Kevin Wack is American Banker's national editor, and is based in southern California. He was formerly the publication's consumer finance reporter and its Capitol Hill correspondent. Earlier, he worked on financial policy in Washington. He has also reported for the Associated Press and worked as the investigative reporter for the Portland Press Herald in Maine.

-

The inquiry, which is focusing on the nation's four largest airlines, aims to protect consumers from potentially unfair, deceptive and anticompetitive practices.

By Kevin WackSeptember 5 -

The top executive at Royal Bank of Canada expressed reluctance about expanding south of the border again, citing what he characterized as a changing regulatory landscape and pointing to lessons learned from the 2015 acquisition of City National Bank.

By Kevin WackAugust 28 -

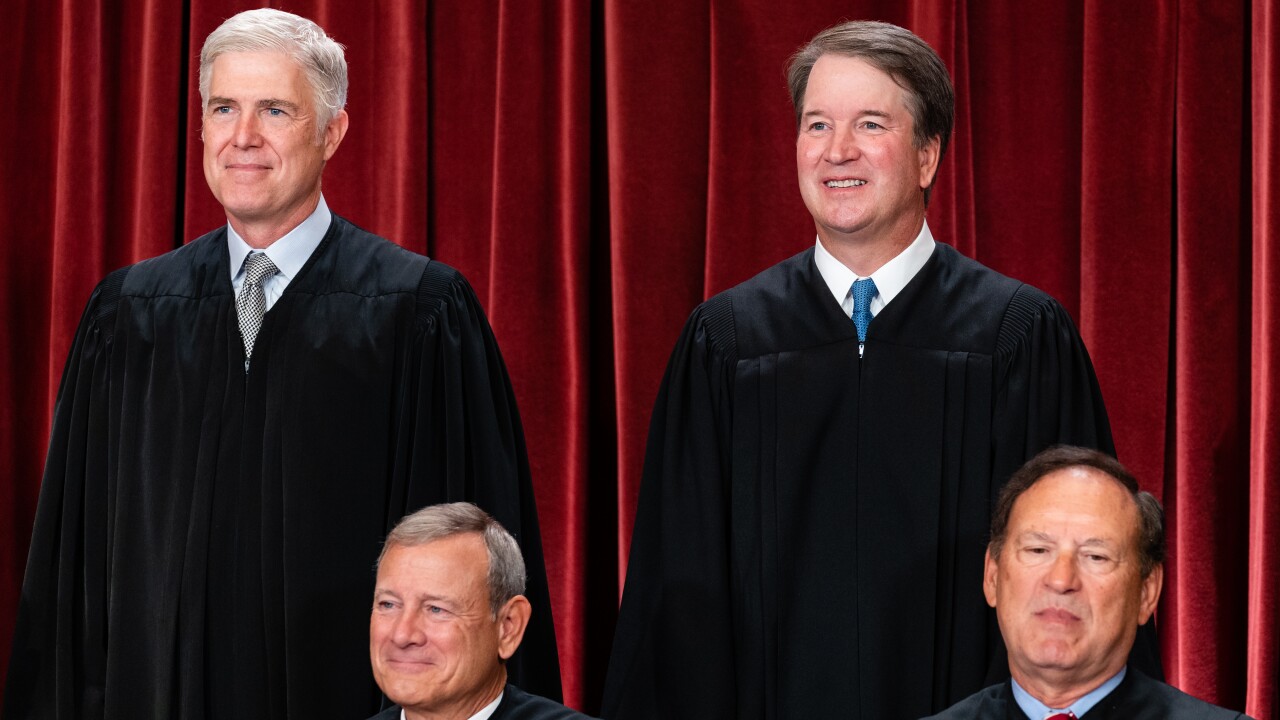

The Federal Deposit Insurance Corp. is trying to limit the impact of a Supreme Court decision that curtailed federal agencies' use of administrative law judges.

By Kevin WackAugust 26 -

The store-branded credit card company revised its revenue guidance upward on the assumption that the CFPB's late-fee cap won't take effect before 2025. Still, Bread is moving ahead with plans to make up some of the revenue that it stands to lose from the contested rule.

By Kevin WackJuly 26 -

The $72.8 billion-asset bank lowered its guidance for net interest income, explaining that while business prospects on the island are relatively rosy, its stateside opportunities for loan growth look weaker.

By Kevin WackJuly 24 -

The credit card giant increased its allowance for credit losses by more than $800 million following the termination of a partnership with Walmart.

By Kevin WackJuly 23 -

Evergreen Money offers affluent savers both high returns and ready access to their money. The startup's founder, former PayPal CEO Bill Harris, says that increased regulatory scrutiny of bank-fintech partnerships is a positive development.

By Kevin WackJuly 11 -

Two days after the Fed released the results of its annual stress tests, the nation's eight largest banks all announced plans to supplement their payouts to shareholders. At the same time, most of the banks also said that their capital requirements are expected to rise.

June 28 -

The high court's much-anticipated ruling gives federal courts — rather than executive agencies — the power to interpret ambiguous statutes. The decision is expected to facilitate an increase in litigation over banking regulations.

By Kevin WackJune 28 -

A landmark ruling by the Supreme Court's conservative majority means that defendants will have the right to a jury trial in cases where bank regulators are seeking civil penalties. The consequences for federal banking agencies are expected to be substantial.

By Kevin WackJune 27