Kate Berry has covered the Consumer Financial Protection Bureau for American Banker since 2016. She joined the publication in 2006 covering mortgage lending and the financial crisis. Berry also has covered big banks including Bank of America, J.P. Morgan Chase and Wells Fargo. She has won five awards from the Society of American Business Writers and Editors, and has worked at several news organizations including the Orange County Register, the Los Angeles Business Journal and the Associated Press. Berry began her career as a clerk at the New York Times.

-

A core issue in the upcoming fight over late fees involves what data is being collected on card issuers' costs and losses associated with late payments.

By Kate BerryFebruary 3 -

Consumer Financial Protection Bureau Director Rohit Chopra plans to propose a rule to set late fees at reasonable levels and no longer peg late fees to inflation.

By Kate BerryFebruary 1 -

The Consumer Financial Protection Bureau's data-access rule could create an uneven playing field because banks and credit unions are examined by regulators but hundreds of nonbank fintechs are not.

By Kate BerryJanuary 30 -

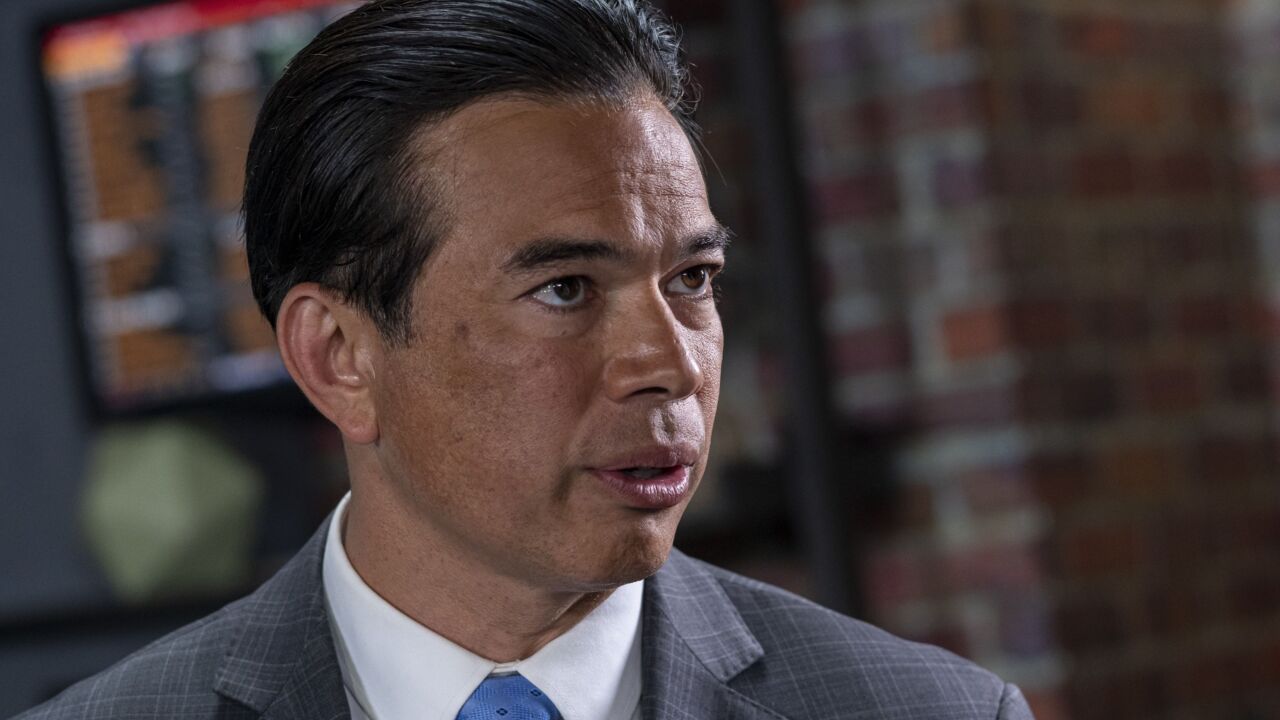

California Attorney General Rob Bonta is standing by the state's commercial financing disclosure law, urging more protections for small-business financings and arguing that federal consumer law does not not apply to commercial lending.

By Kate BerryJanuary 24 -

The Consumer Financial Protection Bureau sent a memo asking employees to take a survey that will help the Office of Personnel Management formulate a coordinated governmentwide policy.

By Kate BerryJanuary 23 -

A proposal by the Consumer Financial Protection Bureau to rein in credit card late fees could result in changes to a "safe harbor" that would favor consumers rather than financial institutions.

By Kate BerryJanuary 19 -

The Consumer Financial Protection Bureau says companies need to clearly and conspicuously disclose terms of subscription services and get informed consent from consumers.

By Kate BerryJanuary 19 -

The Consumer Financial Protection Bureau expects mortgage servicers to offer streamlined loss mitigation options to borrowers experiencing financial hardship — even if it's not related to COVID-19.

By Kate BerryJanuary 18 -

Fannie Mae has selected five organizations to share in a $5 million pilot program aimed at expanding and promoting affordable housing and Black homeownership.

By Kate BerryJanuary 18 -

Signature Bank of New York is pulling back from crypto deposits and has increased borrowings from the Federal Home Loan Bank of New York.

By Kate BerryJanuary 17