John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

Dupuis started in banking as a high schooler. She is now the retail banking director at $16.4 billion-asset First United.

By John ReostiJuly 29 -

Friday's deal for Premier Financial ends a five-year M&A hiatus for the Wheeling, West Virginia-based company while marking its expansion into Michigan.

By John ReostiJuly 26 -

Indirect auto loan originations at the Ohio-based bank rose by 31% from the first quarter. Huntington sees the business as an opportunity at a time when numerous other banks have been pulling back.

By John ReostiJuly 19 -

The Cleveland-based regional bank continues to benefit from strength in investment banking, though concerns about stalled loan growth emerged as CEO Chris Gorman described demand as tepid.

By John ReostiJuly 18 -

The Minneapolis-based company reported an 18% increase in quarterly net income thanks largely to slimmed-down operating expenses. It also notched modest increases in loans and deposits, while asset quality issues remained manageable.

By John ReostiJuly 17 -

CEO Ron O'Hanley touted an "encouraging financial performance" at the $326 billion-asset custody giant due to asset inflows and a jump in income from securities and loans.

By John ReostiJuly 16 -

The New York-based company saw assets under custody and management jump, driving strong increases in both fees and overall revenues for the quarter ending June 30.

By John ReostiJuly 12 -

Susser Bank has proved successful attracting business from small and midsize companies the past two years. It's hoping a successful capital raise and continued branch expansion can extend the trend.

By John ReostiJuly 10 -

The Sacramento-area institution moved quickly and decisively to fill the gap created by the loss of First Republic and Silicon Valley Bank. A first-quarter rise in Bay Area deposits is a sign of bigger gains to come, San Francisco Bay Area President DJ Kurtze says.

By John ReostiJuly 8 -

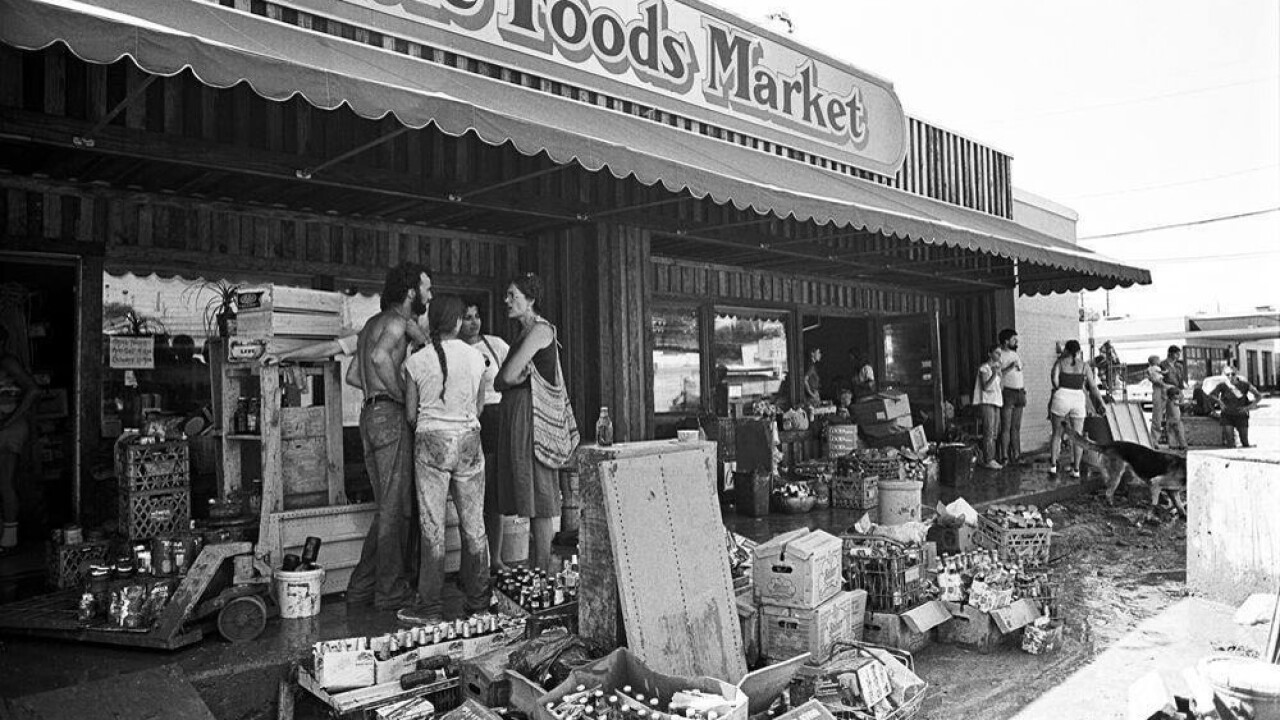

Former employees of the Austin-based City National Bank still recall the 1981 flood that deluged the city and Whole Foods, and they take pride in the lender's role in rescuing what was then a fledgling health food store.

By John ReostiJuly 3 -

VersaBank plans to use the one-branch Stearns Bank Holdingford in Minnesota as a platform to expand a lucrative niche business acquiring loan and lease receivables from point-of-sale lenders.

By John ReostiJune 27 -

Funding Circle US fought to win a coveted license to make SBA 7(a) loans only to see its London-based parent company agree to a sale before it could make its first government-guaranteed loan

By John ReostiJune 25 -

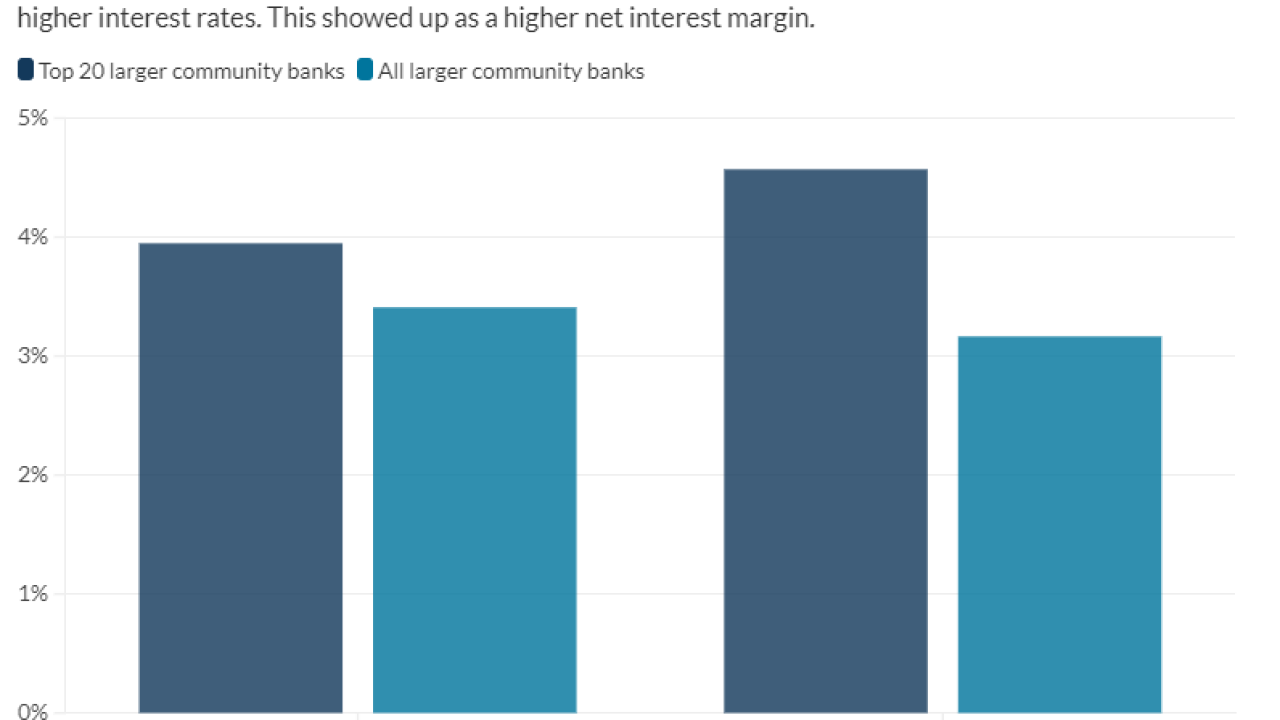

The best-performing larger Main Street Banks, those in the $2 billion to $10 billion asset class, were asset sensitive, a position that worked to their advantage as rates continued to climb in 2023.

By John ReostiJune 23 -

During the nine years Kevin Riley led the Billings, Montana-based institution, it quadrupled its size, largely through deals. New leadership could mean that the company focuses less on M&A and more on integration.

By John ReostiJune 18 -

IntraFi has joined two banking industry trade groups spearheading an effort to source large institutional deposits at small, cash-starved CDFI and MDI banks.

By John ReostiJune 14 -

Dickinson Financial in Missouri has no intention of departing from its expansionary mindset as it lays plans for de novo branches and scouts new acquisition opportunities.

By John ReostiJune 11 -

Though hard times put a dent in profitability, asset quality and net interest margin continued to shine among the list of the best performing publicly traded community banks.

By John ReostiJune 9 -

The 3-year-old Climate First in St. Petersburg appears primed to take its renewable energy lending nationwide now that it's exiting the de novo phase.

By John ReostiJune 6 -

Though Jenius Bank hasn't reached breakeven, it's evidencing solid progress gathering deposits and making loans as it gets ready to celebrate its first birthday.

By John ReostiJune 3 -

Gesa Credit Union in Washington agreed to acquire a 103-year-old community bank in Centralia, as it eyes opportunities for additional growth in the Pacific Northwest. In the District of Columbia, a bank group is calling for exit fees on banks selling to tax-exempt credit unions.

By John ReostiMay 30