

By Jim DobbsJanuary 23 -

Franklin Financial agreed to be sold less than a year after issues surfaced in its portfolio of shared national credits.

By Jim DobbsJanuary 22 -

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

By Jim DobbsJanuary 21 -

The Southeast banks expect to complete their merger by midyear, hit their savings targets and still be able to invest in growth, according to Bryan Jordan.

By Jim DobbsJanuary 17 -

Brian Moynihan said banks must be mindful of pricing and risk as they contend with lower yields on loans and securities.

By Jim DobbsJanuary 15 -

The banking giant is counting on continued growth in cards, deposits and digital accounts to drive returns higher in 2020.

By Jim DobbsJanuary 14 -

Lower rates and more nonbank competition will make it harder for banks to keep loans on their books as business borrowers have plenty of opportunities to refinance elsewhere.

By Jim DobbsJanuary 13 -

Organizers of Founders Bank in Washington still need to raise at least $25 million before opening.

By Jim DobbsJanuary 10