Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

Green Dot Corp. has tapped one of its board members, Mary Dent, to take the helm of its banking unit.

By Kevin WackAugust 31 -

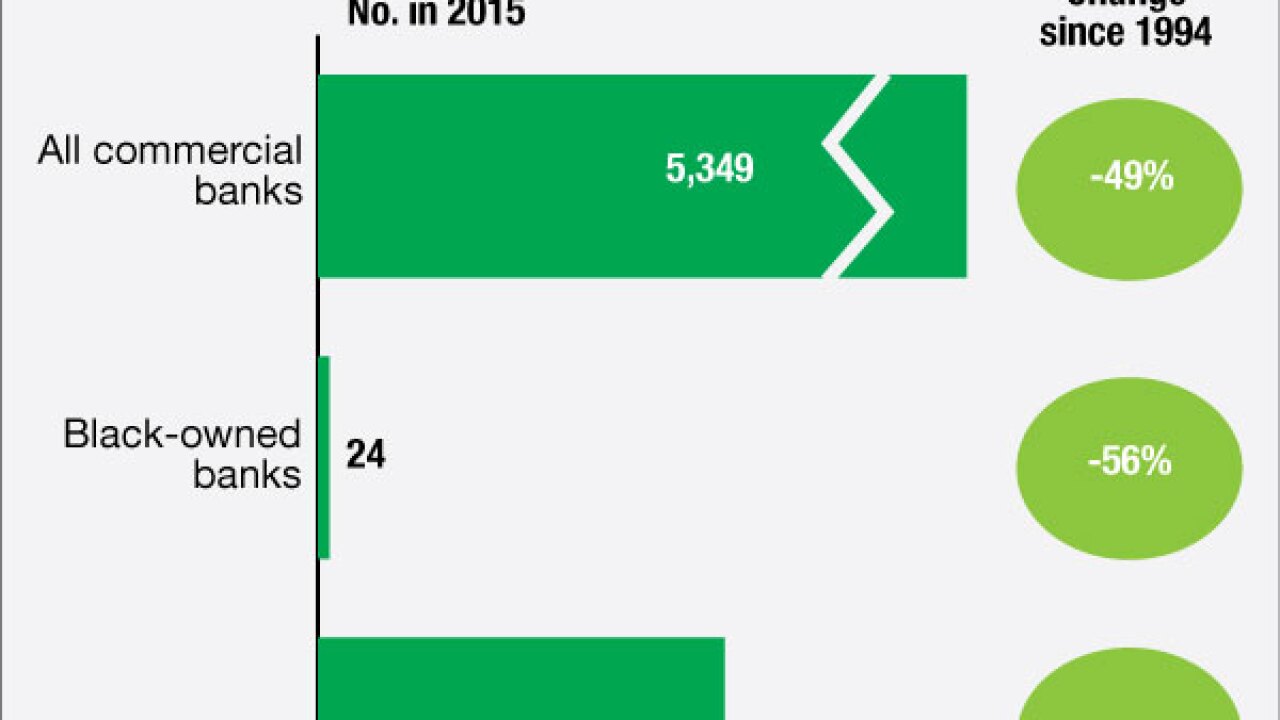

A longtime advocate for African-American-owned financial institutions argues that regulators should be taking more forceful action to keep them alive.

By Kevin WackAugust 30 -

Medallion Financial, trying to diversify beyond its traditional business of financing taxi drivers, plans to issue loans on behalf of web-based lenders. But that new strategy faces some potential pitfalls.

August 24 -

Fundation Group, a New York-based online small-business lender, announced Tuesday that it has secured a $100 million credit facility from Goldman Sachs.

By Kevin WackAugust 23 -

Financial institutions across the country are in the final stages of readying for the same-day processing of electronic payments, which are scheduled to begin on Sept. 23.

By Kevin WackAugust 23 -

Next month all U.S. banks and credit unions will be required to process speedier payments on the automated clearing house network. Here is what bankers need to know.

By Kevin WackAugust 22 -

This week Minneapolis-based U.S. Bancorp is launching a new consumer account that's designed to appeal to millions of Americans shut out of the mainstream financial system.

By Kevin WackAugust 22 -

U.S. Bancorp is the latest big bank to offer an overdraft-free account. Skeptics are questioning how many Americans are benefiting from these products, and want banks to do more to market them.

By Kevin WackAugust 22 -

LoanDepot, a Foothill Ranch, Calif.-based company that offers mortgages, home equity loans and personal loans, has raised $150 million in term debt financing.

By Kevin WackAugust 17 -

Like its peers, the San Francisco-based marketplace lender is struggling to manage the fallout of a sharp reversal in the interest of investors.

By Kevin WackAugust 16