Kate Berry has covered the Consumer Financial Protection Bureau for American Banker since 2016. She joined the publication in 2006 covering mortgage lending and the financial crisis. Berry also has covered big banks including Bank of America, J.P. Morgan Chase and Wells Fargo. She has won five awards from the Society of American Business Writers and Editors, and has worked at several news organizations including the Orange County Register, the Los Angeles Business Journal and the Associated Press. Berry began her career as a clerk at the New York Times.

-

The Consumer Financial Protection Bureau's data-access rule could create an uneven playing field because banks and credit unions are examined by regulators but hundreds of nonbank fintechs are not.

By Kate BerryJanuary 30 -

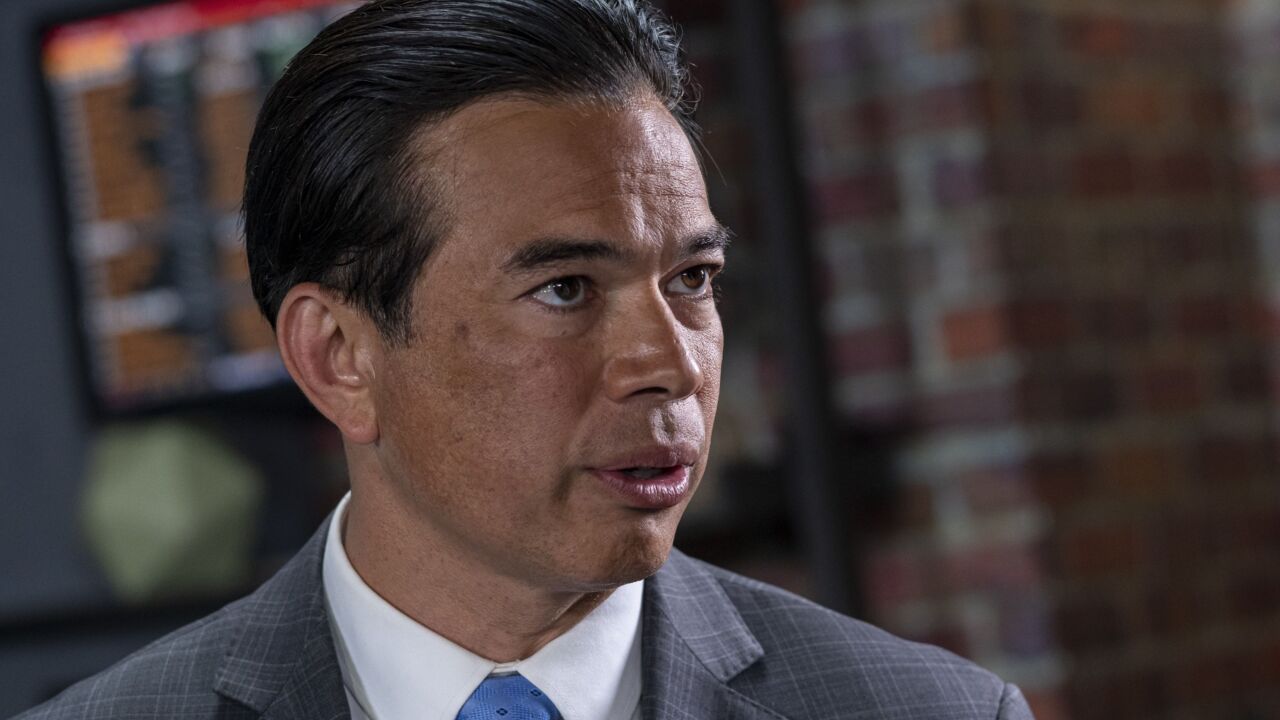

California Attorney General Rob Bonta is standing by the state's commercial financing disclosure law, urging more protections for small-business financings and arguing that federal consumer law does not not apply to commercial lending.

By Kate BerryJanuary 24 -

The Consumer Financial Protection Bureau sent a memo asking employees to take a survey that will help the Office of Personnel Management formulate a coordinated governmentwide policy.

By Kate BerryJanuary 23 -

A proposal by the Consumer Financial Protection Bureau to rein in credit card late fees could result in changes to a "safe harbor" that would favor consumers rather than financial institutions.

By Kate BerryJanuary 19 -

The Consumer Financial Protection Bureau says companies need to clearly and conspicuously disclose terms of subscription services and get informed consent from consumers.

By Kate BerryJanuary 19 -

The Consumer Financial Protection Bureau expects mortgage servicers to offer streamlined loss mitigation options to borrowers experiencing financial hardship — even if it's not related to COVID-19.

By Kate BerryJanuary 18 -

Fannie Mae has selected five organizations to share in a $5 million pilot program aimed at expanding and promoting affordable housing and Black homeownership.

By Kate BerryJanuary 18 -

Signature Bank of New York is pulling back from crypto deposits and has increased borrowings from the Federal Home Loan Bank of New York.

By Kate BerryJanuary 17 -

Ryan Crowley, previously a Citigroup client-experience executive, replaces the unit's former chief operating officer, Pooja Daswani. The company also picked a CEO for its North America business and launched a search for a new wealth management chief.

January 12 -

The Department of Justice said City National avoided offering home loans in Black and Hispanic neighborhoods in Los Angeles County from 2017 to 2020.

By Kate BerryJanuary 12