John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

First NBCs annual report disclosed a full-year loss, lower capital levels and a spike in nonperforming loans, leaving outsiders to ponder how long it will take for the company to get back on track.

By John ReostiAugust 29 -

United Bankshares in West Virginia has quietly become a $14 billion-asset player in its region thanks to the M&A strategy of its highly respected leader, Richard Adams, who has a way of establishing a rapport with community bank chiefs. One recent seller is a repeat customer.

By John ReostiAugust 23 -

The Ohio company is eager to rev up SBA lending in the Windy City now that it has closed on its purchase of FirstMerit. CEO Steve Steinour also credits his company's willingness to make big upfront community commitments for a seamless approval process.

By John ReostiAugust 16 -

Basel III could deal some serious blows to capital levels at First NBC Bank in New Orleans. The big question is how large will the issue become over the next two years.

By John ReostiAugust 15 -

United Community and Wells Fargo are among the banks building platforms to lend to senior-care facilities. Demographics suggest the business should grow significantly in coming years.

By John ReostiAugust 12 -

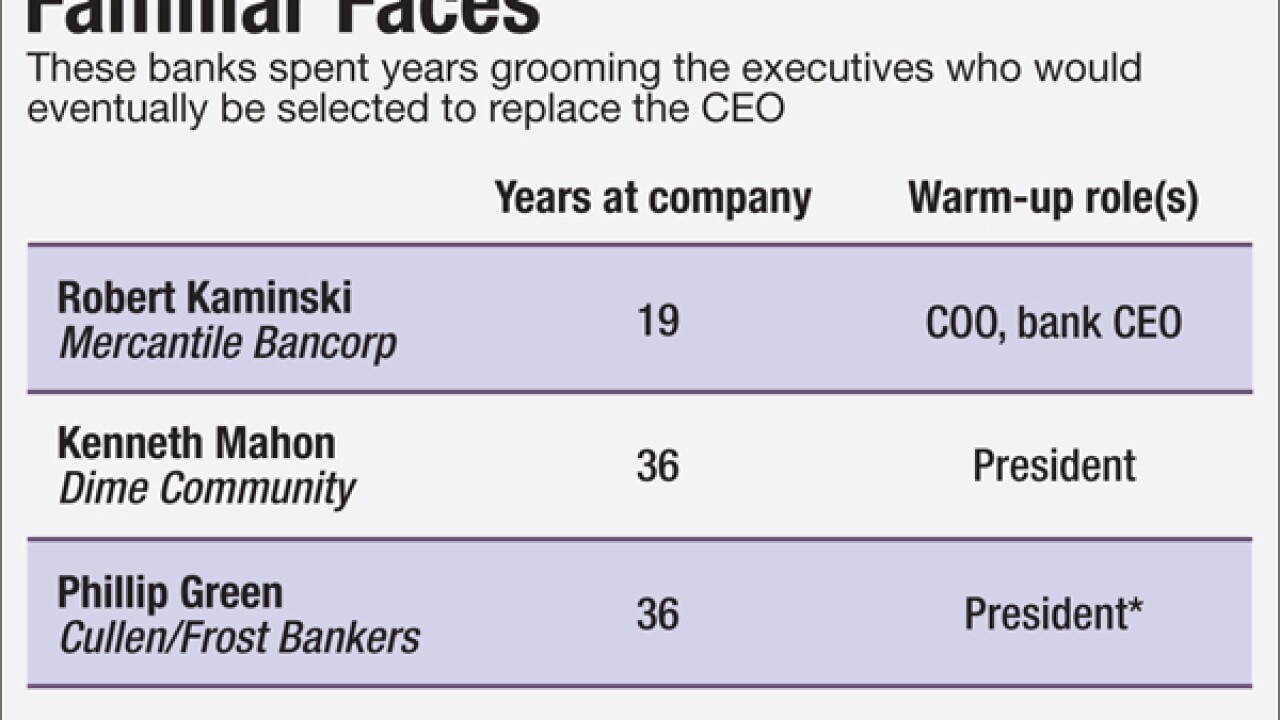

Mercantile Bank and Dime Community recently outlined plans for their CEOs' retirements, while Cullen/Frost made the transition earlier this year. Each transition is anchored in a belief that success hinges on turning day-to-day operations over to a trusted lieutenant.

By John ReostiAugust 10 -

By buying EverBank Financial, the insurance and retirement savings behemoth will gain billions of dollars in low-cost deposits and access to many new lending products that it can offer to millions of clients.

By John ReostiAugust 8 -

Susan Ralston plans to stay with Dollar Bank after the Pittsburgh mutual absorbs Bank @tlantec in Virginia Beach, where she is CEO. The longtime executive also plans to keep pushing for reforms designed to preserve the mutual banking model.

By John ReostiAugust 5 -

Unity Bancorp is raking in money from holding and selling 7(a) loans, but don't expect the bank to extend its operations beyond New Jersey and New York. Management learned that lesson the hard way during the financial crisis.

By John ReostiAugust 3 -

The former C1 Financial chief, expected to play a critical role at Bank of the Ozarks, resigned just a week after his company's sale. Thanks to a lengthy noncompete, it could take years to determine his next move.

By John ReostiJuly 28 -

The Green Bay, Wis., company reported net income of $47 million in the second quarter, down about 1.5% from the same period last year. Associated's profitability was constrained by a $14 million provision for loan losses.

By John ReostiJuly 21 -

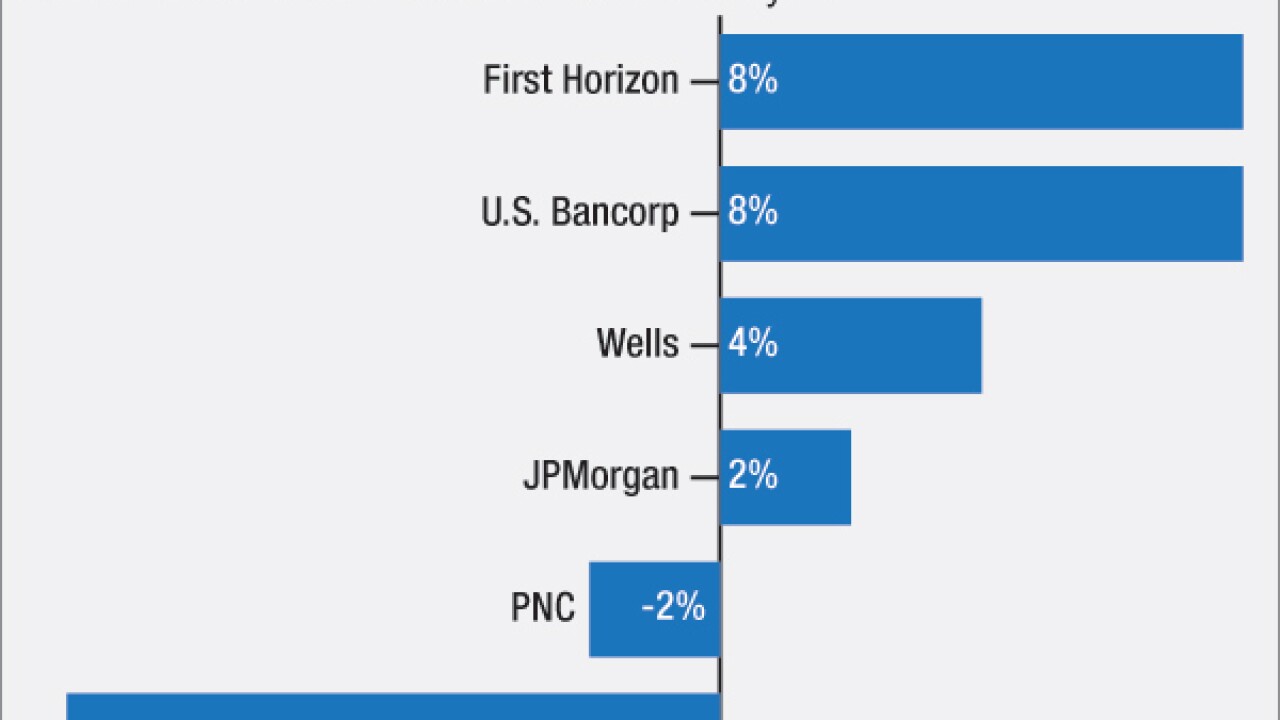

Regional banks like BB&T, Huntington Bancshares and Citizens Financial are growing through acquisition and targeted business-line initiatives, but they are having to contain spending simultaneously.

By Paul DavisJuly 21 -

Huntington Bancshares in Columbus, Ohio, reported a second-quarter profit of $175 million, off 11% from the same period in 2015. Part of the reason for the drop was a $21 million charge related to its pending acquisition of FirstMerit in Akron.

By John ReostiJuly 21 -

Executives at several minority-owned community banks nationwide, including OneUnited Bank in Boston and Carver Federal Savings Bank in New York, say they have received a windfall of deposits in recent weeks, coinciding with the introduction of the Black Money Matters Project.

By John ReostiJuly 20 -

Webster Financial's investments in its Boston expansion program and HSA Bank subsidiary contributed to an 11% increase in noninterest expense. However, the spending spike was more than offset by 10% loan growth and record noninterest income at the Waterbury, Conn., company.

By John ReostiJuly 20 -

Mercantile Bank Corp. in Grand Rapids, Mich., announced Tuesday that Michael Price plans to retire as president and chief executive at the end of the year after a decade at the helm of the company.

By John ReostiJuly 19 -

The hit smartphone game Pokemon Go taught banks a lesson in mobile strategy this week: gamify it.

July 15 -

It's liable to be an uphill climb as banks try to boost revenue and hold profit steady over the rest of the year. Here's why.

July 15 -

First Horizon National in Memphis, Tenn., reports solid quarterly results on the strength of revenue growth.

By John ReostiJuly 15 -

Loans tied to franchises were often an area of concern for banks before the financial crisis. Industry growth, improved credit metrics and a need to diversify commercial loan portfolios are prompting several banks to take a second look at the business.

By John ReostiJuly 14