-

A couple of years ago, the activist investor Joseph Stilwell said Anchor Bancorp in Lacey, Wash., deserved more time to try to right itself. Apparently he thinks that time is up.

July 12 -

The management team at Bank of the Ozarks knows it has a dependency on commercial real estate. But they assert that sound underwriting, and efforts to diversify, are what really matters when assessing risk.

July 11 -

First Hawaiian Bank in Honolulu will be spun off rather than sold.

July 11 -

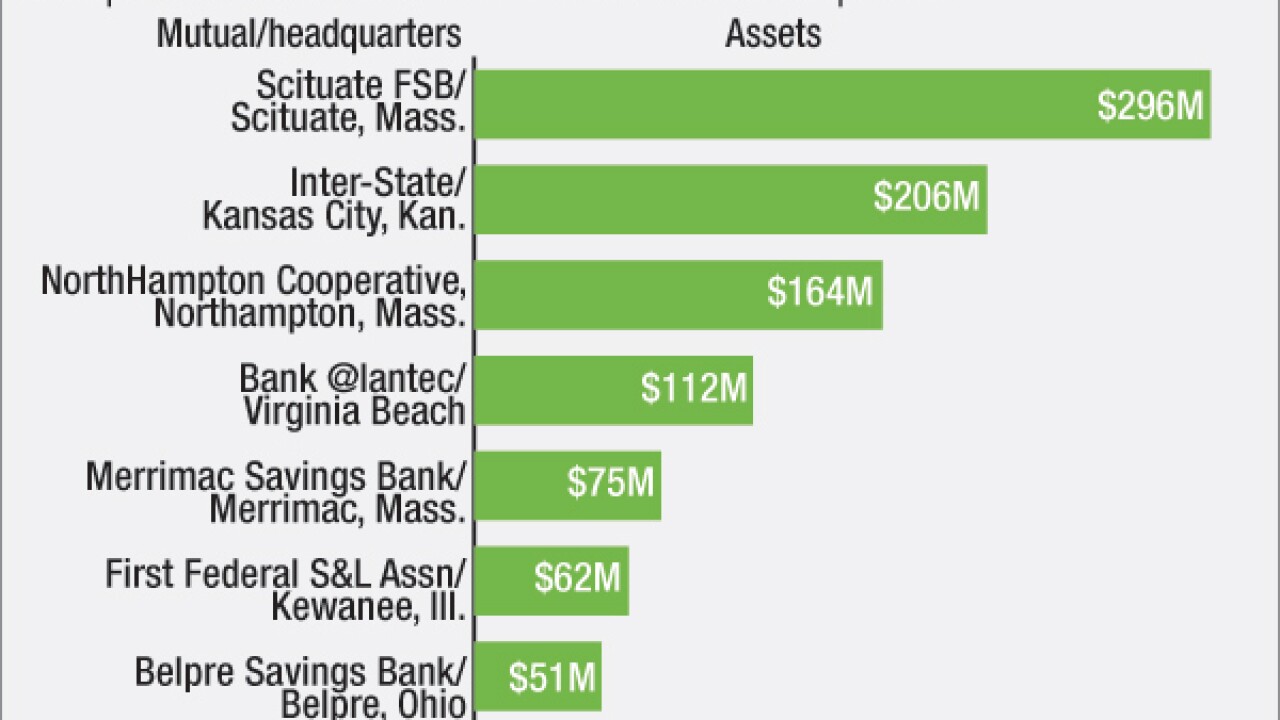

At least eight small mutuals have agreed in recent years to merge with another institution rather than convert to stock ownership. More deals could be on the way.

July 7 -

On the day Maurice Spagnoletti was murdered, his black Lexus sedan was full of balloons. It was June 15, 2011, the day before his wife's birthday, and he was planning a celebration.

July 6 -

Community banks are stepping up efforts to raise cheap capital to fuel loan growth, make acquisitions and redeem pricier sources of funds.

July 6 -

North Carolina has lost more than 40% of its banks in the past decade, creating a new tier of larger institutions. More deals are expected to occur, raising questions about the pace of M&A and the fate of those bigger banks.

July 5 -

Medallion Bank in New York has sold nearly $100 million in prime-credit consumer loans, largely consisted of home improvement and recreational vehicle installment loans, to an unnamed buyer.

July 5 -

The $99 million-asset thrift said in a recent press release that Best Hometown Bancorp, a holding company it created, raised $8.3 million as part of an initial public offering tied to its mutual-to-stock conversion. Home Federal also plans to change its name to Best Hometown Bank.

July 1 -

Liberty Shares in Hinesville, Ga., one of a handful of banks still stuck in the Troubled Asset Relief Program, has raised $26 million in capital.

July 1