Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

The San Francisco company, which has racked up big losses over the last two and a half years, signaled Tuesday that it is on a path to profitability after resolving a series of longstanding regulatory problems.

By Kevin WackNovember 6 -

JPMorgan Chase and Wells Fargo detailed aggressive marketing plans, defended their credit judgments and downplayed the threat of a retailer revolt over high fees on rewards cards.

November 6 -

The Atlanta-based consumer lender, which partners with both retailers and banks, cited a higher-than-expected cost of funds as one reason for its less rosy forecast.

By Kevin WackNovember 6 -

The New York-based online lender plans to spend an additional $15 million next year, largely on bank partnerships and international expansion.

By Kevin WackNovember 6 -

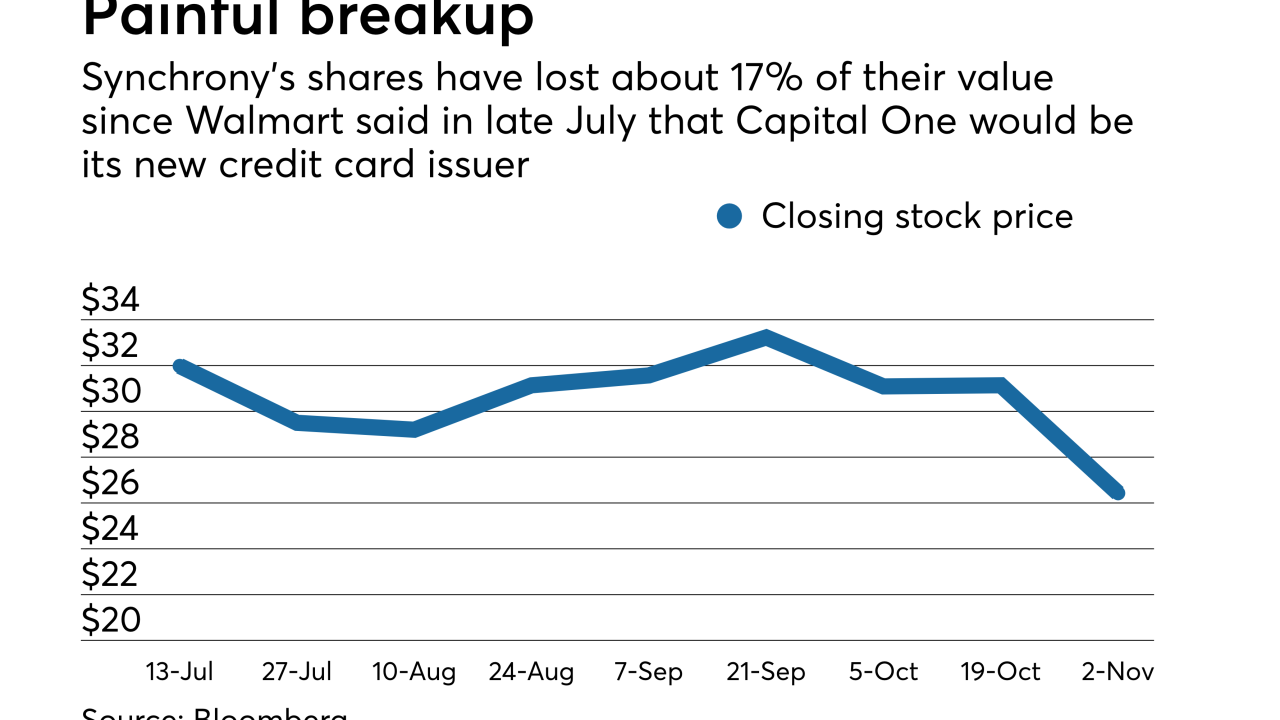

After the retail giant filed an $800 million lawsuit against its former credit card partner, shares in Synchrony plunged. Now analysts fear its relationship with Sam’s Club may be in jeopardy.

By Kevin WackNovember 2 -

A multimillion-dollar deal between Chicago Mayor Rahm Emanuel and Stephen Calk was supposed to deliver 400 new jobs to the city. Here’s what really happened.

By Kevin Wack -

In a letter Monday to Federal Reserve Board Chairman Jerome Powell, the four House Democrats argued that the nation’s aging payments system is contributing to economic inequality.

By Kevin WackOctober 30 -

Hope Hardison, Wells Fargo's chief administrative officer since 2015, and David Julian, its chief auditor since 2012, have both been removed from the bank's operating committee and begun leaves of absence in the latest fallout from the bank's phony-accounts scandal.

By Kevin WackOctober 24 -

A smaller provision for loan losses helped counteract declining loan volume and higher expenses during the third quarter.

By Kevin WackOctober 23 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

By Kevin WackOctober 22