Kate Berry has covered the Consumer Financial Protection Bureau for American Banker since 2016. She joined the publication in 2006 covering mortgage lending and the financial crisis. Berry also has covered big banks including Bank of America, J.P. Morgan Chase and Wells Fargo. She has won five awards from the Society of American Business Writers and Editors, and has worked at several news organizations including the Orange County Register, the Los Angeles Business Journal and the Associated Press. Berry began her career as a clerk at the New York Times.

-

The Consumer Financial Protection Bureau extended the deadline for lenders with the highest volume of small-business loans to July 18, 2025, and will not assess penalties for reporting errors for a year.

By Kate BerryJune 25 -

The Federal Housing Finance Agency wants feedback on how the Federal Home Loan banks can improve their affordable housing programs, including efficiencies in the application process.

By Kate BerryJune 20 -

In a win for credit card issuers, a lawsuit challenging the Consumer Financial Protection Bureau's $8 credit card late fee rule will remain in a Texas court and not be transferred to Washington, D.C.

By Kate BerryJune 20 -

Payday lenders want an appeals court to rehear a novel claim about the Consumer Financial Protection Bureau's funding despite a Supreme Court ruling last month that upheld the agency's funding as constitutional.

By Kate BerryJune 17 -

PNC has cut its credit card late fees to $8, and Wells Fargo has eliminated the charges on one new card. The moves signal that issuers are already adjusting to a CFPB rule that's currently on hold amid a court challenge.

By Polo RochaJune 13 -

Fifteen million Americans who owe a combined $49 billion in medical debt would benefit from a proposal by the Consumer Financial Protection Bureau to scrub medical debts from credit reports and ban their use in underwriting decisions.

By Kate BerryJune 11 -

Comerica Bank has agreed to a proposed settlement of fraud claims after denying refunds to Direct Express beneficiaries who alleged money was stolen from their prepaid accounts. In the past month, beneficiaries have been sent postcards announcing the settlement.

By Kate BerryJune 7 -

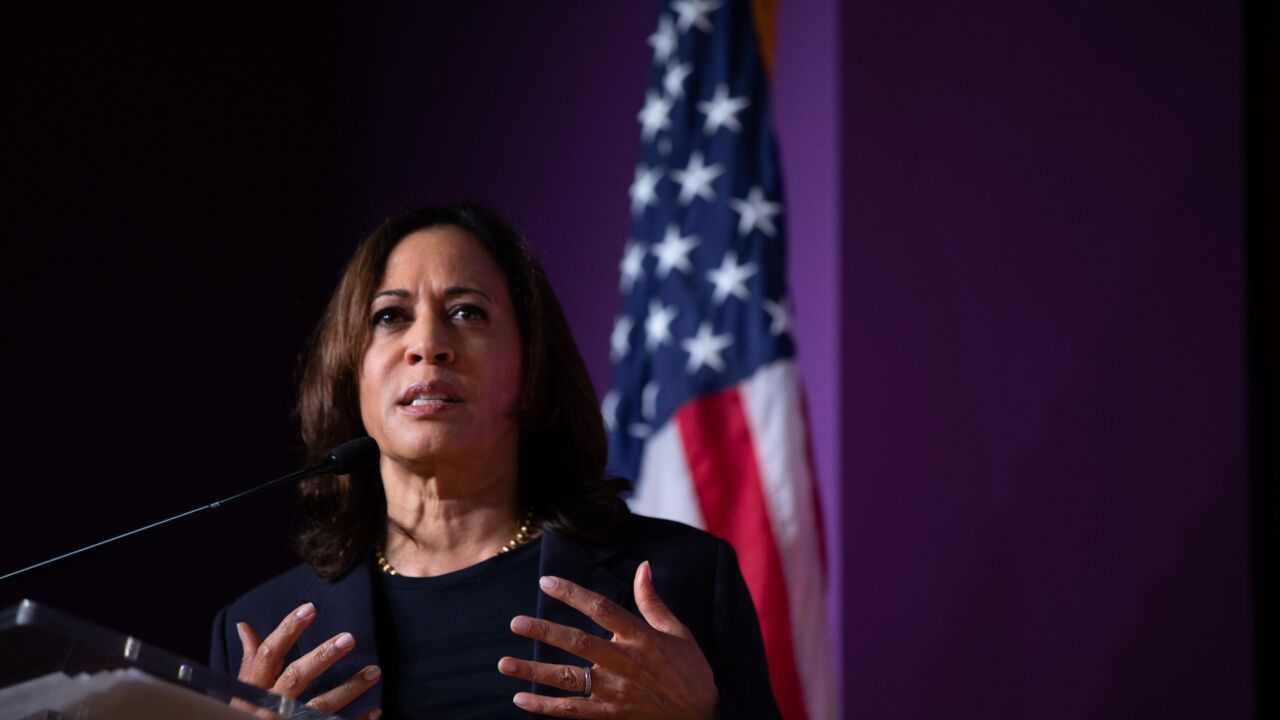

Rohit Chopra, director of the Consumer Financial Protection Bureau, said Friday that the agency will be moving forward with rules and enforcement actions after the defeat of a Supreme Court challenge to the agency's constitutionality.

By Kate BerryMay 17 -

The Supreme Court issued an opinion Thursday morning that was unequivocal in its view that Congress is constitutionally empowered to fund agencies with open-ended and indirect funding mechanisms, overruling a 5th Circuit opinion from 2022 that found that executive branches must be subject to direct Congressional appropriations.

By Kate BerryMay 16 -

The real-life British banker behind the hit Netflix movie 'Bank of Dave' talked with American Banker about the sequel due out next year and why opening more local community banks is so important.

By Kate BerryMay 14