Want unlimited access to top ideas and insights?

As Big Tech companies funnel capital into digital innovation, users have become accustomed to highly personalized digital experiences. These experiences are regularly updated to be faster and easier to use through automation and ever-improved

To answer these and other questions, Alkami conducted primary research among 795 U.S. consumers and 150 regional and community financial institutions in June of 2021 to better understand Big Tech’s influence on the digital banking experience.

To qualify for the double-blind study, consumers aged 18-75 admitted to online or mobile banking at least once per month. These consumers were well represented as customers or members from multiple types of financial institutions, including megabanks, neobanks, and regional and community financial institutions. Financial institution respondents had between $200 million to $100 billion in assets and 10,000 to 2,000,000 customers or members. Each respondent was involved in digital banking decisions, with two-thirds in senior or executive management.

What users want

As new technology finds its way into the hands of users, the way

We found that users from both FI types want more of what they experience in their day-to-day mobile and web apps from their FIs. Those experiences are data-driven and personalized—a signature of Big Tech.

FIs face challenges meeting these expectations considering development needs. Matching Big Tech’s standards requires huge investments. To align with what users want, FIs should scrutinize any third-party digital banking provider for evidence that they can keep up with the dizzying pace of innovation. After all, more than half of regional and community FIs and close to 40% of consumers agree that the ‘bank’ of the future will be a technology company.

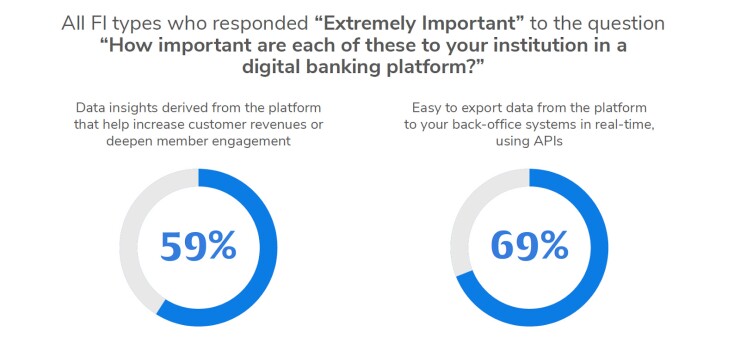

Data is key to retaining users

FIs have plenty of usable data to improve their digital apps. How that data is used to understand and empower their members and customers without exploiting them is the biggest task FIs face. Whether intentional or not, biases from the way banking has been done up to today will influence decisions as AI is developed around existing data created by influenced systems. AI is what drives high-value experiences, so it must be used, but until it can be trusted to do the right thing alone, humans will need to be involved in AI decisioning.

Tomorrow’s tech is today’s competition

Users are becoming more comfortable doing business in platform-based Big Tech experiences. With platforms, users are engaged throughout their journey through a hub for multiple technologies, making for a seamless, fast, secure experience that learns user preferences and behaviors. Personalization is crucial to engagement and earning loyalty.

Users accept and even prefer that technology learns what they like in order to anticipate needs, so long as the offers are relevant and their privacy is respected. We found that 73% of users prefer an app that understands their needs and priorities and shares relevant offers over an app that respects privacy and doesn’t push offers.

Considering the influence Big Tech has on user preference, regional and community FIs still generally agree their competition is the FI down the street. However, they also believe their institution’s greatest risk is the changing technology landscape. FIs seem to be missing the pervasive influence of Big Tech over consumer preferences. The direct or indirect threat Big Tech poses in notching up consumer expectations over time appears to be more of a threat than any nearby FI. Considering that, given the option, consumers would switch to a Big Tech company offering similar financial services to what they receive today, FIs should reconsider their competitive strategies in order to stay relevant among consumers.

The competition is only made more intense by fintechs and neobanks that are certainly influenced by Big Tech. Factoring in these competitors, 79% of digital banking consumers would consider opening a new checking or savings account with a Big Tech, fintech, or neobank. Half say they would sign up for said checking or savings account. Nearly one-third say they would switch from their primary FI to one of these tech brands.

Regardless of if Big Tech companies are directly vying for the financial relationship or not, the larger threat to the ongoing relevance for FIs is Big Tech’s influence on the digital banking experience. FIs capable of adopting innovation in their digital banking experience with a provider committed to the same will ride the wave of growth that would otherwise engulf them.