John Reosti is a reporter covering community banks in particular and the financial services industry in general. He also focuses on the Small Business Administration, the National Credit Union Administration Board and issues connected to the CECL accounting standard.

-

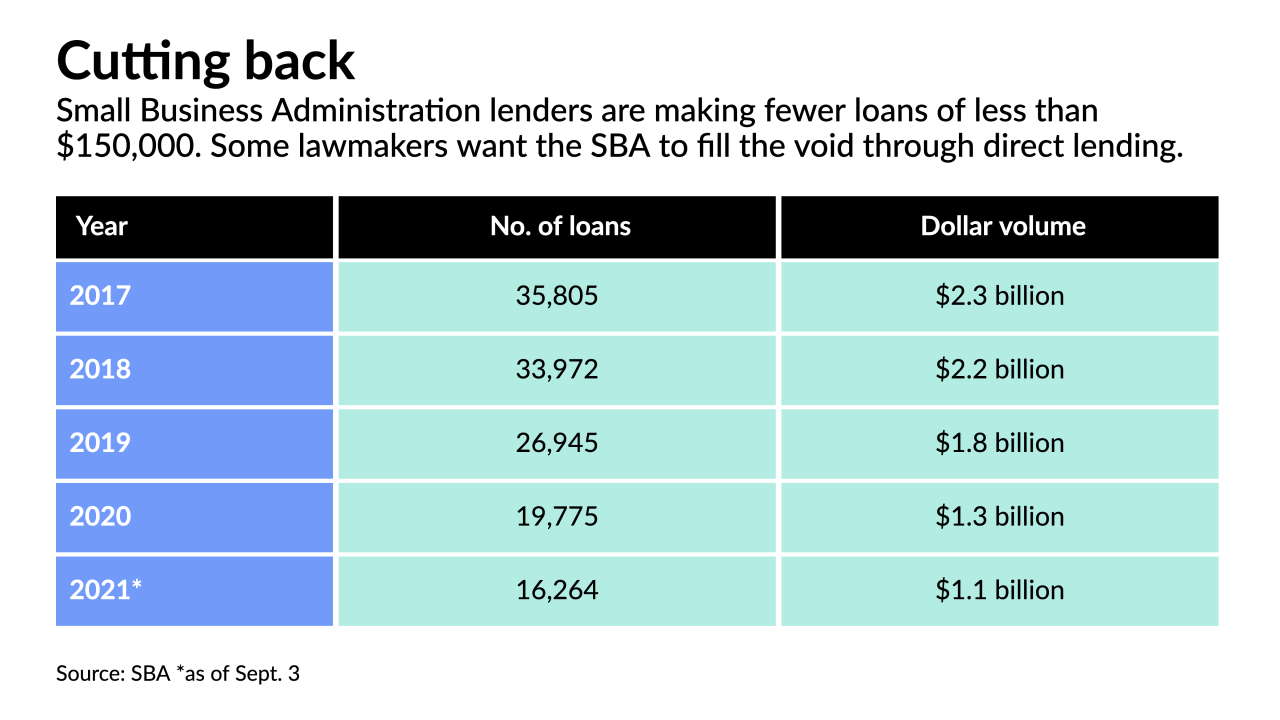

The White House and key lawmakers want to allocate $4.5 billion for smaller 7(a) loans that would be made by the Small Business Administration. The financial services industry says the government should collaborate with the private sector rather than compete with it.

By John ReostiSeptember 15 -

Rochelle State Bank is flush with capital after a group led by investor Rajib Das purchased the bank from its longtime owner in June. Das says his priority is boosting lending locally, but he is also planning to invest heavily in technology and mulling acquisitions.

By John ReostiSeptember 13 -

Its $53 million purchase of Pacific Enterprise Bank would be BayCom's 10th bank acquisition since 2010.

By John ReostiSeptember 8 -

James Kim will succeed James Ford, who is retiring, as chief executive.

By John ReostiSeptember 8 -

First US in Birmingham will take a $1.2 million third-quarter charge to close the subsidiary. It plans to recoup the expense by focusing on commercial and indirect lending.

By John ReostiSeptember 7 -

It started with an email suggesting there would be consequences for lenders that failed to use the Small Business Administration’s website to handle forgiveness applications for Paycheck Protection Program loans. Then lawmakers got involved.

By John ReostiSeptember 7 -

With its sale to Blue Ridge Bankshares set to close within months, FVC Bankcorp is moving to diversify by taking a 29% stake in Atlantic Coast Mortgage.

By John ReostiSeptember 1 -

There's still a month left in the federal government's fiscal year, and the Small Business Administration's 504 program is perilously close to hitting its congressionally mandated funding limit for new loans.

By John ReostiAugust 30 -

The sale to the Florida-based insurer Brown & Brown would give Berkshire Hills Bancorp an infusion of capital that it intends to invest in more profitable businesses, executives said.

By John ReostiAugust 25 -

Infrastructure will command most of lawmakers’ attention, but expect banks to keep pushing for bills that would ease the transition away from a key benchmark rate and help them serve legal cannabis businesses.

By Kate BerryAugust 24